Program enables homeowners to share rental income with charities for homeless

Jeff Lee

Sun

Two Vancouver charities that help the homeless will be the beneficiaries of a unique program to match visitors to the Vancouver 2010 Olympics with home-stay accommodation.

In what is being called an Olympic first, Covenant House and the Streetohome Foundation will share revenues with homeowners with a conscience who want to rent out beds, rooms or even houses to Games-time visitors.

Today, the founders of the Web-based accommodation-matching service will kick off their plan to try to raise thousands of dollars for the two charities by capitalizing on the demand for visitor accommodation during the Games.

The non-profit project has the support and backing of the Vancouver Organizing Committee, but the group isn’t using any of the Olympic marks or logos.

“We’re a collective of people who were very concerned about creating a social opportunity to benefit from the Olympics,” said Tracey Axelsson, project manager for Home For The Games. “We want a thousand people to do this, and the benefits will go to helping the homeless.”

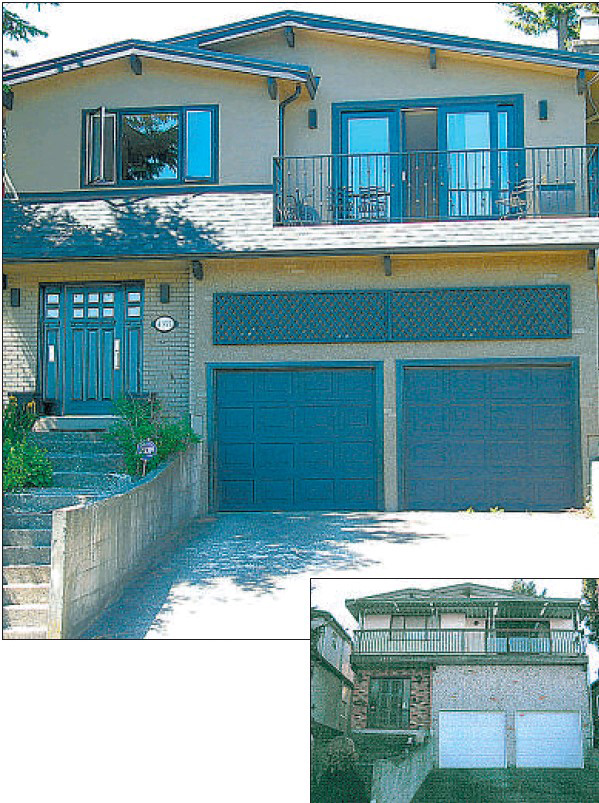

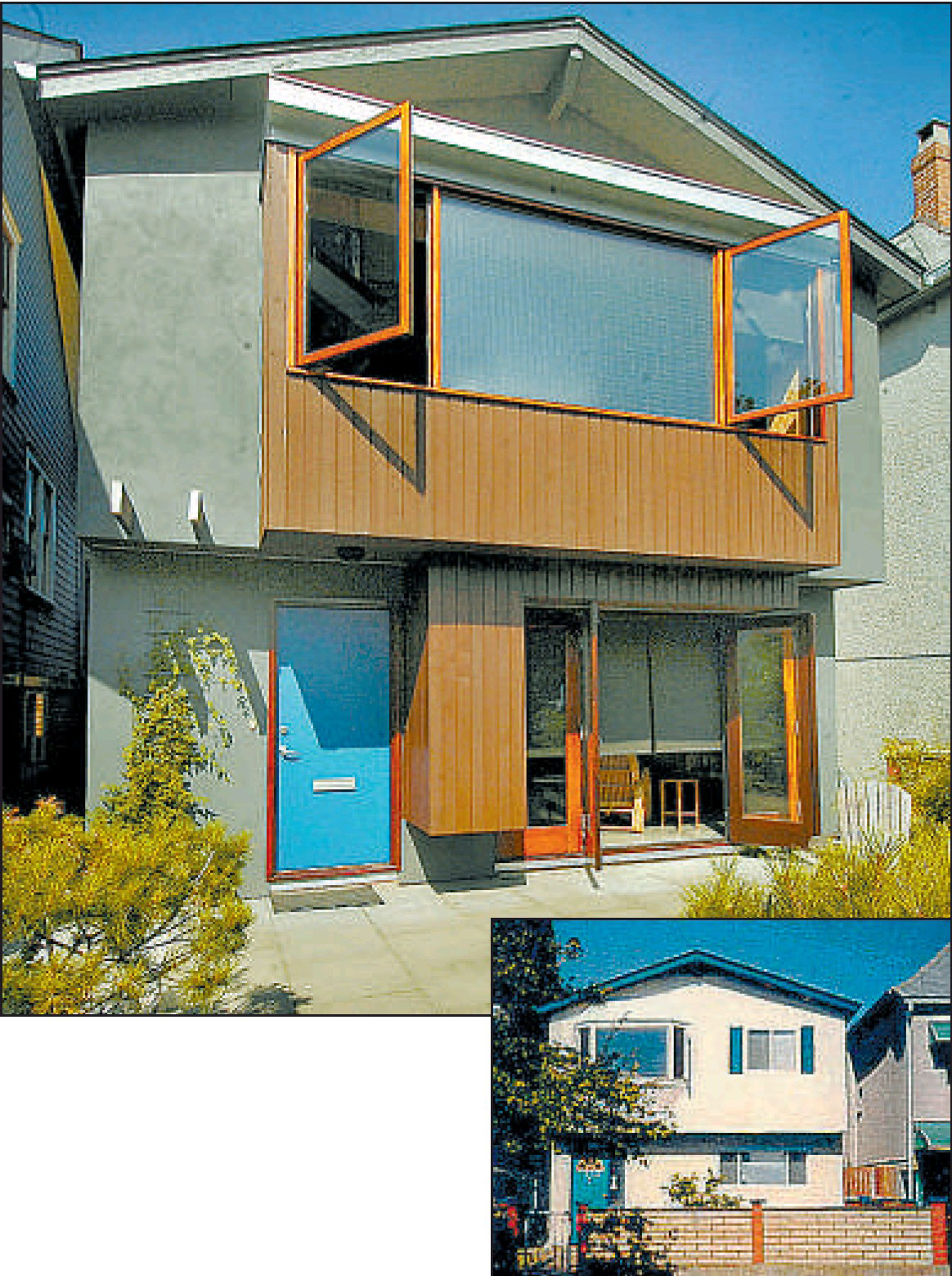

The idea was the brainchild of Charles Montgomery and several others who gathered up several corporate sponsorships and $150,000 in in-kind donations to get the website operating. Their idea calls for people who want to rent out rooms for the Games to list their facilities on the website, www.homeforthegames.com.

Volunteers will vet each listing to make sure the rooms actually exist and meet minimum safety standards, Axelsson said.

When people book accommodation, they have to leave with the society a down payment of half the amount. That portion is then given to Covenant House and Streetohome Foundation, which in turn will issue tax receipts. The homeowner retains the rest.

The society’s website was soft-launched Tuesday. It doesn’t yet list any beds, but Axelsson said it has already received a number of applications, as well as one online donation.

“This is such a wonderful idea,” said Jae Kim, president of Streetohome, which provides funding programs to homeless shelters.

“When you think about people who have a home using their revenue not to make a quick buck during the Olympics but to help people who are homeless, I think there is something poetic about that.

“We thought it was a very interesting way to leverage what is going on with the city in terms of homelessness.”

Kim said she didn’t know how much money the program will raise for Streetohome, but said none will go to cover administrative expenses. Axelsson said Home For The Games worked directly with Vanoc’s sustainability department.

© Copyright (c) The Vancouver Sun