Fiona Anderson

Sun

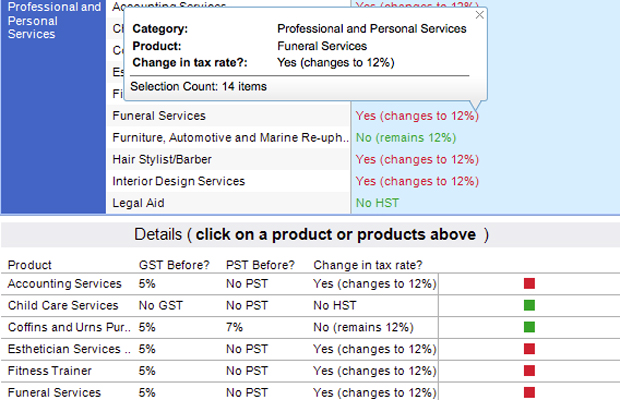

Some go up; some go down. And some taxes won’t change at all. Check out this clickable chart to find out if the tax on the goods and services you buy most often are changing. Photograph by: Screengrab, Tableau on vancouversun.com

According to a recent poll, 47 per cent of small businesses in British Columbia said they weren’t ready to implement the new harmonized sales tax, even though it is less than a week away.

And Ken Ghag, executive director of commodity tax at Ernst & Young in Vancouver says he’s still getting calls from companies asking for help.

For some companies it may be pretty straightforward — just increase the goods and services tax from five per cent to 12 per cent, rename it, and then delete any reference to the seven per cent provincial sales tax. Because in most cases if the item was subject to GST, it now will be subject to HST.

But that only applies to companies whose customers are all in B.C. and don’t sell any items that are subject to the province’s point of sale rebates, which the government has put in place to keep some of the exemptions B.C.’s taxpayers have enjoyed to date.

Then it gets more complicated, Ghag said.

One of the main complications is charging different customers different amounts of tax, depending on where the customer is, he said. For example, if the product is shipped to an Ontario customer, the B.C. business has to charge 13 per cent tax, the rate in that province.

Under the old system, B.C. merchants weren’t registered to collect Ontario tax, so all they charged for out-of town customers was the five per cent goods and services tax. The Ontario purchaser was then supposed to “self-assess” the tax it owed to its own government.

Businesses that sell goods subject to point-of-sale rebates, they have the choice of charging 12 per cent and then rebating the seven per cent provincial portion, or just charging five per cent, Ghag said.

So businesses have to make sure whatever system they use, its up-to date to ensure everything is taxed properly, he said.

And that’s a lot easier than it sounds, with companies like Home Depot and Loblaw Companies Ltd., which owns Real Canadian Superstores, recently admitting they’d been charging B.C. customers provincial sales tax on items that were exempt.

To make sure they don’t make the same mistake, companies should do a “post-implementation review” a few weeks after the HST comes into effect to make sure it’s being charged properly, Ghag said. “Because you don’t want to have that Home Depot situation a year down the road [where] people find you’ve been charging the tax [when you shouldn’t], he said. “The reputation risk is pretty high for these retailers.”

On the flip side, companies should also make sure they are properly keeping track of the amount of HST they are paying so they can make sure they get it all back.

Because the advantage of the HST — a value added tax — is that only the final consumer pays the tax. That means companies who charge HST get refunds for the tax they pay.

While companies are used to updating their systems for tax changes, the switch to HST is on a much broader scale than they’d be used to, so there is a lot to do, Ghag said.

And if that wasn’t enough, an unrelated change means that starting July 1, companies with revenues of more than $1.5 million a year now have to file their returns electronically.

© Copyright (c) The Vancouver Sun