North Vancouver’s 10 Plums attracting interest from a range of homebuyers

Kathleen Freimond

The Vancouver Sun

The 10 Plums development offers ocean and city views in District of North Vancouver?s Upper Delbrook area

This show home at 283 Monteray Ave. features white cabinetry, neutral floor tiles and decorative mouldings.

This show home on Monteray Avenue in the District of North Vancouver gives potential buyers an idea of the home they can custom design in the 10 Plums community.

This show home at 283 Monteray Ave., part of the 10 Plums development in North Vancouver, has some traditional features along with contemporary elements for a ?transitional? esthetic.

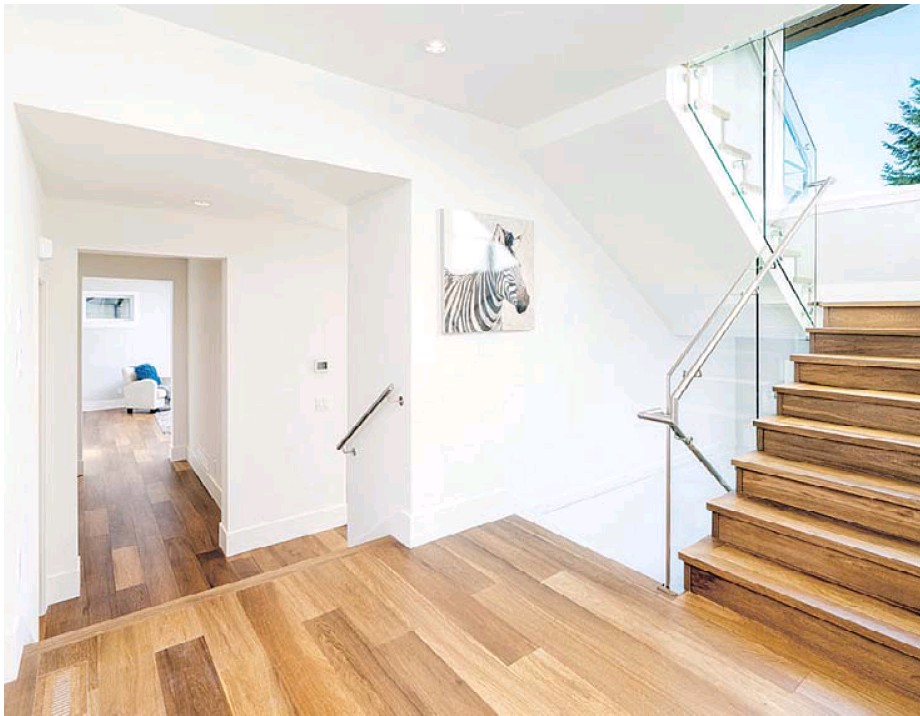

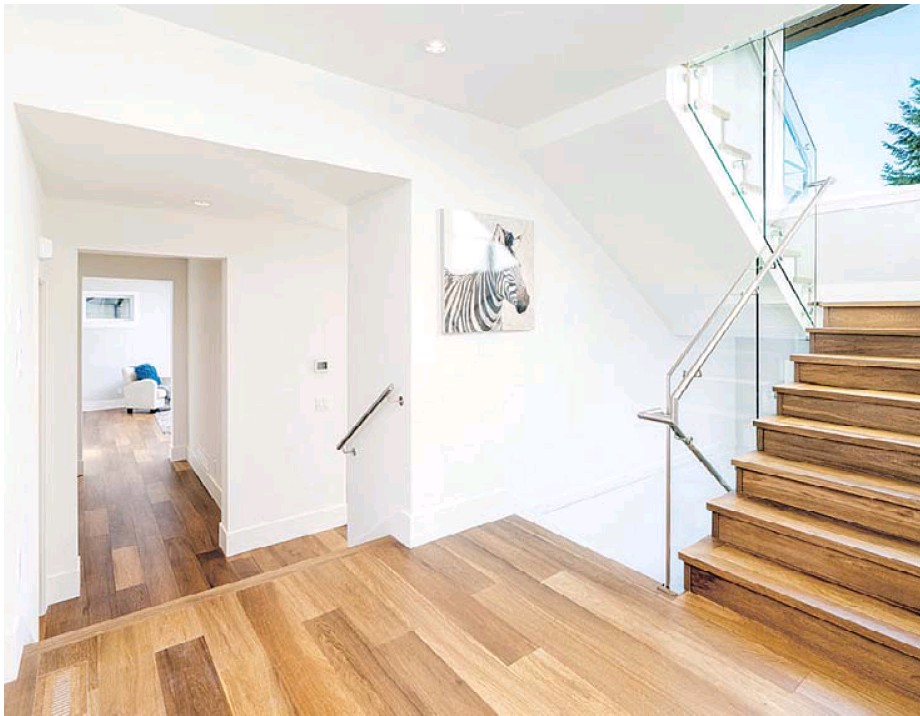

A striking staircase connects three levels of the 291 Monteray Ave. home

The laundry and storage room may not be eye-catching, but it is functional

Every bedroom has its own character, but also complements the others

Show homes for the 10 Plums site give potential buyers design ideas

Each year, about 140 single-family homes in the District of North Vancouver are rebuilt, but it’s rare for developers to find a site for a cluster of new houses. When they do, it presents a unique opportunity for custom homebuyers to integrate into an already well-established neighbourhood.

