Builders, buyers hammered

John Bermingham

Province

Homebuyers will be the biggest losers under B.C.’s controversial new harmonized sales tax.

Once the numbers are crunched, buyers of new or used homes — whether their first or their 31st — will be squeezed for tens of thousands more in taxes come July 1 of next year.

They’ll pay tax on the land, tax on the house and tax on any professional who performs a service in the real-estate transaction.

Under the HST just announced by the Liberal government, an extra seven per cent in tax will be applied to all new homes.

Buyers of new homes already shell out for the five-per-cent federal goods-and-services tax.

B.C. also charges a property transfer tax of one to two per cent on a home, with a partial exemption for first-time homebuyers.

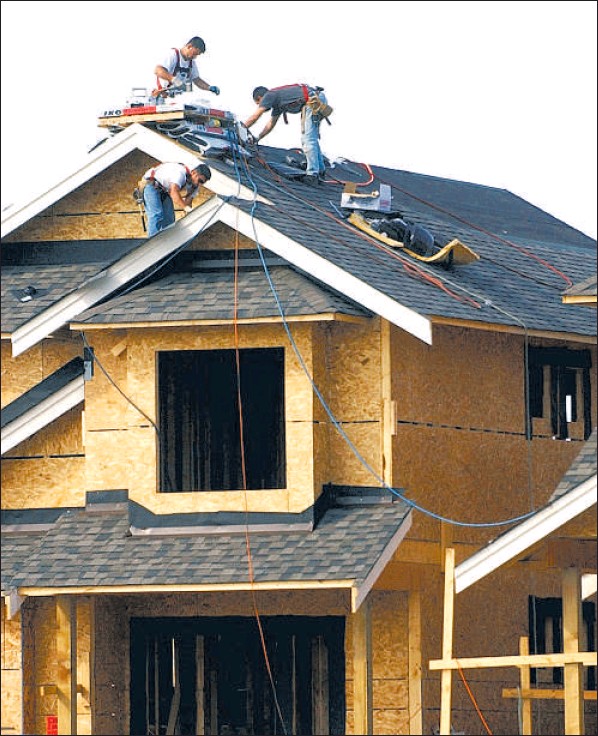

Builders say the HST will add $56,000 to the price of a new $800,000 home.

B.C. is promising to rebate seven per cent of the HST on new homes up to $400,000, with a flat $20,000 rebate on homes over that price — which still leaves $36,000 in extra sales tax.

Builders will now be able to pass on the provincial sales tax for building materials — about two per cent, which they currently embed in the price of a new home. Under the HST, they can claim that money back as an “input tax credit,” which would knock $8,000 off the tax bill if they passed the saving along to the buyer.

But in all, the HST still leaves the buyer of a new $800,000 home paying as much as $28,000 more in tax. In the Fraser Valley, where the average price for a detached house is $505,976, the HST would add $15,418.32, after the rebate.

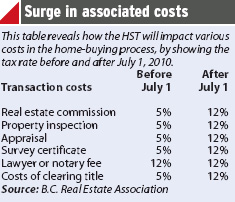

The HST will also increase the cost for a host of transaction services. Realtors’ commissions will rise from five to 12 per cent, which will add several thousand dollars to the average commission of $40,000 on an $800,000 home. Throw in professional fees — a home inspector, a notary, surveyor and appraiser, who will also be charging 12-per-cent HST — and that adds several hundred dollars more. Finally, the tax will apply to “residual costs” — meaning all home renovations will carry a 12-per-cent tax instead of the current five.

“It’s going to be a huge increase in costs to the consumer,” said Jake Friesen, vice-president of Qualico Developments, which builds 150 new homes a year around the Lower Mainland.

“Either the consumer pays, or we reduce business and lay off people, or go out of business,” he added. “There’s going to be tremendous anger in the general public. For a time, they’ll refuse to pay it. Sales of new homes will stop.”

In anticipation of a cliff-like drop in demand, his firm will build flat-out to complete before July 1, Friesen said. Any home that can’t be finished by that date won’t be built, he insists.

Peter Simpson, CEO of the Greater Vancouver Home Builders’ Association, called the HST a “barrier to affordability.” “It’s going to hit the middle class,” he said. “It’s not going to be hitting the folks who pay the million-dollar-plus homes.”

M.J. Whitemarsh, CEO of the Canadian Home Builders’ Association of B.C., said 60 per cent of homebuyers will pay more in tax because they will go over the $400,000 threshold. She said a more realistic cut-off would be $750,000.

Finance Minister Colin Hansen has said that half of all new homes in Metro Vancouver are condos, so $400,000 is a truer standard.

Duncan realtor John Tillie, who heads the B.C. Real Estate Association, argued that the Liberal government should phase out the property transfer tax to offset the HST. “We pay more in property transfer tax than any other province,” said Tillie. “Now you put HST on this. It is totally unfair.”

Tsur Somerville, of the University of B.C.‘s Sauder School of Business, said the tax will also raise the price for used homes, which won’t be taxed under the HST but will see a surge in demand as a result.

“It’s a tax-shift to consumers, away from business,” said Helmut Pastrick, chief economist with Central 1 Credit Union. However, he added that the HST should start paying back within a few years, as business will invest more, which should create economic growth and more jobs.

© Copyright (c) The Province