Speculation includes new iPhones, a Mac OS, iPods with cameras

MURRAY HILL

Sun

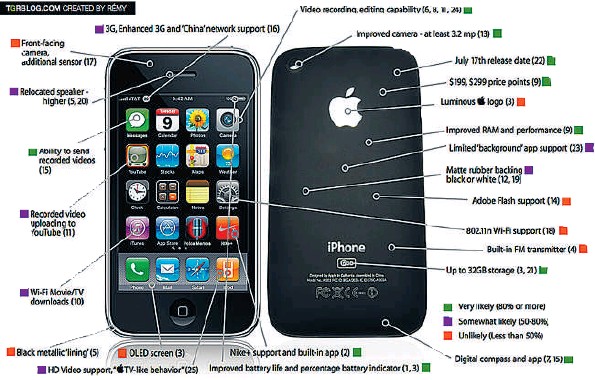

TGRBLOG.com’s iPhone rumour chart.

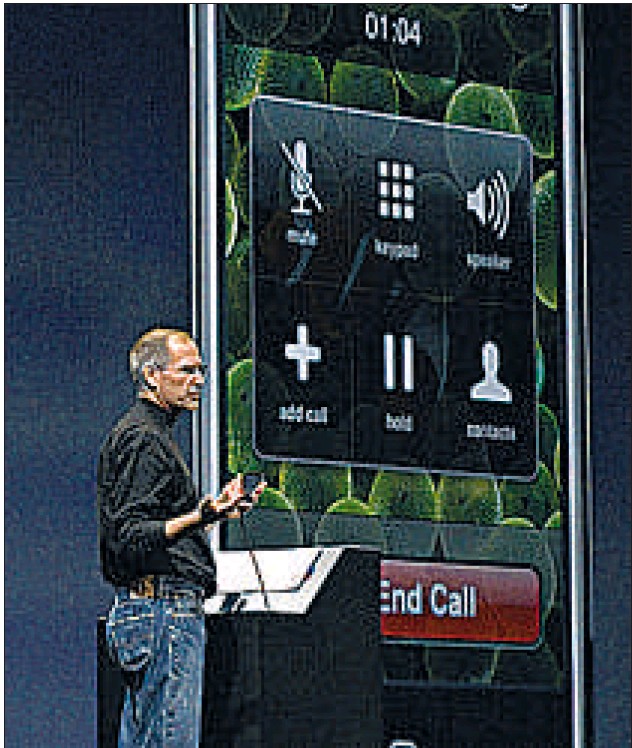

Steve Jobs has traditionally delivered the keynote address at the Macworld conference. But Apple has since switched its efforts to the WWDC event. BLOOMBERG NEWS FILES

SAN FRANCISCO his year’s World Wide Developer’s Conference has taken on a new meaning since Apple decided that the Macworld Convention would no longer feature the Apple keynote address. Deciding that focused events such as the WWDC, which is an Apple-run event, provide a better platform for its announcements, Apple has effectively made this event No. 1 for all the world’s MacHeads.

As with any event involving Apple, the WWDC that begins today is rife with rumours about what will be announced.

Apple is a master at keeping information private until it announces it, which has always made the keynote address at Macworld an event worth doing almost anything to get into.

This year’s WWDC keynote is no exception, with rumours floating around about new iPhones, the impending release of a new Mac OS (called Snow Leopard), and even talk of new iPods with cameras and some sort of announcement about a netbook.

These stories are the real fun part of a conference like this — for the mortals. Real Mac developers, the people who write all the software and design the hardware that works with the Mac OS and Apple’s hardware, use the WWDC to network and learn. They’re what the conference is really all about; the keynote is designed to tell them what’s coming up and to make new announcements — and to whip the rumour mongers into a frenzy.

It works. The Internet has been full of speculation for weeks now.

The best site I’ve found online to describe potential upgrades/changes to the iPhone is at TGRBLOG.com, which has a terrific iPhone rumour roundup diagram created by Remy. He’s even attributed every rumour, with a link at the bottom of his blog.

Snow Leopard promises to be a huge step forward in the Mac OS. With the release of Windows 7, Microsoft has writ-

Tten the most Mac-like operating system to date, and according to many analysts, it has closed the gap somewhat in the debate over which operating system is superior. The release of Snow Leopard will start that debate all over again as the myriad new features and enhancements are expected to vault Apple back to the top.

The debate on an Apple netbook-type computer has been raging for several months, with Apple flat-out stating that it is not interested in competing in a space that contains inferior products.

One rumour is the possible release of a smaller version of the MacBook Air, with ramped-up multi-touch capabilities.

One thing is for sure, if Apple decides to come out with a small computer to “compete” against the low-cost netbooks now being offered, it will do it in a fashion that will immediately vault it to the front of the pack and will wow consumers.

Chief executive officer Steve Jobs, who is on medical leave, has been actively involved in preparations for the event.

The main address at the developer conference, which has featured Jobs each year since 1998, will be given by marketing chief Philip Schiller, Apple said last month.

If Apple doesn’t release a new iPhone, the company may hold another event to introduce new models and mark Jobs’s return.

Today’s WWDC keynote address will certainly lay to rest this latest round of rumours, fuel a new round, and provide us with a glimpse of the direction Apple intends to take for the next year or two.