Other

Presented to the BC Select Standing Committee on Finance and Government Services by the Real Estate Board of Greater Vancouver’s Government Relations Committee on October 15, 2010.

The story they tell is the same. They’re potential home buyers, eager and even desperate to buy a home in Canada’s most expensive housing market. Coming out of one of the worst recessions, they’ve managed to hang onto jobs and through sheer effort and thrift, they’ve saved for their down payment, needing every cent.

Then comes the surprise and the shock when they realize they’re unprepared for the overwhelming taxes associated with the purchase of their property.

First it was the Property Transfer Tax ( PTT), which adds about $ 16,000 to the average price of a detached home in Greater Vancouver. Now, new home buyers must also pay a 12% Harmonized Sales Tax ( HST), which is 7% more than they used to pay with the Goods and Services Tax ( GST).

Fence sitters are candid: paying both the PTT and the HST is too much. In the Board area, fewer and fewer potential home buyers can afford to buy a small starter home even in an outlying area. Even modest condominiums are taking longer to sell. Wary buyers wait, hoping the HST will be eliminated following the referendum, while they calculate taxes in the Lower Mainland that are more than twice those of other areas across the province due to the higher home prices.

Over the life of a mortgage, the $ 96,939 in taxes ( see table opposite) that a Metro Vancouver home buyer pays will cost a total of $ 152,976, using a 4.00% mortgage rate and 25 year amortization, with monthly payments of $ 509.92.

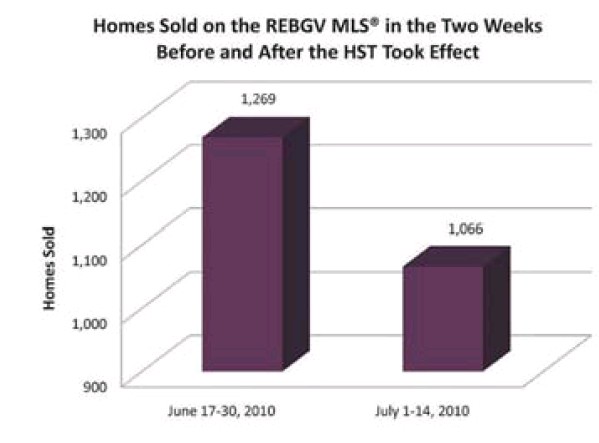

How have home buyers in Greater Vancouver reacted to the HST so far?

In the two weeks leading up to the July 1, 2010 implementation of the HST, home buyers jumped off the fence and into the market. In contrast, home sales in the two weeks after July 1, 2010 dropped 16%. ( see chart opposite)

Although REALTORS ® continue to inform buyers that the HST applies to new homes only and that there is a rebate program, buyers incorrectly believe the HST applies to all properties, including resale properties according to an August 5, 2010 survey by Royal Lepage. The results of the misperceptions are clear. In the two months following HST implementation, MLS home sales fell further and we’re hearing that home buyers are holding off buying a home until after the referendum.

REALTORS ® are attuned to the hopes and worries of property buyers, sellers and owners. What they’re hearing is that the HST and PTT are hurting home buyers and everyone associated with the transaction, from home inspectors to landscapers to furniture sellers.

Home buyers can’t sustain this level of taxation, a situation which is creating uncertainty for potential buyers, investors and businesses – and undermining economic growth. All of this could delay the housing market recovery, hurt the fragile economic recovery and inhibit the province’s ability to grow and compete.

Further, renters may be concerned that building owners may not be able to cover upkeep expenses because they are unable to claim HST input tax credits for goods and services.

Those owning a condominium worry about future building envelope problems and rising maintenance and repair costs that increase strata fees.

Recommendations

Here are five recommendations to help propel us out of the home sales slow-down and put us back on track to generate more opportunities for home buying and the resulting economic spinoff benefits.

1. Increase the 1% PTT threshold to $ 525,000 from $ 200,000, and in expensive markets increase it to $ 700,000. For 2011, index this threshold to BC Assessment average sales prices and then for 2012 onwards, index the threshold to the Canadian Real Estate Association’s National Housing Price Index ( currently under development). Apply the 2% tax rate to the remainder of the sale price and index annually. The threshold hasn’t been raised since it was introduced in 1987 and has resulted in a much larger tax burden as a result. It’s a classic example of tax bracket creep.

2. Raise the HST New Housing Rebate threshold to $ 700,000 from $ 525,000 in expensive markets such as the Lower Mainland. The threshold should be indexed to BC Assessment average sales prices for 2011. For 2012 onwards, index the threshold to the Canadian Real Estate Association’s National Housing Price Index ( currently under development). This would result in a fairer distribution of these taxes province-wide.

3. Allow Input Tax Credits for owners of residential rental accommodations. Owners of rental apartment buildings cannot claim HST input tax credits for goods and services to provide the rental service. While the HST adds 1.5 – 3% to

1 operating expenses, owners can’t raise rents more than 2.3%. This disincentive

2 discourages rental investment. We support the provincial government lobbying the federal government to allow zerorating of rental housing so that rental landlords can claim input tax credits on HST paid on operating expenses.

4. Reinstate the provincial portion of the HST Rebate or Tax Credit for leaky condominium repairs. This will help owners with repair costs, protect future owners and ensure that building envelope repairs are completed to accepted standards.

5. Extend the provincial portion of the HST Rebate or Tax Credit on energy efficient products.

In order to help home owners make their properties more energy efficient, there needs to be an exemption for the provincial portion of the HST on energy efficient products. This could be a point of sale rebate or a tax credit similar to the federal Home Renovation Tax Credit.

( Note: Subsequent to this presentation being made, the provincial government reinstated the Live Smart BC program – see www. livesmartbc. ca) 1 British Columbia Apartment Owners and Managers Association 2 Ministry of Housing and Social Development, www. rto. gov. bc. ca/ content/ news/ default. aspx

copyright© REBGV