In 2013, the North Vancouver School Board sold a 1.17-hectare site in Upper Delbrook formerly occupied by the Monteray elementary school to a property developer. Two years later, the land was rezoned by the district to allow for the development of 12 single-family homes, and the sites on Monteray Avenue and Starlight Way were sold to Wallmark Custom Homes, Fusion Homes and Noort Homes. Wallmark, with six lots, and Fusion, with four, combined their marketing initiatives to give the group a catchy name and present the homes as 10 Plums.

Homes have been built on six of the 10 Plums sites. Fusion has completed four houses, while Wallmark has completed two homes in the subdivision and has four lots available with a custom-build opportunity for each lot.

Brad Cowden, Wallmark’s director of business development, says these completed houses give prospective buyers a good idea of the single-family homes that can be custom built on the balance of the lots with their ocean and city views.

“We have plans for each site; we can build the home according to those plans, adjust the plans or buyers can choose to plan from scratch and customize the home to their needs,” he says.

Leslie Waters, West Coast Design Interiors’ principal and interior designer for the two Wallmark show homes, says the team decided to give each a different and distinctive esthetic to enable the custom builder to show its range of work.

“We decided to make one transitional – some traditional features along with some contemporary elements – and in the other, we leaned more toward modern and contemporary,” she says. “The transitional home [now sold] features white cabinetry, light, neutral floor tiles, decorative mouldings and a coffered ceiling.”

The home at 291 Monteray Avenue has a side-to-side layout rather than the more typical front-to-back plan. This maximizes the shape of the 7,104-square-site on the cul-de-sac and provides the opportunity to include broad expanses of windows to take in ocean and city views.

A few steps inside the front entrance the glass and stainless-steel staircase that connects the three levels sets the tone for the interior design.

“It’s my favourite feature in the home,” says Waters.

Moving to the kitchen, the three-by 10-foot island with its three-inch thick engineered stone countertop with subtle grey veining against a creamy white background (Caesarstone Calacatta Nuvo) is also a standout.

The island is an integral part of the open-plan kitchen, dining room and living room and provides a natural gathering place for casual get-togethers while also serving as a functional complement for more formal occasions.

“From the kitchen, you can see the fireplace in the living room and enjoy the view through the large windows in the dining room. It’s an awesome entertainment space to host a good number of people,” she says.

The dual-tone kitchen with its white acrylic and contrasting edge-grain oak cabinetry, stainless steel appliances and pendant lights, reflects the modern design direction with the wood adding warm tones to the space. Also contributing to the overall ambience is the-wide plank, brushed oak engineered floor used throughout the living spaces on the main level.

The 4,483-square-foot home is large enough to give each of the four bathrooms (plus powder room) their own character. White Caesarstone Blizzard countertops are a common element in all the bathrooms and, Waters adds, although they have different features, the materials are all similar enough to complement one another.

In the ensuite bathroom, Waters chose 24-by-24-inch black tile for the floor, Carrera-look 24-by-36-inch porcelain tiles for the walls, a vanity with double sinks, a Maax freestanding tub and a large shower with a seamless glass enclosure to give the space a dramatic look.

On the lower level, a large carpeted 16-by-33-foot recreation/entertainment room with double doors to the landscaped front garden and a wet bar provides homeowners with many options. Also on this level, another large space could be a media or hobby room, while an extra bedroom and bathroom make a perfect guest or nanny suite.

Waters believes the family that moves in is likely to stay for many years.

“I always consider the longevity of the design and the material selections – I don’t want it to date,” she says.

Cowden says 10 Plums is attracting interest from a range of buyers, including families, North Shore residents who want to move out of an older home into a new home at a similar price and empty nesters who are considering a smaller custom-built home.

Located in an established neighbourhood, Cowden says the grade changes in the subdivision ensures every 10 Plums site has great views.

10 Plums

Project address: Wallmark Custom Homes’ show home: 291 Monteray Avenue; Fusion Homes’ show home: 283 Monteray Avenue

Project location: Upper Delbrook, District of North Vancouver

10 Plums builders: Wallmark Custom Homes, Fusion Homes

Homes on show: 4,000 to 4,791 square feet

Bedrooms: three to six

Price: $2,748,800 — $3,798,000

Hours: Saturday and Sunday from 2 p.m. to 4 p.m.; weekdays by appointment

Phone: 778-688-6977 (realtor David Matiru)

Website: 10plums.ca

© 2019 Postmedia Network Inc.