Adrian Sainz, David Twiddy, Daniel Wagner, Alex Veiga,

USA Today

After the worst crisis since the Great Depression, the housing market has stabilized, according to data.

It was — note the past tense — the worst housing recession anyone but survivors of the Great Depression can remember.

From the frenzied peak of the real estate boom in 2005-2006 to the recession’s trough earlier this year, home resales fell 38% and sales of new homes tumbled 76%. Construction of homes and apartments skidded 79%. And for the first time in more than four decades of record keeping, home prices posted consecutive annual declines.

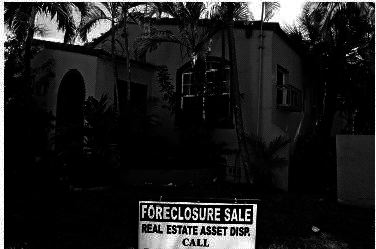

A staggering $4 trillion in home equity was wiped out, and millions of Americans lost their homes through foreclosure.

Now take a deep breath and exhale. The worst is over.

By every measure, except foreclosures, the housing market has stabilized and many areas are recovering, according to a spate of data released in the past two weeks. Nationwide, home resales in June are up 9% from January, on a seasonally adjusted basis. Sales of new homes have climbed 17% during the same period. And construction, while still anemic, has risen almost 20% since the beginning of the year.

Even home prices, down one third from the top, edged up in May, the first monthly increase since June 2006.

“The freefall is over,” says Dean Baker of the Center for Economic and Policy Research.

The problem is that, Baker, like many economists, expects the housing market will “be bouncing around the bottom” for the second half of the year.

There are also real threats that could poison this budding recovery. The unemployment rate, which is 9.5%, is expected to surpass 10%, leaving even more homeowners unable to pay their mortgages. Mortgage rates could rise, making homeownership less affordable. And the federal tax credit for first-time homebuyers, which as lured many into the market, is set to expire on Nov. 30.

“As long as jobs are being lost, regardless of all the federal programs out there to help the borrowers, you’re still going to have problems in the housing market,” says Steve Cumbie, executive director of the Center for Real Estate Development at the University of North Carolina‘s Kenan-Flagler Business School.

True, but when you’ve got bidding wars for foreclosures in places like Las Vegas, Phoenix and Los Angeles, it’s time to call the bottom.

Northeast

Nobody knows the power of a dollar like New Yorkers.

After home on Long Island sat on the market for four months recently, the sellers’ real estate agent told them to drop the price from the mid-$600s to $599,000. The house sold the next weekend.

In Merrick, about 30 miles east of New York City, homes are starting to sell “as long as they’re priced right,” the agent said.

In January, with the ground and financial markets still frozen, few would have believed that the worst of the housing crisis in the Northeast would turn around within six months.

But the evidence is clear: home resales in the region in June hit a seasonally adjusted pace of 820,000, up 28% from the beginning of the year. Sales of new homes were also up slightly and construction in the region more than doubled.

Even the median sales price of $249,400 in June was up 10% from January and was off just 6% from year-ago levels, according to the National Association of Realtors.

“We certainly had our share of problems, but overall the severity of what happened here was far less” than what happened elsewhere, says Michael Lynch, an economist with IHS Global Insight.

Pittsburgh has the region’s strongest home market in terms of sales and prices because the city saw less of a housing bubble and the area has 7.7% unemployment rate that is below the national rate.

One of the weakest markets, by contrast, was Providence, where a jobless rate of 12% exacerbated the city’s foreclosure crisis. Too many residents took out risky subprime loans they couldn’t afford when the interest rates spiked within a few years. Today, more than one in 10 homeowners with a mortgage in the state is at least one month behind or in foreclosure.

The Northeast, more than any other region, felt the full force of the credit crisis that reshaped Wall Street. Manhattan‘s real estate market, long immune from price declines, tanked this year as tens of thousands of people lost their jobs.

Prices of for-sale apartments plunged in the second quarter by the largest amount in decades. Prices have fallen, on average, between 13 and 19%, according to four reports published recently by real estate firms.

