Christine Dugas

USA Today

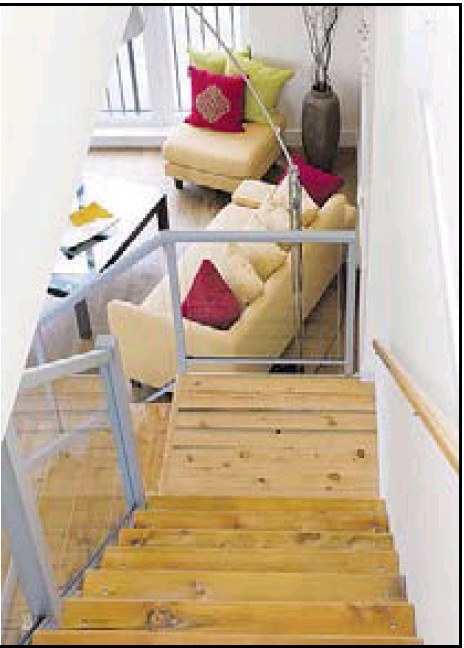

To get more space without moving, Carol and Mark Durgin built a basement with a family room, a bathroom and a laundry area. By Josh T. Reynolds for USA TODAY

Home remodeling is on the rise.

And no wonder. Owners having trouble selling their homes in this sluggish real estate market want to give them as much buyer appeal as they can afford.

Others are deciding that if they can’t move, they might as well make the most of the house they may be calling home for a long time.

After a year of decline in home remodeling, the number of homeowners saying they plan to remodel in the next 12 months increased from last year, according to RemodelOrMove.com, a website that provides homeowners remodeling options and has conducted semiannual surveys of owners since 2005.

Carol and Mark Durgin have owned a Cape Cod home in Marshfield, Mass., for about 15 years. Even though their son is grown and no longer lives with them, they thought the home was too small. Rather than try to sell it and buy a larger home, they decided to add a full basement.

They didn’t do much research before they launched into the project in June 2009.

“My husband just said he wanted to do it, and I said that I was on board,” says Carol, who owns a beauty salon in Quincy.

The new basement, which is nearly finished, has a second bathroom, a laundry room and a family room with a pool table. Mark, who works for the local laborers‘ union, did much of the interior work.

It took longer and cost more than they expected. They had to fix up their yard after the construction turned it into a mud pit. But they are happy with the results. “It’s wonderful,” Carol says.

In tough economic times, it’s important to make smart decisions. Here’s what to consider before you pick up a hammer:

1. The biggest bang for your buck

Before you even come up with a plan, consider how long you will live in the home. If you only plan to stay for several years, you may not be able to earn back the cost of a major renovation. Short-term owners should consider simple cosmetics, such as refinishing floors, painting and updating fixtures and lighting. “They are little things that don’t cost much but can really update a room,” says David Lupberger, home-improvement expert with ServiceMagic.com, a website that connects homeowners to prescreened contractors.

If you plan to stay in the home for five years or longer, then a kitchen or bathroom renovation provides the best return on your investment.

“Owners can enjoy a nice modern kitchen and bathroom,” says Elizabeth Blakeslee, associate broker at Coldwell Banker Residential Brokerage in Washington, D.C. “Down the road if they want to sell the home, they’re in good shape, because it’s kitchens and bathrooms that sell homes.”

One of the biggest mistakes that people make is to install a new pool in parts of the country where the weather is colder, she says. In general, renovating should bring a property up to the value of the comparable houses nearby.

“But you don’t want to over-improve it and have the most expensive home on the block,” says Ben Woolsey, director of marketing and consumer research at CreditCards.com. “A good rule of thumb is that you shouldn’t try to improve the value of your home more than 25% of its current value.”

2. Financing the project

Before you start renovating, estimate the cost and decide how you will pay for it.

The Durgins are happy with their lender’s advice. When they applied for a home-equity line of credit he suggested a higher limit than they asked for. They wouldn’t have to use all of it, but they’d have a cushion if they’d underestimated their cost.

They originally thought they would need about $40,000. But they decided to ask for a $75,000 line of credit and they ended up using $62,000.

Borrowing is not the only way to finance a remodeling job.

If your project is inexpensive and you have adequate savings, tapping them is the easiest way to go.

Many use their credit cards for projects under a few thousand dollars.

Owners can finance a kitchen or bath renovation or add a deck that way. If you hire a contractor for a bigger project, the costs can balloon. Then you may be better off with a personal loan, a home-equity loan or line of credit.

Sharp declines in home values mean many owners have no equity to tap. For those who do, financing home improvements with a home-equity loan makes sense because the interest is tax-deductible, Woolsey says.

3. Are you covered?

Before you start a project, make sure the contractor and subcontractors have adequate insurance coverage. Ask if the contractor has workers’ compensation, which covers lost wages and pays for medical and rehabilitation expenses if workers are injured. If not, an injured worker can sue you, says the Insurance Information Institute.

If you are adding an extra room, you will need to increase your home insurance coverage. Don’t wait until the renovation is completed to contact your insurance agent. If the addition is damaged or destroyed before insurance coverage has been increased, you may be responsible for the cost of repairing or rebuilding it, says Loretta Worters, vice president of the Insurance Information Institute.

Homeowners also should visit DisasterSafety.org, where the Institute for Business & Home Safety provides info about each state’s building codes and standards. It’s where homeowners can find out how to be sure contractors make their homes hurricane- or wildfire-resistant.

And during the renovation keep all of the receipts for items purchased, such as furniture and electronics, because you will want to make sure you have the right amount of coverage for personal possessions.

4. Ways to save money

Kitchens and bathrooms are the most popular renovation projects. But don’t overlook less-visible improvements that may cut the costs of owning a house.

Updating old plumbing and electrical wiring and disaster proofing your roof may lower your insurance premiums.

Owners of older homes can reduce their energy bills by adding insulation and installing new windows. Federal and state tax credits for certain improvements — such as energy-efficient central air conditioning, heating or water heaters — can lower your costs even more.

In the end, a renovation project’s payoff may be measured best by how much satisfaction it gives the homeowners.

Newlyweds Keith and Julianne Knapp encountered many difficulties buying their house, a fixer-upper in the Cincinnati area that they eventually landed when it was sold in foreclosure for $168,000.

Keith moved in before the wedding in July and started replacing ceilings and painting rooms. They have since added new fixtures and appliances, new carpeting and landscaping.

“Our neighbors tell us that they can’t believe that it’s the same house,” Keith says.

Their cost: about $10,000, paid out of savings, wedding-gift cash and a personal line of credit.

Now it’s the home where they plan to start a family. Says Keith, “We had a house-hunting nightmare with a storybook ending.”