Bare lot priced near $1 million

Province

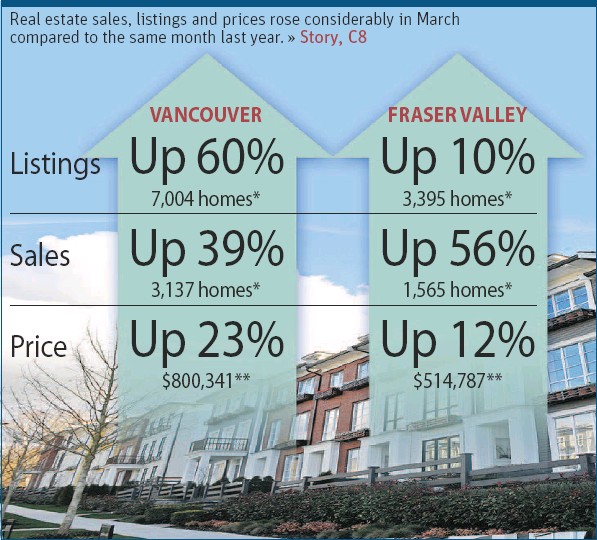

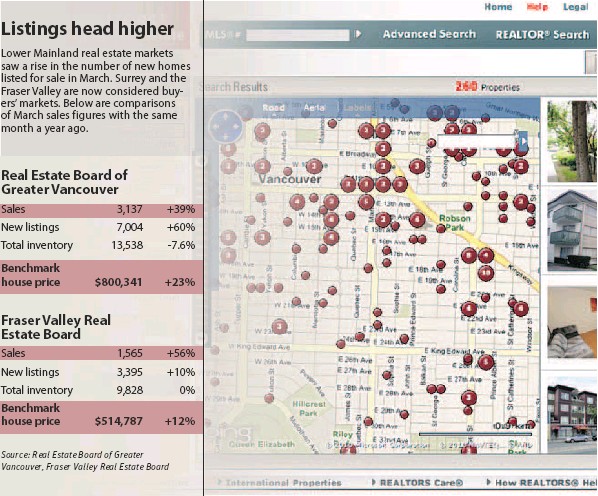

Houses in Vancouver East and North Vancouver remain relatively affordable but single-family homes on Vancouver’s west side and in West Vancouver are increasingly beyond the reach of many buyers, a new survey says.

Across Vancouver, detached bungalows were the star performer in the first quarter, posting a year-over-year increase of 21.8 per cent to an average of $906,045, according to a Royal LePage house price survey released Thursday.

“Single-family homes on Vancouver’s west side are the hot ticket,” said Chris Simmons, owner of Royal LePage Sunshine Coast. “They’re a diminishing commodity, due to zoning changes to allow for higher density. A bare lot on the west side can now cost up to $1 million.”

In North Vancouver, standard condos climbed 13.8 per cent year-on-year to $330,000. But that’s an affordable price compared with other Vancouver markets, Royal LePage said.

Detached bungalows in North Vancouver rose 22.3 per cent to an average of $740,000.

Across the nation, the housing market was generally buoyed by strong consumer demand in the first quarter of 2010, even though it experienced uneven growth, according to Royal LePage.

“The first quarter of 2010 continued where 2009 left off, with more Canadians enthusiastically participating in a rejuvenated residential real-estate market,” said Royal LePage Real Estate Services’ CEO Phil Soper.

“One of the earliest sectors of the economy to return to growth after the difficult recessionary period, the housing sector has been a prime beneficiary of low borrowing costs and improving consumer confidence.”

House prices were up across all key housing types surveyed, with the average price of a detached bungalow in Canada rising 11 per cent to $329,209 in the first quarter compared to the first quarter a year earlier. Standard two-storey homes rose 10.3 per cent to $365,141 and standard condominiums increased 10.9 per cent to $228,963.

The survey, which looks at seven types of housing in more than 250 neighbourhoods, found that there were three different trends across the country.

The first pattern, seen in urban centres such as Toronto, Vancouver and Victoria, was a roller-coaster effect in which prices dropped sharply then rose dramatically to levels that exceed pre-recessionary prices.

The second trend saw non-stop growth in markets such as Halifax, Ottawa, Regina, Saint John, St. John’s and Winnipeg, while the third saw level markets, where house prices have remained relatively unchanged in Calgary, Edmonton, Moncton and Montreal.

However, the report notes that price increases in all markets are expected to ease in mid-to late-2010.

“Even in our most frenzied pockets of market activity, the inevitable rise in interest rates coupled with home-price appreciation will rein in demand as affordability erodes,” said Soper.

“Expect house prices to continue to rise, but the rate of appreciation should ebb steadily, month by month, throughout the remainder of the year, as balance returns to the industry,” he added.

© Copyright (c) The Province