Property values fall while tenants are vanishing

Diane Francis

Sun

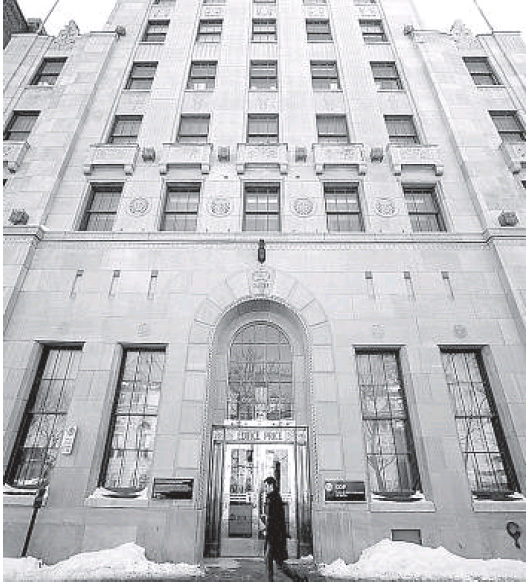

Commercial real estate is the next economic shoe to drop. Photograph by: Mathieu Belanger, Reuters, The Financial Post

The new mantra is about to migrate from “too big to fail” to “too many to fail” as another banking tsunami, involving commercial real estate, heads toward the global economy.

“Commercial real estate is the next shoe to drop,” according to James Helsel, Treasurer of the U.S. National Association of Realtors in recent testimony before Congress.

This is another delayed result of the meltdown as nonresidential property values have collapsed more than have residential properties and their loans need to be rolled over.

Commercial properties are usually mortgaged for five or more years, in tandem with the leases they have signed. But renewing or increasing mortgages will be difficult to impossible given the economic and banking climates.

Moody’s Investors Service says the value of U.S. commercial real estate has fallen from the 2007 peak by an average of 35%, more than the residential property average. At the same time, these landlords’ tenants are in trouble and so are their lenders.

This means they must sell in a lousy market, put in more equity or find themselves foreclosed because they are unable to finance.

This stalled ripple effect is starting to accelerate: Tenants are going bust; some move out in the middle of the night; existing tenants demand concessions and others pay lower rent and also consolidate into smaller space. This is the logical outcome when consumer spending disappears and retailers and manufacturers are hurt.

The Obama White House is preparing for the next round of banking/real estate crises by trying to shore up liquidity so that landlords can refinance.

Reports are that Tarp 2 is being designed to backstop the smaller, regional banks that are more commonly in commercial property lending.

Here is the landscape: America’s four largest banks have been successfully bailed out. Their exposure to commercial real estate is only 2% of assets. And their commercial exposure is mostly the trophy properties because they skimmed off the best risks.

– The banks that are 30 to 100th in size in the U.S. have a 12% average exposure to commercial property, Deutsche Bank real estate analyst Richard Parkus told Congress.

– There are US$3.7 trillion in outstanding commercial real estate-backed loans. Some US$400 billion will reach maturity by the end of 2009 and accelerate to US$2 trillion in 2010 and 2011, according to some sources.

The good news is that many of the entrepreneurs in this sector were blown out as owners in the last real estate collapse in the early 1990s, and replaced with deep-pocketed pension funds or other institutions with greater staying power. But they are also being badly impacted, signing sweetheart leases to keep tenants or taking massive write-downs like Canada’s Caisse de Depot et Placements which took a $5.7 billion hit last quarter.

The worst case scenario will be if the jobless recovery lasts more than two years, consumer spending remains lacklustre and bank losses on these properties trigger another financial crisis worldwide.

© Copyright (c) The Vancouver Sun