The Province

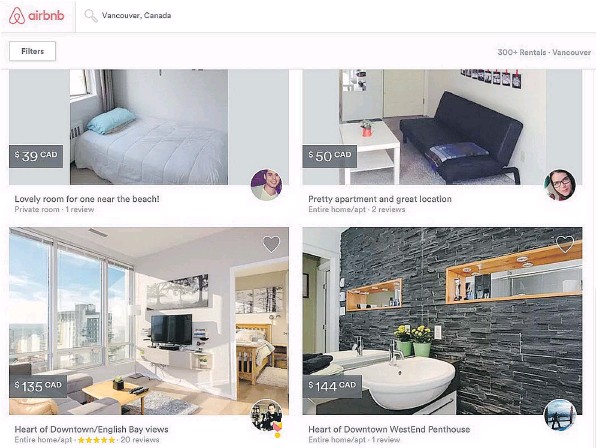

Airbnb rentals can average anywhere from $39 up to $144 per night for simple or more luxurious accommodations

Airbnb, the global, online short-term rental booking service, has released a new report on its Vancouver rental community, generated from guest surveys and the firm’s own data.

Here are some highlights:

5½ nights

The average length of stay for an Airbnb user in Vancouver, compared to 4.8 nights for typical overnight guests. 81 per cent of Vancouver Airbnb users say that compared to other accommodations, the service made them more likely to visit the city again. One in three guests say they would not have come or stayed in Vancouver as long had it not been for Airbnb.

$6,500

How much an Airbnb host in Vancouver typically earns hosting in a year. According to the firm, 53 per cent of hosts report being able to afford to stay in their homes because of the added income. Five per cent of hosts say Airbnb helped them avoid eviction while seven per cent say the added income helped them avoid foreclosure. Nearly three-quarters of hosts chose to list their home on Airbnb because they want additional income, while 10 per cent report having extra space and eight per cent report “enjoying being a guest and thus wanting to become a host.”

Vancouver Airbnb guests, inbound and outbound

123,900 are international inbound

22,100 are B.C. domestic inbound

31,800 are rest-of-Canada domestic inbound

170,000 are Vancouverites booked outbound (7,500 are also Airbnb hosts)

An entire home

The most commonly-booked listing, representing 4,400 out of the 6,400 listings that hosted a trip in 2015, was an entire home. There also were 1,800 private-room listings and 200 shared-room listings. Total 2015 booked listings grew by 86 per cent from 2014 and in 2014 grew 93 per cent from 2013.

Nights hosted on Airbnb by percentage of listings in 2015 (including all room types)

1—30 nights hosted: 35% of listings

31—60: 18%

61—90: 11%

91—120: 8%

121–180: 10%

181–240: 9%

241–300: 7%

301+: 3%

Airbnb’s ‘Community Compact’ to address housing-shortage concerns

“In cities where there is a shortage of long-term housing, we are committed to working with our community to prevent short-term rentals from impacting the availability of long-term housing by ensuring hosts agree to a policy of listing only permanent homes on a short-term basis.”

Hosts with one or more entire-home listings that were booked up to 30 days in 2015

© 2016 Postmedia Network Inc.