Real estate listing website partnered with Canadian company

Christopher Alexander

REM

U.S. real estate listing website Zillow has arrived north of the border. Zillow broke the news with the announcement of its partnership with a well-known real estate brand in Canada that will directly feed listings to the site.

This has long been a source of concern throughout the real estate industry for a few reasons. But first, a little background.

How did Zillow come to be? Its widespread appeal in the U.S. began with a fragmented MLS system. The idea was to streamline every property listing into one easy-to-access platform. Today, Zillow’s living database merges more than 110 million listings from over 625 MLS feeds in the U.S. By adding Canadian listings into the mix, Zillow will widen the pool of potential homebuyers – and leads for agents.

However, unlike our neighbours to the south, Canada already has a unified MLS system in Realtor.ca, which displays almost every residential listing.

Part of the perceived problem is that Zillow’s listings include sold-price details, among other personal data that the Toronto Real Estate Board maintains must be kept private. The matter is currently before the Supreme Court, in the board’s attempt to secure its position. (Update, July 19, 2018: Zillow’s Alexa Fiander wrote to REM to say: “This is incorrect. Zillow will not show Canadian sold listings, and we will comply with local rules and regulations that affect the display of property details in Canada.”)

Beyond the data dilemma, part of Zillow’s modus operandi involves taking listing feeds from real estate companies and selling leads back to Realtors. That is the real underlying reason behind the industry’s apprehension. (Update, continued: Fiander says: “Listing agents are not charged for leads on their own listings.”)

With publicized sold data and Zillow’s high-tech toolkit, is it possible that it will disrupt the real estate industry as we know it? Might agents actually abandon their brokerages and their brands? Could this be the start of the For Sale By Owner (FSBO) era? It’s unlikely.

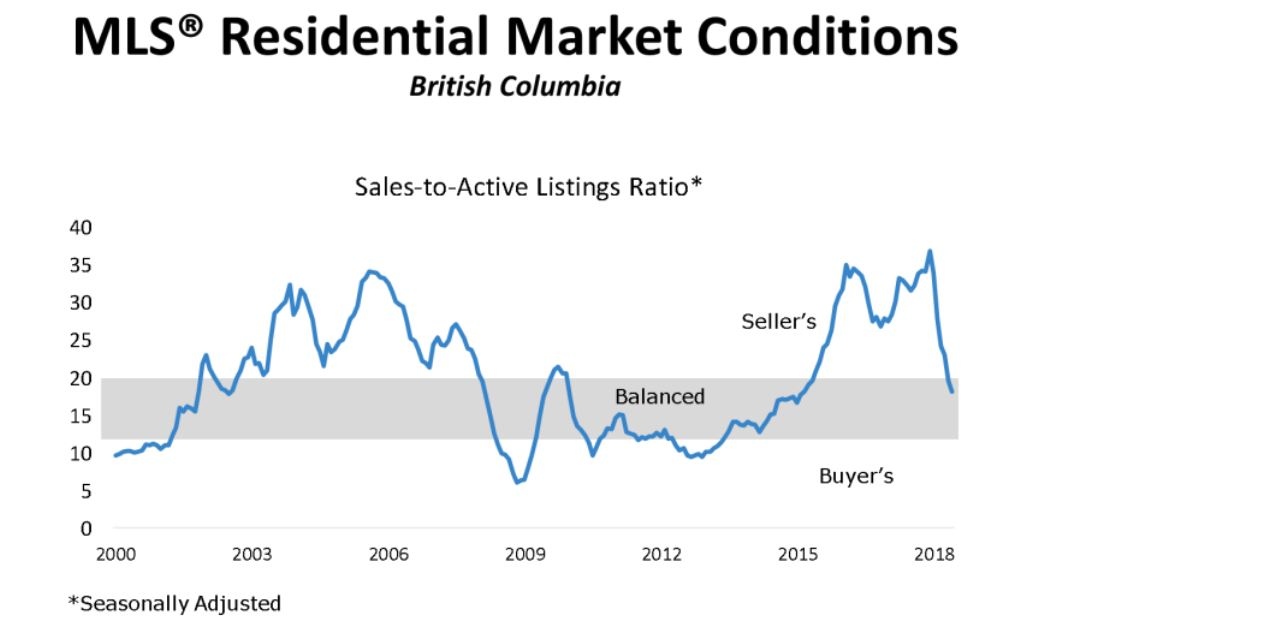

The truth is, 12 years since the birth of Zillow, FSBO transactions in the U.S. are at an all-time low. In Canada, DIY home sales became more common – and feasible – in 2017, at the peak of the real estate roller coaster when bidding wars erupted before the For Sale sign was up on the lawn. But what goes up eventually comes down again – and in this more challenging market, real estate agents will continue to provide essential expertise and value to consumers.

Canadian agents don’t need Zillow to promote their listings to foreign buyers. Anyone south of the border and beyond who is searching for Canadian properties will find them on Realtor.ca and remax.ca.

Ultimately, Zillow has not changed the basics of the business. It still takes market knowledge, smart strategies and good old-fashioned hustle to convert leads.

In spite of the success of Canada’s existing property listing platforms, there’s always room for improvement. Real estate is a highly competitive industry by nature. Agents will need to step up their game to stay ahead. In my opinion, the good ones are already doing that every day.

© 2017 REM Real Estate Magazine