Our ever-evolving technology is a runaway train that has forever changed the way we live

Shelley Fralic

Sun

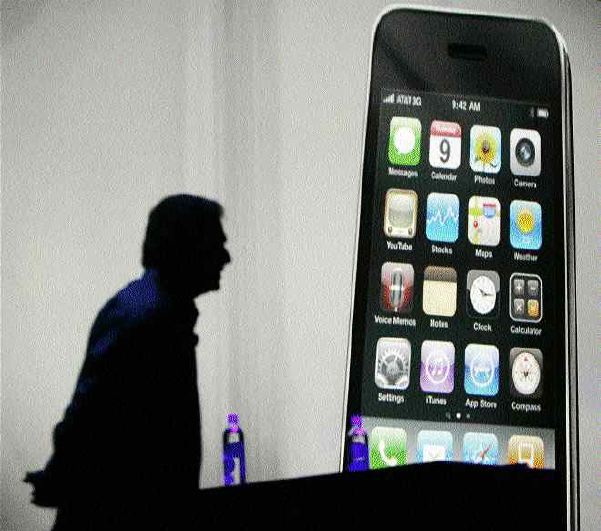

Apple’s new iPhone 3GS with its many applications that we can use to organize our entire lives is a sign of how technology keeps taking over more of what we do. Photograph by: Robert Galbraith, Reuters, Vancouver Sun

As Apple introduced yet another faster, sexier version of its wildly popular iPhone this week, one is reminded that there was a time when the automatic washing machine was the hottest gadget on the planet.

But that was then, and this, this is the time of the smartphone.

With a single handheld device, without burning a calorie, without getting out of your chair, in fact, without any effort at all, 21st-century technology and the brave new world of applications allow you to do pretty much anything.

Anything.

Like start a band, play Scrabble, read a restaurant review, compose music, book a trip, converse with the boss, do the banking, hire a nanny, get directions, shop for shoes, watch The Bachelorette, upload a grad photo, find a phone number, shoot a video, order a pizza, screen a movie, look up an address, buy Olympics tickets, calculate your 2009 taxes and, of course, text and Twitter and Google and MySpace and blog and instant message with not only strangers halfway around the world, but with friends and family you never see much any more because you talk to them via a magic satellite every five minutes.

Some would say you can even have sex with a PDA (which used to mean public display of affection before it meant personal digital assistant), though we wouldn’t know anything about that.

What we do know is that technology is a runaway train that has forever changed the way we live.

Apple reported recently that it had reached one billion application downloads, with 35,000 tech tools available to users in 77 countries, and even more applications will debut this summer.

The truth is, that little smartphone — and all the other PDAs like it, the iPod Touch, Blackberry Curve, Palm Pre, G1, HTC Touch and Sidekick — have become a fingertip secretary, serving an entire generation that no longer needs to learn fundamental life skills because a microchip does it all for them.

Welcome to Generation App.

That would be the generation that has never not had a computer in the house, the generation raised on the 30-second sound bites of Sesame Street in the 1970s, the generation for whom a touch screen has eliminated the need, and ability, to get information the old-fashioned way, through a phone book or library or any of those other increasingly quaint hard copy sources.

And while Generation App knows more stuff than any generation before it, it is knowledge that comes without learning, without effort.

High-schoolers, for instance, were once required to perform a trig function with nothing but a pencil and a brain, until the calculator made mathematics from scratch all but obsolete.

Try getting your average 16-year-old to work out a percentage without a calculator, or finding a sales clerk who can give you change without a cash register.

To say that we don’t need to understand pi to balance our chequebook (what’s a chequebook?), is to not understand that math isn’t about finding the solution. It’s about learning to solve the problem.

Think, too, for a millisecond, just how technology has transformed our social interactions.

Why talk face-to-face when you can Facebook? Why write in longhand when there’s LOL and GR8, the new literary hieroglyphic that requires its own elementary school syllabus?

And who needs an attention span when 140 characters, give or take Ashton Kutcher, says it all?

Does any of this too-much-information-without-knowing-anything matter?

Is it any different than the wave of post-war technology — the microwave oven, the television, the supersonic jet, the credit card — that changed life for the better for baby boomers?

Maybe not. But as comic Louis C.K. declares, we live in an increasingly amazing world and yet everyone’s grumpy.

We freak out when the cellphone takes a second longer to connect than we think it should. We get angry when the ATM isn’t working, forgetting that not too long ago you had to go into the bank to get your money.

We complain when the Internet connection on the airplane fails, forgetting the marvel that is “flying through the air incredibly, like a bird . . . sitting in a chair in the sky.”

We demand to have an app to make our life easier, right now, even though we managed without it an hour ago.

One of the many Web definitions for application software is this analogy of a lightbulb and a power plant:

“The power plant merely generates electricity, not itself of any real use until harnessed to an application like the electric light that performs a service that benefits the user.”

Except that even good ol‘ light bulbs are becoming passe.

Here’s hoping the PDA will light the way.

© Copyright (c) The Vancouver Sun