Stephanie Armour

USA Today

After breaking up with her longtime boyfriend and finding a job she loves in Denver, Quinn Kelsey decided last Friday to take advantage of the home buyers’ tax credit.

She found a condo she liked in her neighborhood and called a local Realtor’s office to hire an agent. She got preapproved for a loan in an hour. Early this week, she put in her offer, with just one contingency: Her offer had to be accepted before the tax credit deadline Friday.

After all, it’s the main reason she decided to rush and buy now. Her offer was accepted Tuesday night.

Buyers like Kelsey have been in a final sprint for the past week to meet Friday’s deadline for signing purchase contracts to stay eligible for the tax credit, worth up to $8,000 for first-time home buyers and up to $6,500 for move-up buyers. Many Realtors have been busier than in months past, homes that languished on the market have suddenly gotten offers, and buyers who were sitting on the fence have quickly cobbled together offers in the nick of time.

If a binding sales contract is signed by April 30, home buyers have until June 30 to complete the purchase. The tax credit is projected to have added 2 million first-time buyers in 2009 and be adding another 900,000 in 2010, plus 1.5 million repeat buyers, according to the National Association of Realtors.

More calls, more visits

Signs of the last-minute purchase rush:

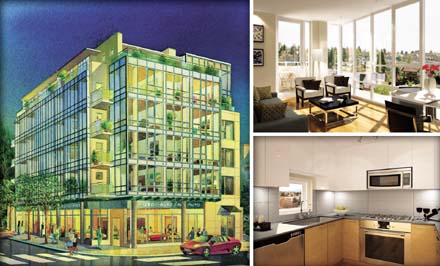

•Sheldon Good & Co., a national real estate auction, has scheduled a one-day auction of 25 residences at Market Street West — a 60-unit condo building in Willow Springs, Ill. — today to purposely allow both first-time and repeat home buyers to take advantage of the expiring tax credit.

“We’re doing a selling event to take advantage of the tax credit deadline,” says Craig Post, managing director of Sheldon Good.

•Fields Development Group’s The Saffron in Jersey City reports it has had a high velocity of sales from home buyers looking to take advantage of the tax credit. In the past several weeks, the new collection of 76 condos has seen a rush of first-time buyers who want to benefit from the tax credit, resulting in significant buyer activity — pushing the building past the mark of 40% sold.

Homes at The Saffron are available for immediate occupancy, which allows purchasers to close in time to be eligible for the credit.

“The tax credit really made us decide to do it sooner,” says Chris Seminowicz, a first-time home buyer who closed April 9 on a condo at The Saffron.

•Elika Associates, a buyers’ brokerage firm in New York, is seeing a surge in calls from first-time home buyers eager to pull the trigger before Friday. In the past two months, it has been averaging dozens of inquiries a day from preapproved buyers searching for homes in the $400,000 to $700,000 range. With the deadline looming, many of these buyers are now opening up their search to fringe neighborhoods that they may have bypassed earlier.

“People need to have the contract signed, so you’ve definitely seen a pickup (in activity),” says Bob Walters, chief economist at Quicken Loans, where buyers are turning for preapprovals and mortgage loans. “There’s been a significant influx of people trying to take advantage of this.”

But there can be risks in a rush.

Buyers may be so eager to get the tax credit that they may sign a mortgage agreement without really understanding all the terms, says Sylvia Alayon, vice president of operations at Consumer Mortgage Audit Center in Fort Lauderdale.

They may not grasp that their principal and interest payments will stay the same, but insurance and taxes will go up, for example. Or they may not understand what will happen to their loan, such as whether it will reset to higher payments, if it’s not a fixed-rate loan.

“I’d be concerned about bullying tactics, such as, ‘You have to do this because it’s going to expire,’ ” Alayon says. “Unfortunately, if you’re in a mad rush, you’re not going to give yourself time to inspect your mortgage. My concern would only be that they wouldn’t conduct due diligence.”

And many buyers are in a mad scramble.

“I’ve sold more houses in the past 30 days than in the past five years. It is so exciting to see the multiple contracts again. It’s what we Realtors live for,” says Lisa Stickels in Fairfield, Iowa. “Everyone at the Century 21 where I work is falling over each other to get to the folks who are showing up by the boatload. These buyers (and) sellers know they are under the deadline to get the first-time home buyer tax credit.”

Brokers also are seeing an increase in business in the past days as buyers try to get under contract in time.

“I have seen a spike this week in people scrambling to get preapproved for a mortgage so that they can get under contract by Friday. Both yesterday and today I have seen buyers trying to squeeze in before Friday,” says Gary Parkes, a broker in Woodstock, Ga. “Most sellers will not entertain an offer on a home without a preapproval letter, meaning us mortgage professionals need to help these last-minute buyers.”

The tax credit has already been credited with bolstering sales.

Existing-home sales rose 6.8% to a seasonally adjusted annual rate of 5.35 million units in March from February, according to the National Association of Realtors.

Last fall, before a previous tax credit expired, existing-home sales peaked at a 6.5 million annual rate, according to Moody’s Economy.com. This spring, they’re expected to peak at a 5.7 million rate in May.