Northeast states: Connecticut, Maine, Massachusetts, New Hampshire, New Jersey, New York, Pennsylvania, Rhode Island, Vermont

Data compares June vs. January and June vs. June 2008:

• Home resales: up 28%; down 5 percent

• Median price: $249,400, up 10% from January; down 6 percent

• New-home sales: up 3%; down 11 percent

• New home construction: up 113%, down 68 percent

• Mortgage delinquencies as of March: 10.4 percent

Regional outlook: The region should experience “a nice rebound in home construction” over the rest of the year, according to IHS Global Insight, an economic research firm. Sales for new and existing homes are likely to rise. Just don’t expect your home’s value to shoot up. Rising unemployment will lead to more foreclosures, and that will keep a lid on prices.

South

The real estate market in the South remains one of extremes.

On one end, are oil-rich cities in Texas, Arkansas and Oklahoma that nearly skirted the housing recession altogether. Tipping the scale on the other side are foreclosure-ridden areas in Atlanta and swaths in Florida where prices are still falling annually by double digits.

Taken as a whole, home resales in the 17-state region rose 10% in the first half of this year on a seasonally adjusted basis, and are off just 4% from June of last year, according to the National Association of Realtors.

“Generally speaking, the rate of decrease, both in sales and prices, has started to bottom,” says the University of North Carolina‘s Cumbie. “But that doesn’t mean it’s going to come roaring back.”

Mass layoffs at Bank of America and Wachovia, for example, have taken their toll in their home state of North Carolina. Home price declines in Charlotte accelerated this year, and home resales in June were off nearly 30% from last year.

Home and apartment construction, a key economic engine, will also vary widely across the region. Parts of the South, notably Florida and Atlanta, were vastly overbuilt during the housing boom. So construction in the region rose a meager 7% in the first half of the year, the lowest of the four regions, according to the Commerce Department.

There was little reason for builders to start laying new foundations. New-home sales fell 2% from January to June, the only region in the country to post a decline.

“In the longer term, I’m confident that the real estate market is going to shift where buyers are coming out not only because of attractive interest rates and low prices, but because more people are getting jobs,” says Les Simmonds, president of L.G. Simmonds Real Estate Corp. in Longwood, Fla. an Orlando suburb. “But, as we speak, it’s not right. It’s going to take more time.”

Southeast states: Alabama, Arkansas, Delaware, D.C., Florida, Georgia, Kentucky, Louisiana, Maryland, Mississippi, North Carolina, Oklahoma, South Carolina, Tennessee, Texas, Virginia, West Virginia

Data compares June vs. January and June vs. June 2008:

• Home resales: up 10%; down 4 percent

• Median price: $163,200 up 14%; down 12 percent

• New-home sales: down 2%; down 34 percent

• New home construction: up 7%; down 44 percent

• Mortgage delinquencies as of March: 12.7 percent

Regional outlook: The southern market has several characteristics that could help it recover, Cumbie says. The population continues to grow and businesses continue to move into the region. But the weight of foreclosures and job losses stretching into next year could delay any meaningful recovery.

Midwest

It’s no surprise that the housing market and the auto industry are intertwined in Detroit, though, this is the first time anybody can remember that you can buy a home for less than the price of a new car.

But step out of devastated towns in Michigan, Ohio and Indiana and the housing market in the Midwest is showing some of the strongest signs of recovery in the country.

Thanks to places like the Dakotas, Iowa and Nebraska, the median sales price in the region rose almost 20% to an affordable $157,000 in June from January levels.

Sales of new homes jumped almost 38% in the first half of the year, which encouraged builders to get out their hammers. Construction, which was at a standstill in some communities, rose 86% on a seasonally adjusted basis, which accounts for typical variations in weather and other factors.

“New construction has been a good indicator for us in the past of what the general market is doing,” says Chris Collins, president of the Kansas City Regional Association of Realtors. “Our new market is not what we’ve been used to but it’s substantially better than other parts of the country.”

