Close to nature, parks and trails, Polygon’s Kentwell takes its place atop Coquitlam?s Burke Mountain

Simon Briault

The Vancouver Sun

Kentwell is a townhome project from Polygon Kentwell Homes Ltd. in Coquitlam.

Kentwell is a collection of 124 four-bedroom townhomes with Tudor-inspired architecture. Walkways throughout the development link to area green space. PHOTOS: PNG MERLIN ARCHIVE

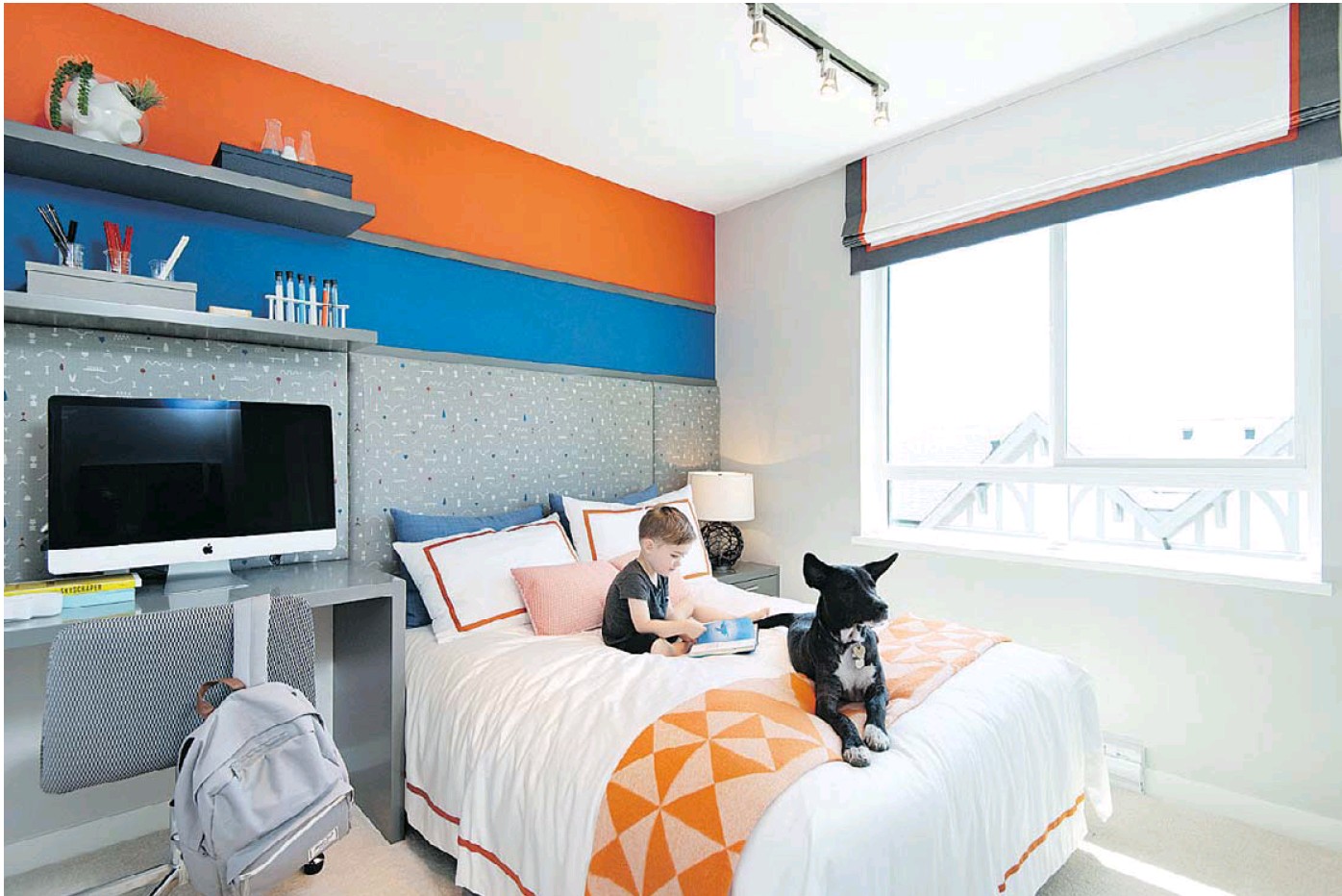

Kentwell, a collection of 124 four-bedroom townhomes in the Smiling Creek neighbourhood atop Burke Mountain, will have large windows, allowing for an abundance of natural light.

All Kentwell homes are wired for technology and high-speed cable

Kitchens are fitted with flat-panel cabinetry, engineered stone countertops and stainless steel appliances.

