Stay on track with streetcars

Jon Ferry

Province

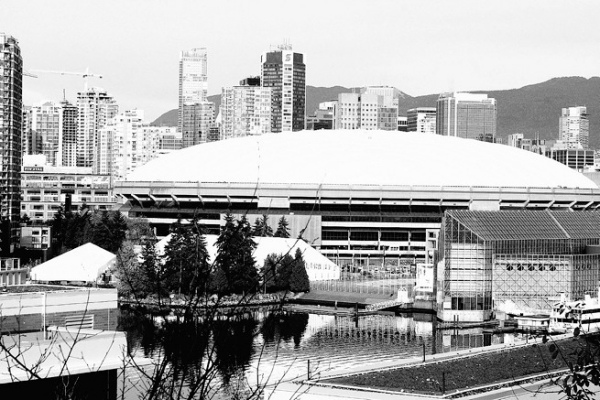

The Bombardier streetcar makes its inaugural ride with Mayor Gregor Robertson and other dignitaries on board. Photograph by: Ian Lindsay, PNG

Sophie Lennox-King, with niece Maika, says streetcars are smoother, more comfortable and romantic. IAN LINDSAY –PNG

As Sophie Lennox-King got set Wednesday to try out Vancouver’s new Olympic streetcar service, along with her two-year-old niece Maika, I asked her what exactly it was she liked about this back-to-the-future form of transportation.

Well, the Vancouver designer told me she’d recently moved here from Toronto, so she was used to streetcars. Taking one was better than riding the subway because you could see what was going on outside, she said. And it was smoother, more comfortable than the bus.

Then, she added, as the Dal Richards jazz band played in the background outside the Canada Line’s Olympic Village station, “it’s more romantic.”

Lennox-King is right. Streetcars, which hark back to those golden days when Vancouver had an extensive electric streetcar network, are way more romantic than most forms of public transit. Which is why I believe that, despite their eye-popping expense, they’ll catch on again in Vancouver. Not everything comes down to dollars and cents.

Take the Olympics. On a strict accounting basis, I’m sure they make little sense. But the day we win our first gold, no one will admit to having been opposed to them . . . at least until the bills start trickling in.

Talking of which, much of the informal chatter at yesterday’s official opening of the trial service between the Olympic Village Station and Granville Island was of how Whistler resort owner Intrawest was broke and of how that might impact the Olympics. The weather was also, well, blah.

The electric streetcar, however, seemed to lift everyone’s mood. Hundreds lined up to test the gleaming Bombardier car.

New Westminster courier driver Atti Torok, 46, told me he was the first member of the public to climb aboard, after waiting since 4:30 a.m.

“It was great, it was very smooth, it’s very quick,” he said. “It’s a nice ride to Granville Island, and it would be a shame for the city not to expand that.”

And that, of course, is the multimillion-dollar question. The Olympic streetcar will run 18 hours a day, but only for the next couple of months. Then the two cars have to go back to the Brussels Transport Company and the land of chocolates, waffles and beer. So what happens then?

Does the old 1.8-kilometre track, which just cost $8.5 million to upgrade, get mothballed again? Or is this the start of a streetcar revival?

It’s obvious where the streetcar should go now — from the Olympic Village station to Gastown and Stanley Park, via our own newspaper building at the foot of Granville Street. But I’m not waiting at the curb just yet.

In Toronto in 2004, construction of 6.8 km of the St. Clair streetcar track was supposed to cost $48 million and take three years. More than five years later, it still isn’t finished and the price has reportedly ballooned to $105 million.

When it comes to romance, though, what’s a few million bucks?

I’m up for it, as I was for the Olympics. But just how much desire is there among other Vancouver-area taxpayers?

Judging by Wednesday’s enthusiastic turnout, more than you’d think.

© Copyright (c) The Province