The home resale market, however, remains weaker than the nation as a whole. That again can be blamed on the economy. The jobless rate in the Midwest is 10.2% compared with 9.5% nationally. And if you don’t have a job you are not buying a house.

William Strauss, a senior economist for the Federal Reserve Bank of Chicago, cautioned that job cuts are still high in the region, and loss of income is the No. 1 reason homeowners default.

“We never got as bad as (other) states but nonetheless we still took a hit,” he says, and the market remains “soft in the Midwest.”

Midwest states: Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Missouri, Nebraska, North Dakota, Ohio, South Dakota, Wisconsin

Data compares June vs. January and June 2008:

• Home resales: up 7%, down 2 percent

• Median price: $157,000, up 20%, down 9 percent

• New-home sales: up 38%, up 6 percent

• New home construction: up 86%, down 21 percent

• Mortgage delinquencies as of March: 11.5 percent

Regional outlook: “Before we can even talk about the housing sector materially improving, we’re going to have to see these job losses get down quite a bit,” said William Strauss, a senior economist for the Federal Reserve Bank of Chicago. Financial markets must also improve, he said, so more homebuyers can qualify for a mortgage.

West

For years Las Vegas symbolized the boom, as mile after mile of desert gave way to three-bedroom homes and swimming pools. Then came the crash and it symbolized something else: a decade of speculation and excess.

Now, Las Vegas is one of the hottest housing markets in the region again. This city has always profited from others’ misfortune, and the same can be said of the current housing market.

In Clark County, Nev., home to Sin City, one in every 11 homes had received at least one foreclosure-related notice in June, according to RealtyTrac. The glut of deeply discounted foreclosures has almost doubled sales activity for most of this year.

“In January the market was busy, and since that time, it’s gone a little haywire,” says Brad Snyder, an agent with ZipRealty in Las Vegas. “There’s (sales) activity now that we haven’t seen even since ’04.”

The situation is similar in California‘s Riverside, San Joaquin and San Bernardino counties, where one out of every 14 homes was in foreclosure.

After falling 18% in the second half of 2008, monthly home prices were flat in the first half of this year, on a seasonally adjusted basis, according to the National Association of Realtors.

Markets like these have seen a surge this year in all-cash buyers, many of them investors, scooping up the sharply discounted properties. It’s not uncommon to see multiple offers on a single property, and that’s helped slow the rate of price declines a little. The demand also has helped whittle down the inventory of homes for sale to the lowest level since the boom.

“We have seen such a steep decline in supply right now, that when a home comes on the market it’s first day there could be seven or eight or 10 people there in a matter of hours,” Snyder says.

To lure buyers away from foreclosures, homebuilders have slashed prices or are simply tearing down vacant homes. New-home sales jumped almost 59% in the first half of the year, while construction in these grossly overbuilt markets slid 12%.

In the Pacific Northwest and states such as Utah, by contrast, housing markets are on a different timer than the rest of the West. Home sales and values held up better and longer while markets in the Southwest were already in decline. These markets also haven’t seen as many foreclosures wreaking havoc with home prices.

States in the region: Alaska, Arizona, California, Colorado, Hawaii, Idaho, Montana, Nevada, New Mexico, Oregon, Utah, Washington, Wyoming

Data compares June vs. January and June 2008:

• Home resales: down 1%, up 12 percent

• Median price: $214,800, flat, down 25 percent

• New-home sales: up 59%, down 10 percent

• New home construction: down 12%, down 42 percent

• Mortgage delinquencies as of March: 12 percent

Regional outlook: The recession remains the region’s wild card. Unemployment is at 10.2% in the West, but that could go higher if the economy worsens. If that happens, expect more foreclosures and a slower turnaround.

Adrian Sainz reported from Miami, Alex Veiga reported from Los Angeles, Daniel Wagner from Washington, and David Twiddy from Kansas City. AP Data Specialist Allen Chen contributed to this report.

Copyright 2009 The Associated Press. All rights reserved.