At Boffo Properties? Haven, the design is in the details

Mary Frances Hill

The Province

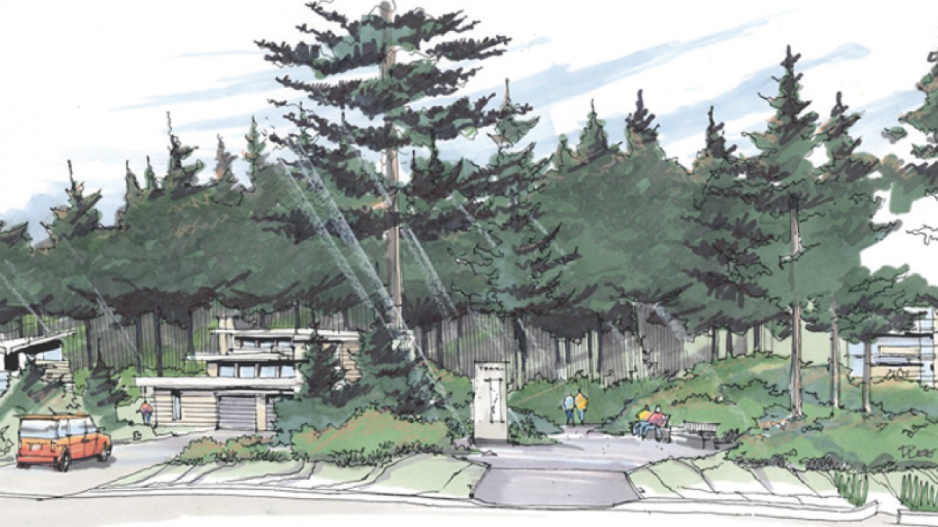

Haven

What: 45 townhomes with three or four bedrooms

Where: 2560 Pitt River Road, Port Coquitlam

Residence sizes and prices: 1,312 to 1,843 sq. ft; prices starting in the mid $700,000s

Developer and builder: Boffo Properties

Sales centre: 16 — 2560 Pitt River Road, Port Coquitlam

Hours: noon — 5 p.m., Sat — Thurs

Telephone: 604-690-6672

At Haven, Boffo Properties’ planned community in Port Coquitlam, Joanne Laurino has created sophisticated spaces with the comfort homeowners want and a respect for the flexibility and practicality that they need.

When Laurino and her colleagues at Ross & Company Interiors first examined the specifications for the townhomes’ interiors, they were pleased to see a lamp that stretches from the wall into the kitchen prep area. So they added a large ceiling fixture in a similar form — a desk-like work light in a black metal thin silhouette extending from long-hinged arms.

The fixture, inspired by the style of the late French industrial designer Serge Mouille, hangs in the centre of the ceiling over the living room space, in contrast to the mostly white palette of the room and a stark white sofa.

“We knew we wanted to bring black accents into the otherwise fresh white space to ground the room, and we thought this light would allow us to do that, while also bringing lots of visual interest with its strong lines,” Laurino says.

“We chose this light because we liked how it didn’t take away from the space, because of how closely it could be mounted to the ceiling, complementing the room, rather than being an obstruction.”

In that same living room, a dark wood armchair provides the space with a mid-century modern feel.

“We always try to incorporate an armchair or two in the living room when we can because we like how that allows for not only additional seating, but also flexibility in using the space,” Laurino says. “We liked how this chair brought wood tones into the room to warm it up.” Laurino says she and her colleagues wished, above all, to stay flexible and adaptable with furnishings.

That flexibility extends to the banquette seating beneath two shelves in the dining area. It’s practical and looks as if it naturally belongs with the shelves as part of a wall unit. “We always want to take into consideration how the space is going to be used and we thought the use of a banquette, with storage above and around it, would allow for ample storage, circulation and seating in the space, which checked a lot of boxes.”

Haven is within a few minutes’ walk of Gates Park, the largest in Port Coquitlam, and that green space is referenced in the design of Haven. “We considered how it is located near water and lush greenery, and we used that inspiration to influence our design decisions in not only designing the show homes, of course, but also in picking the finishes when designing the project,” she says. “In doing so, we incorporated wood finishes, with warm tones and also some organic lines.”

© 2018 Postmedia Network Inc.