Balconies at Concord Brentwood?s Hillside East will significantly enhance residences? living space

MICHAEL BERNARD

The Vancouver Sun

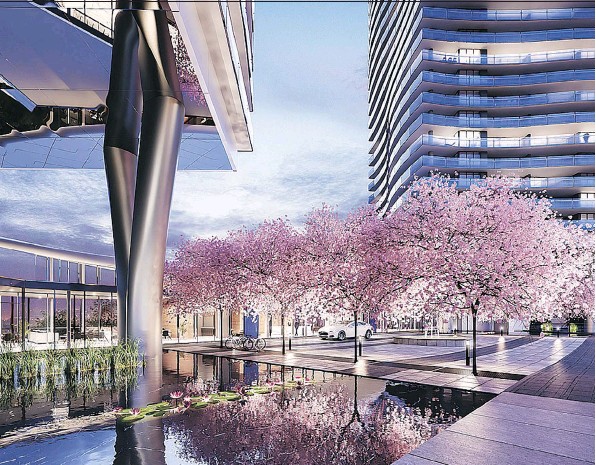

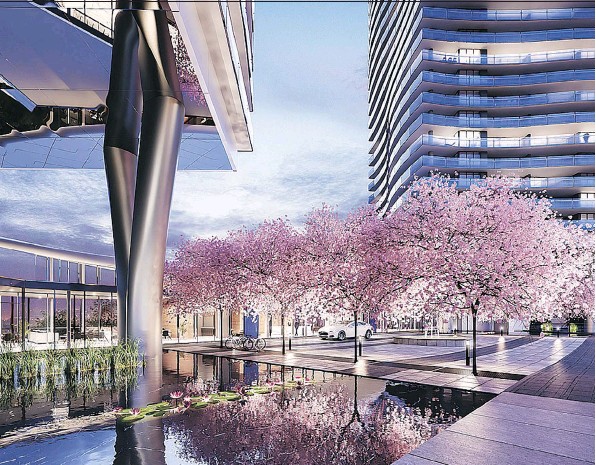

An artist?s rendering depicts a courtyard area at Hillside East, the second phase of the 26-acre Concord Brentwood development, which is expected to feature 11 buildings when completed.

Kitchens at Hillside East feature Bosch and Panasonic appliances

An artist?s rendering depicts a double-height entertainment lounge at Hillside East. Additional amenity spaces includes sports and games lounges and yoga and ping pong rooms.

Bathrooms at Hillside East are outfitted with Grohe and Kohler fixtures and showers with niches

