B.C.’s plan provides 1,354 subsidized units, but there are 5,740 low-income seniors on wait list

KIM PEMBERTON

The Province

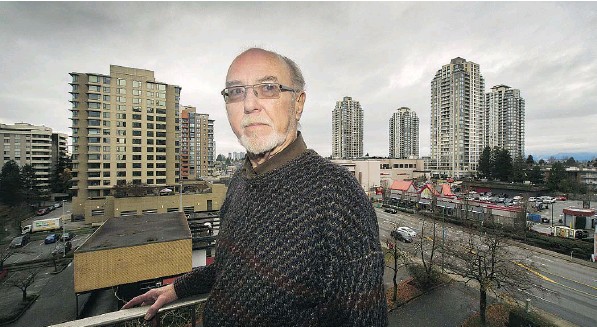

John Young, 69, lives in B.C. Housing temporary accommodation in Burnaby. He lived on the street for a week while trying to find rental housing. ARLEN REDEKOP/PNG, FILES

The backlog of low-income seniors in B.C. needing social housing will not be met, despite a recent announcement by the provincial government to increase the number of subsidized housing units through B.C. Housing.

There are about 5,740 low-income seniors on B.C. Housing’s waiting list, but the recent announcement will provide only 1,354 units specifically for seniors requiring subsidized housing.

“This is a government that has ignored housing for a really long time, and as a result there are thousands of seniors and families in need,” said NDP housing critic David Eby. “Now that there are low-income seniors visibly living on the street, in an election year, they decided to act. But even assuming those numbers (the 1,354 units unveiled for seniors) are new, it’s just a fraction of seniors still on the wait list.”

Eby says Premier Christy Clark’s announcement to build nearly 2,900 affordable-housing units, which includes the 1,354 units for seniors, was misleading. He noted Postmedia News reported the numbers provided by the Liberals showed nearly one in 10 of the announced units aren’t new builds, and about one-third of all the units had been previously announced by the government.

Asked about whether the announcement regarding seniors units are new builds, the ministry responsible for housing said by email: “In terms of seniors housing, we’ve committed to build 30 projects, which will create 1,354 units of housing. Two of these projects are redevelopments where we will take 206 units and transform them into 368 units, a net increase of 162 units.

“When we originally announced the funding, we clearly stated that ‘projects will include a combination of acquisition of existing units from the private market as well as new construction.’ ”

Eby added that missing from the recent announcement is how the B.C. government anticipates it will meet future social-housing needs, resulting from a changing demographic as the population ages.

“The first thing we need is a long-term plan for housing. We have a predictable rate of aging, and we can’t continue to ignore the crisis. We need something specific, especially since the federal government is back at the table willing to talk about housing,” said Eby.

Recently, the federal government released a paper on plans for a National Housing Strategy for the 2017 budget, which included 27 mentions of the requirements for seniors. According to the paper: “A rapidly aging population may experience growing affordability problems, especially seniors living on littleor fixed-income pensions, and place stress on long-term-care facilities and hospitals.”

B.C. Seniors Advocate Isobel Mackenzie said she is hearing some seniors, who are struggling with the high rental market in Vancouver and Victoria, have questioned whether they should go into long-term care to escape the challenges in finding affordable housing. But, she added, seniors can only go into a long-term-care facility if their health needs qualify them to do so.

She said that, of B.C.’s 850,000 seniors, 20 per cent would be renters and more than half of elderly renters — 58 per cent — would have household incomes of less than $30,000.

“Most of our seniors own their own home, but it doesn’t make it (affordable housing) any less of an issue for the 20 per cent of B.C. seniors who are renters.”

She added seniors who are in subsidized housing are most likely to stay there for the rest of their lives. She said an equally important benefit to them, besides having affordable rent, is the community support they get in such an environment.

But getting into subsidized housing, which ensures a senior pays only 30 per cent of their income on rent, takes an average of 2.2 years in B.C. Seniors living within the Vancouver Coastal Health Authority had the longest waiting time for a subsidized unit: 2½ years. The lowest wait time was the Interior Health Authority, with a waiting time of 1.3 years in 2015.

The 411 Seniors Society, which offers an advocacy centre to seniors in Metro Vancouver, saw the numbers of seniors who came for housing support last year rise to 25 per cent of clients, compared with 15 per cent the previous year.

“Housing and the ability to access the benefits they’re entitled to is the No. 1 issue,” said society executive director Leslie Remund.

“Twenty-five per cent of the seniors who came to us were precariously housed or homeless — living on a couch or in housing that far exceeded their ability to pay,” she said. “We’re encouraged the needs of seniors are being put forward. We know there’s a housing crisis, and low-income seniors are often the forgotten group since they’re not that vocal. We are referring seniors on a weekly basis to homeless shelters.”

According to the most recent Homeless Count, which tallies seniors living in shelters, on the street or couch-surfing with relatives and friends, there were 371 homeless seniors in 2014 in Metro.

For the Vancouver affordable-housing projects that were recently unveiled, 10 projects, or 611 units, were slated for Vancouver, and of this number, 362 were earmarked for seniors. Surrey was to get five projects of 326 units, of which 48 were designated specifically for seniors.

Burnaby will get three projects of 202 units, and 193 were designated for seniors, while Richmond will get one project with 160 units, which were designated for both seniors and families.

Elsewhere in B.C., subsidized housing designated specifically for low-income seniors would be in Fort St. James, Kamloops, Kelowna, Keremeos, Madeira Park, Nakusp, Nanaimo, Okanagan Falls, Port Alberni, Port Edward, Port Simpson, Prince Rupert, Quadra Island, Quesnel, Slocan Valley and Saanich.

More than 21,000 seniors are currently living in subsidized units with B.C. Housing. The number of senior subsidized-housing units decreased by 1.4 per cent since 201415, to a total of 32,746 in 2015-16 (this figure would include housing for people with disabilities as well as for seniors).

© 2016 Postmedia Network Inc