The homes are being targeted by families, who will have children?s play areas nearby in the community

Master ensuite bathrooms feature spa-inspired showers with benches, built-in niches and frameless doors

Homes at Kentwell are spacious with four bedrooms and measuring to more than 2,200 square feet

Kentwell

Project location: 3500 Burke Village Promenade, Coquitlam

Project size: 124 four-bedroom townhomes ranging in size from 1,496 to 2,239 square feet, with prices starting from $828,900

Developer: Polygon Kentwell Homes Ltd.

Architect: RLA Architects

Interior designer: Polygon Interior Design Ltd.

Sales centre: 3500 Burke Village Promenade, Coquitlam

Hours: noon — 6 pm., Sat — Thurs

Sales phone: 604-260-8446

Website: polyhomes.com/community/kentwell

You only have to look at the numbers to see that Polygon is a huge player in residential development in British Columbia: the company has built more than 27,000 homes in the Lower Mainland. That kind of experience is likely to earn you a loyal following and Goldie Alam, Polygon’s senior vice-president of marketing, said this is particularly true of Kentwell, the company’s latest townhome development in Coquitlam.

“We’ve built more than 4,700 homes in Coquitlam already and a lot of the buyers at Kentwell are repeat customers from our other Coquitlam communities,” Alam said. “They’ve bought with us before, they know that our customer service is great and they like the new plans. It doesn’t hurt that their initial investments did well too. All of that means they’re confident buying with us again.”

Kentwell is a collection of 124 four-bedroom townhomes in the Smiling Creek neighbourhood atop Burke Mountain. Designed by RLA Architects, Kentwell homes feature Tudor-inspired architecture, picket fencing and individual entry gates. But the big selling point for the development, Alam said, is its proximity to nature, parks and an extensive network of 21 trails suitable for hiking and mountain biking.

“The great thing about Burke Mountain is, of course, that it provides such great access to green space, but the other thing is that it’s so new,” she said. “The City of Coquitlam is still putting in a lot of amenities there, which people really love. There are new schools opening and new parks going in, including one right across the street from Kentwell. There’s also a huge trail network that they maintain really well.”

Access to the great outdoors played an important part in Nicole Wang’s decision to buy a home at Kentwell. A recent arrival from Montreal, Wang will take possession of her new home before the end of the year.

“The idea was for us to move here first and rent somewhere until we decide where exactly we want to live,” Wang said. “I really love Coquitlam because it feels like a brand new city and the environment is so beautiful here.

“We didn’t plan to go to this particular development,” Wang added. “We were just driving past and it looked so beautiful from the outside, so we decided to go into the show room. I really like that it’s a new home with clean, modern designs. The whole community is brand new and it has great access to nature – there’s going to be a new park right in front of my home.”

Kentwell homes feature private double-car garages, custom entry plaques with integrated lighting, wood laminate flooring and main floor powder rooms. All homes are wired for technology with multiple pre-wired connections for high-speed cable. There are hard-wired smoke detectors, hose bibs both front and back and laundry closets with rough-ins for side-by-side washers and dryers.

Kitchens come with flat-panel cabinetry in dark wood, light wood, or high gloss. Cabinets and drawers feature soft-close hardware and chrome pulls and there are expansive kitchen islands, engineered stone countertops and full-height linear mosaic marble tile backsplashes. The stainless-steel appliance packages are by KitchenAid and there are roll-out recycling bins under the kitchen sinks as well as halogen track lighting.

Master ensuite bathrooms feature spa-inspired showers with benches, built-in niches and frameless doors. Vanities include engineered stone counters, dual rectangular porcelain sinks and oversized mirrors. Main bathrooms feature bathtubs with ceramic tile surrounds, rectangular porcelain sinks, porcelain tile flooring, engineered stone countertops and vanity lighting. All bathrooms feature faucets by Grohe, custom flat-panel cabinetry matched with chrome pulls, porcelain tile flooring and dual-flush toilets.

The Kentwell development also includes a private 1,100-square-foot health club with a fully equipped fitness studio, weights area and yoga room. There are two central green spaces, a children’s play area and pedestrian walkways throughout the site that provide interconnected routes to green spaces and trails in the surrounding areas.

“These homes are huge,” Alam said. “We’ve built four-bedroom townhomes before, but it’s not that common that we do a whole community of them. It’s mostly families or downsizers who are buying these homes so it works for both of those markets.”

Prices start at $828,900 for Kentwell’s phase-one homes, with only a few homes left as of late last week. Polygon will release phase two of the project on Sept. 15.

“With the launch of phase two, people will have a lot more choice of plans and locations within the site,” Alam said. “We have some homes right now that have some very quick completions – you could be moving in as early as this fall – but our next phase has longer completion times stretching into next spring and summer. So, for people who need time to save up or sell an existing home, there’s plenty of options too.”

© 2018 Postmedia Network Inc.