Expectations of perpetual price appreciation are more faith-based and less experience-informed

Michael Sasges

Sun

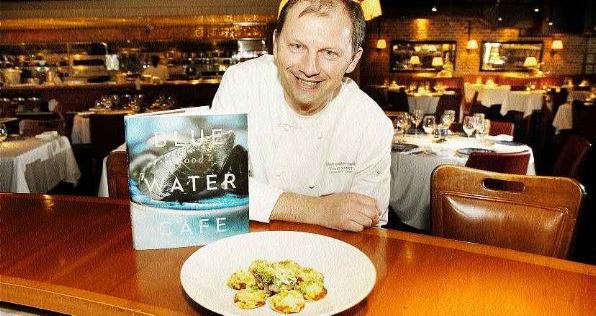

Katherine Tung, 35, of Richmond is pursuing her first home purchase, a transaction that is particularly consequential, and not for her alone, a recent comment from the B.C. Real Estate Association suggests. The relative disappearance of the first-time buyer locally and recently was an absolute brake on transaction numbers and values, the ‘voice’ of the province’s real estate agents reported. ‘First-time buyers were largely absent in the late fall and winter, making it more difficult for move-up buyers to sell their current homes. The chain of ownership is now being oiled.’ The Canadian Real Estate Association recently circulated another measure of the social and economic consequences of buying and selling real estate: every Multiple Listing Service transaction in the three years before this one generated another $46,400 in Canadian economic activity, with the B.C. sum, $60,200, the top sum province by province. Photograph by: Steve Bosch, Vancouver Sun

Right now the topic of real estate is right up there with religion and politics: just don’t go there with extended family and co-workers.

— A comment on the Greater Fool website

The elevation of real estate to another faith-based topic best not discussed in good company was probably inevitable, if an American scholar of investor behaviour is right.

The scholar’s name is Robert Shiller. A couple of years ago he circulated a paper that says property buyers and sellers in the first years of this decade shared a certainty about the inevitability of price-appreciation supported by neither evidence nor experience and, further, they shared that certainty in unprecedented numbers.

“While home-price booms have been known for centuries, the recent boom is unique in its pervasiveness,” the Yale University professor of economics and finance wrote.

“Dramatic home-price booms have been in evidence since the late 1990s in Australia, Canada, China, France, India, Ireland, Italy, Korea, Russia, Spain, the United Kingdom and the United States, among other countries.

“There appears to be no prior example of such dramatic booms occurring in so many places at the same time.”

Shiller is the developer, with Karl Case, of a widely circulated index of American real estate values. (See page G6)

The “Case Shiller” index’s inaugural value was 100, established for January 2000. Its highest value was 206.5, reached in July, 2006. Its lowest value, 140, is also its current value.

The index, among many, many matters, records 78 months of increasing American prices followed by 32 months of decreasing prices. On the way up the average monthly change in the index was almost 1.4 per cent; on the way down, almost 1.9 per cent.

No “fundamentals” — monetary policy, for example — drove international real estate prices up, Shiller says.

Instead, “extravagant expectations for future price increases” lifted them, an extravagance he attributes to an apprehension that “a new era of capitalism . . . is producing phenomenal economic growth, and . . . both extreme winners and unfortunate losers.”

Further, “fundamentals” will not reverse, by themselves, “large real-price declines extending over many years in major cities that have seen large increases.”

Robert Shiller doesn’t say a change in certainties is required, but it clearly is, from faith-based to experience-informed.

A germane Canadian experience might be our immigrant experience: we are a nation of immigrants, arriving and settling in the millions over the 400 years since the founding of Canada‘s first permanent settlement, Quebec City.

A document on the Canada Mortgage and Housing Corporation website, Pro-Home: A Progressive, Planned Approach to Affordable Home Ownership, is the inspiration for the possibility that in our immigrant past is a home-ownership experience of valuable currency.

“In the first half of the 1900s lower-income, immigrant families developed large portions of older Canadian cities using their own, and in some cases their neighbours‘, labour and capital.

“Subdivided park and farm lots were developed unevenly, without any overall plan, but this approach provided affordable homes for many working-class families.

“According to some estimates, as much as 25 per cent of housing built in Toronto between 1900 and 1913 was self-built.”

Not the particulars, the owner-built house, attract in this immigrant achievement.

The ethic attracts, the identification by ordinary people of a need and of a means of acquiring it. These homes were “incremental . . . affordable . . . and flexible,” to appropriate the language the study uses in championing “incremental housing” as a possible solution to the affordability challenges endured today by low-income families.

The homes were incremental because their owners expanded or altered them as household circumstances changed. They were flexible because they could be built by property owner or contractor and could be built to include “an accessory unit . . . as a source of income.” And they were affordable, to start and expand and alter.

The last quality is their most important today. They were affordable because their owners considered them “as a process rather than a product” or as a means rather than end, a means of mastering household circumstances over the years and the decades, good and bad, additions and subtractions.

This mastery was, and is, an achievement of profound value, with dividends that will speak to us today if we would only listen, and learn.

© Copyright (c) The Vancouver Sun