Falling home prices appear to be behind us as Lower Mainland sales gain strength

Derrick Penner

Sun

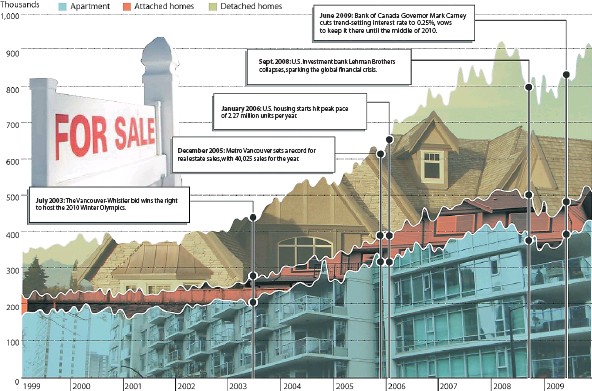

SOURCE: B.C. REAL ESTATE ASSOCIATION VANCOUVER SUN GRAPHIC

When condo marketer Cameron McNeill stood to make a speech at his company’s Christmas party, he presided over an upbeat crowd of developers, realtors and industry insiders.

Dressed casually in a Hawaiian shirt, wearing a lei for the Polynesianthemed soiree at Chill Winston in Gastown, McNeill remarked that the brisk sales and project launches that have marked the end of this year are a long way from the dark days of last December.

A year ago, developers were putting projects on ice, and sales in Metro Vancouver’s resale housing market dropped to 924 transactions in December, half of what they were in December 2007.

“It was only a year ago that many in our industry were cancelling Christmas parties just out of principle,” McNeill, president of MAC Marketing Solutions, recalled in an interview.

“[December 2008] was a very sombre mood. There were broad layoffs happening industry-wide, not only [among] developers, but with service providers, architects, interior designers.”

No one was buying real estate, which meant no developer, even if they had the financial wherewithal, was prepared to take the risk and build, Mc-Neill said.

Fast forward 12 months, however, and sales returned to near historic highs.

From January, when sales across Metro Vancouver had slumped to 724 transactions, sales in the city climbed to 1,480 units in February, then peaked at 4,259 units in June. Sales continued at elevated levels in July, August and through the fall.

“The housing market has seen an extremely volatile year,” Cameron Muir, chief economist for the B.C. Real Estate Association, said in an interview.

“We saw home sales in January at levels we hadn’t seen since the 1980s, leading into near record sales in the fall. So it has been a dramatic rebound indeed.”

Sales in Metro Vancouver had started to decline through 2008, but plummeted in the fall with the collapse of Lehman Brothers, which precipitated the world financial crisis.

At the start of the year, B.C. was experiencing job losses in the tens of thousands per month (January alone saw the province shed 35,000 jobs, according to Statistics Canada), with many of the job losses coming in the construction sector as a result of those stalled housing projects.

However, the decline Metro Vancouver experienced in home prices coincided with dropping interest rates that were precipitated by the Bank of Canada slashing its trendsetting rate to its lowest level since the 1950s.

That combination–lower prices and rock-bottom interest rates–sparked a new round of buying activity that pulled in the potential buyers who put off purchase decisions in late 2008, as well as people who hadn’t considered buying before interest rates fell.

Home sales “basically accelerated in tandem with [declining] interest rates,” Helmut Pastrick, chief economist for Central 1 Credit Union said in an interview.

“Despite the broader economy being in recession for the first half of the year, the fact that we had these very low rates really stimulated sales,” Pastrick said.

He added that in previous economic downturns, housing markets have been the first sector of the economy to begin recovering, so a turnaround in sales wasn’t unexpected, though the magnitude of it was surprising.

“To some extent, it is a bit ironic that in the midst of a recession we see this turnaround [in home sales],” Pastrick said. “Bear in mind that is normal. What isn’t normal is the extent of it, the magnitude.”

By mid-year, mortgage rates had fallen so low that with discounts, buyers were able to secure loans with five-year fixed interest rates at 3.75 per cent, helping to fuel a surge of buying that many observers believed would eventually come to an end.

“Normally, whenever you have these sales surges it does borrow from future demand,” Pastrick said. “At some point, we’re going to see lower sales levels than we currently have.”

However, the rebound in sales has put pressure on prices again.

Muir estimated that average prices in Metro Vancouver fell some 15 per cent during the market downturn, but have mostly recovered that ground in recent months.

The average price for a Metro Vancouver single-family home, for example, peaked at $920,000 in February 2008, then fell as low as $745,000 by November 2008.

By November of this year, the average house price had climbed back up to $903,000, which reignites new worries about Metro Vancouver’s high property prices.

“On the [market] fundamentals side, the most worrisome thing would be home prices rebounding and the prospect of higher mortgage rates in the future,” Muir said.

When Bank of Canada Governor Mark Carney cut the bank’s key rate to historic lows earlier this year, he vowed to keep it there until at least the middle of 2010, as a measure to help stimulate the economy.

Raising the key rate, which sits at 0.25 per cent, will begin to put pressure on mortgage rates and in turn increase debt servicing costs for homebuyers.

Nationally, the surge in home buying, and the upward pressure that it has put on home prices, had Carney at the Bank of Canada warning that growing levels of household debt, particularly mortgage debt, and the degree Canadians will be stretched to make their payments because of higher interest rates is becoming the biggest risk to the country’s economic recovery.

Muir said he is forecasting the pace of Metro Vancouver’s real estate sales to tail off to keep pace with what he expects to be a slow and protracted recovery of the overall economy.

Pastrick added that 2010 should see more property sales than 2009, though he also expects the trend of rising sales to taper off.

“This sharp run-up is not going to be duplicated in 2010,” he said.

It is a level of activity, however, that industry players are comfortable with.

“I’d say that [the development sector] has mostly recovered,” McNeill said, “but it is much more of a stable industry-wide environment that we’re living in right now.”

© Copyright (c) The Vancouver Sun