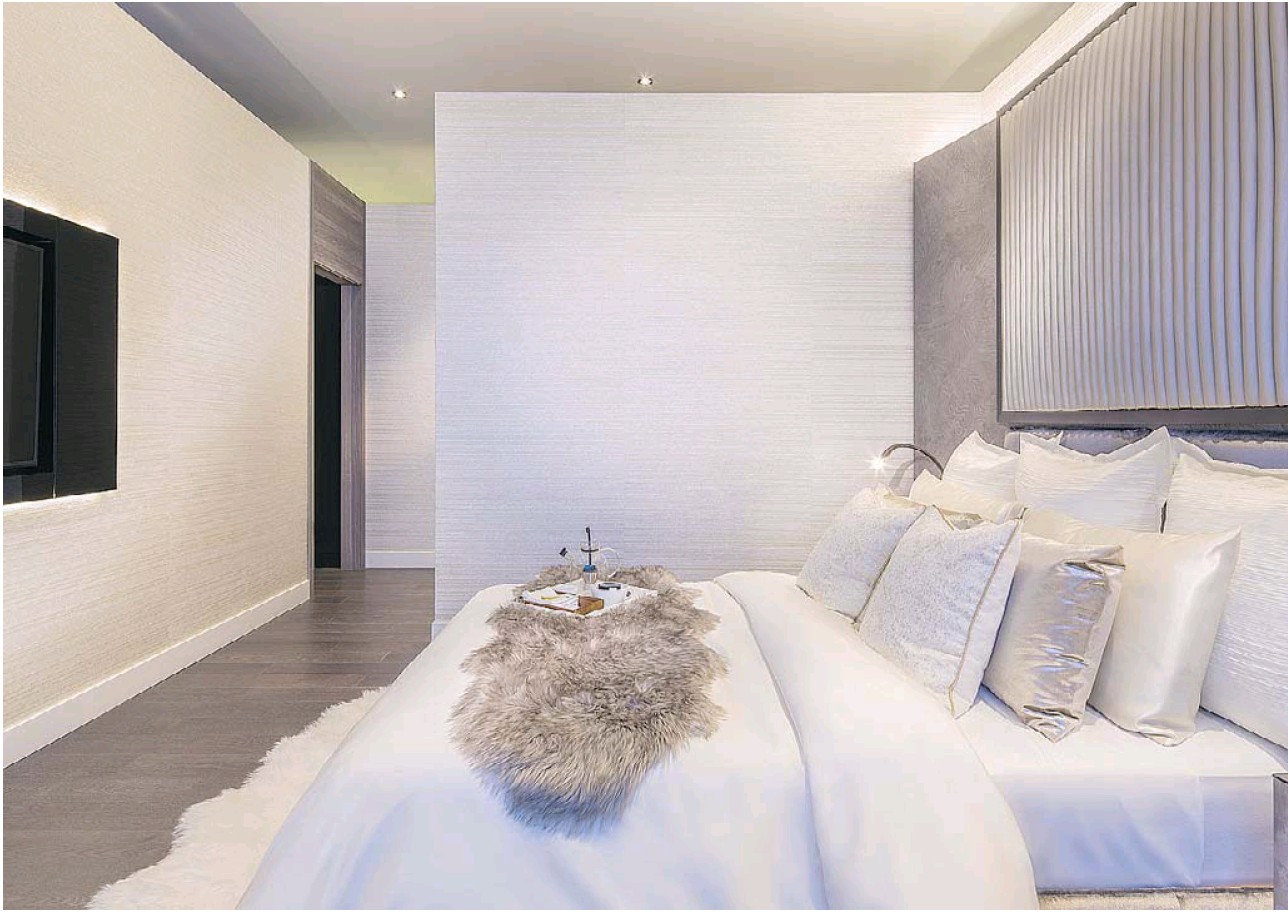

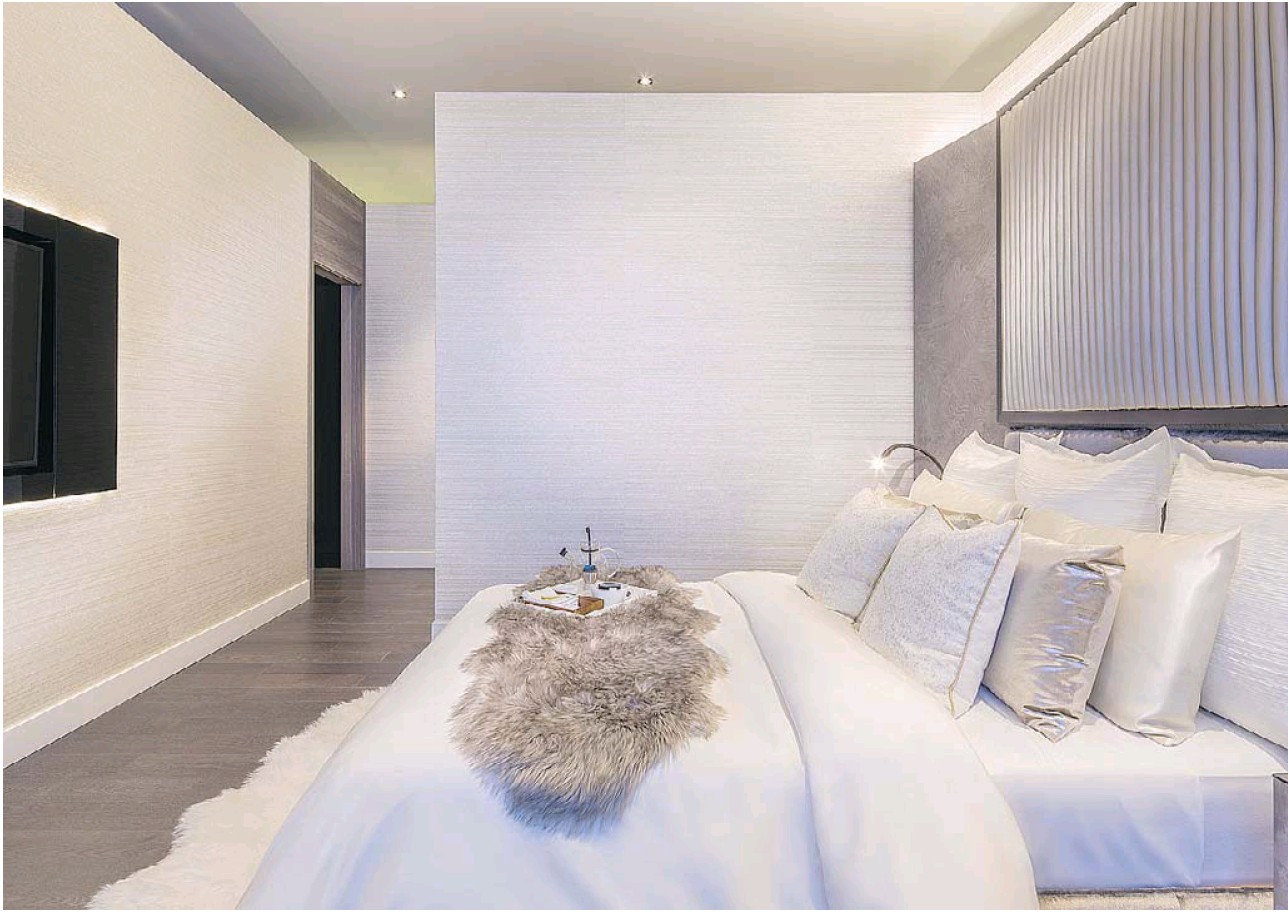

Hillside east homes have one to three bedrooms and range up to more than 2,100 square feet

The large inset balconies, as depicted in an artist?s rendering, are among the most popular features for buyers interested in Hillside East

Concord Brentwood – Hillside East

Project Address: 4880 & 4890 Lougheed Highway, Burnaby

Project Scope: A total of 900 units in two concrete buildings of 55 and 45 storeys each. Set in Concord’s 26-acre parkside community in the emerging Brentwood town centre neighbourhood. Homes range from a 545- square-foot one-bedroom with heated balconies of between 158 and 276 square feet to a 2,101-square-foot three-bedroom penthouse with a nook and study, and outdoor living space of up to 2,862 square feet. Close to SkyTrain, a newly expanded Brentwood Mall and a proposed 13-acre park and green space

Prices: One-bedroom from high $500,000s; two-bedroom from $750,000s; two-bedroom-and-den from $840,000s. Two-bedroom-and-den and three-bedroom homes from Sky Collection (floor 44 and up) start at $1.19 million

Developer: Concord Shokai Brentwood Phase 1B Ltd.

Contact Name: Concord Brentwood sales team at 604-435-1383

Architect: Francl Architecture & PFS Studio

Interior Designer: LIV Interiors

Sales Centre: 4750 Kingsway, Burnaby

Centre Hours: 11:30 a.m. — 5:30 p.m., daily (by appointment only)

Website: ConcordBrentwood.com

Occupancy: 2022

The buyer response to Concord’s latest highrise offering in the newly emerging Brentwood town centre community has been brisk, with buyers taking numbers to line up for appointments with sales agents to purchase one of the 500 homes in the gleaming 55-storey tower.

Grant Murray, Concord’s senior vice-president of sales, said the rush on the first of two highrises — together, the Hillside East phase of the Concord Brentwood 26-acre development — came as no surprise.

“It was crazy busy and we had a phenomenal sales campaign,” Murray said. “I can tell our competition is eyeing it and saying we are going to go higher (price-wise) on our project.”

Murray estimated that prices have risen by $200,000 for one-bedroom suites and up to $250,000 for two-bedroom homes compared to the first two towers at Concord Brentwood, which were sold within a few days of hitting the market in 2016. That increase represents pent-up demand and the fact that prices were relatively stable prior to 2016, he said.

Murray said the price change has led to changes in the type of Concord Brentwood buyers.

“There is a different crowd for this phase. We probably didn’t see as many first-time buyers and by and large, the crowd is very local with some, but not as many, overseas investors. A lot are downsizing from (single-family) homes and going into the larger two- and three-bedroom units.”

While there are fewer first-home purchasers, they are still well represented, including as young couples jumping from the rental market into their own homes, and many single women and men jumping into the home market, he said.

Concord has added a new architecture firm to its stable at Brentwood, bringing on Francl Architecture to design the latest two of the total 11 buildings planned for the site. Vancouver architect James Cheng designed the first two towers called Hillside West and did much of the master planning for the community at Brentwood.

“The suites themselves are fairly similar (to the earlier ones) inside,” said Murray. “Externally, there is a huge transition on the balconies and the curvatures of the buildings.”

LIV Interiors principal Olivia Lam says while the overall palate between Hillside East and West is similar, there is one major change, both on the balconies and in the bathrooms. “We decided to switch from marble tiles to large-format porcelain tiles for various reasons. Firstly, porcelain tiles are more lightweight and resistant to scratches, extreme heat/cold, UV rays and hard chemicals.

“Secondly, porcelain tiles offer greater uniformity from one shipment to the next. By using porcelain tiles, our designs can be realized more consistently from one homeowner’s suite to another. The firm also went with large format tiles on bathroom walls, which she says provide a clean and more refined esthetic.

LIV also factored in the growth of online shopping and food ordering by allocating some common area space for parcel and food storage, which she calls “a valuable extension of people’s homes.”

A very popular feature is the balcony in Concord’s latest project. The balconies are inset, which means the overhang from the apartment above fully protects the balcony space from the elements. As well, the traditional three- or four-inch threshold floor level has been removed, providing a seamless transition between indoor and outdoor spaces. Enhancing that are floor-to-ceiling glass sliding doors that can be retracted, and built-in radiant heating in the balcony ceiling to create a continuous all-season entertainment space.

Murray dubs the design “convertible living.”

“Just as on a nice sunny day you can have the top down on your car and enjoy the outdoor air, it’s the same idea here,” he said. “You can open up the balcony doors and experience outdoor living for a longer time of the year.”

A couple of years ago, a Toronto developer publicly complained that balconies added 15 per cent to a building’s construction costs and were little used, but Murray says it is an entirely different situation on the West Coast.

“There is no question we are the banana belt of Canada. Vancouver and Victoria, our climate is much milder. While you might pay 10 to 12 per cent more [for a balcony], that money is well worth it because of the additional living space you get.”

In some one-bedroom units, Concord disclosure statements show that the total living area is expanded to 821 square feet by the inclusion of the balconies. In some two-bedrooms, the overall living space can be expanded by up to 630 square feet for an overall total of up to 1,656.

Another popular Concord feature at Brentwood is central heating and cooling, controlled by an in-suite thermostat. Also included in the new buildings are water-softening systems and high-speed elevators. An electric vehicle-charging outlet is available with every parking stall. Hillside East also has a car-sharing program and an automatic touchless car-wash system in the eight-floor parkade.

Owners will also have access to a fitness room, entertainment lounge, sports and games lounges, a pet grooming room, yoga and a ping pong room and a children’s area in the lower park space. The outdoor space also includes outdoor ping pong tables, a tricycle path and an open lawn with seating area.

Kitchens feature Bosch appliances, including a bottom-mount freezer in a counter-depth refrigerator, gas cooktop, wall oven, Panasonic microwave with chrome insert kit, and LIV closet organizers with colour coordinated wood trim doors. Bathrooms are outfitted in Grohe and Kohler fixtures, showers with niches and extensive use of Calacatta porcelain walls and floors.

© 2018 Postmedia Network Inc.