Biggest gains will probably be outside Lower Mainland

Derrick Penner

Sun

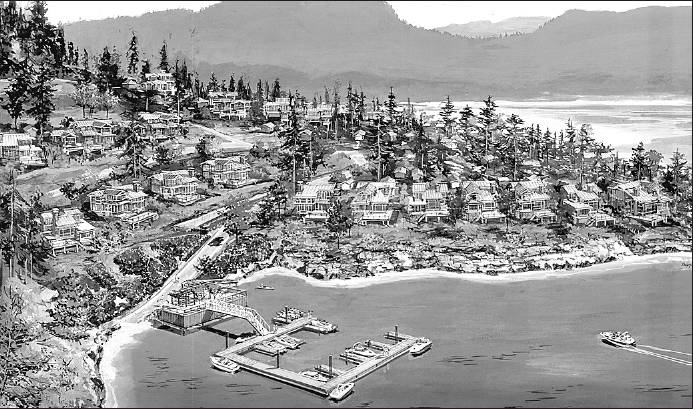

An artist’s conception of a $33-million oceanfront community Rockwater Properties plans to build in Pender Harbour.

British Columbia’s housing boom, already the longest on record, will continue into 2007, but the biggest gains will occur outside the Lower Mainland, Credit Union Central B.C. reported Thursday.

“The economy is growing at a good pace, [with] job growth, income growth and somewhat higher [population] in-migration,” Credit Union

Central chief economist Helmut Pastrick said in an interview.

“There are still favourable mortgage rates, and I think there’s some pent up demand there as well.”

Affordability, however, — particularly in high-priced markets such as the Lower Mainland and Victoria — will worsen.

For that reason, Pastrick believes the number of first -time buyers will decline, both as a proportion of sales and in absolute numbers “until this market makes a correction, or until mortgage rates drop significantly.”

Pastrick released his 2006/07 housing market forecast, which calls for a four-per-cent dip in housing sales in 2006 followed by a six-per-cent surge in 2007 to hit 141,800 units overall.

However, Pastrick predicts B.C. housing starts will climb in 2006 and 2007. Average real estate prices should also continue rising, 14 per cent in 2006 and seven per cent in 2007 to reach a province-wide high of $405,800 by the end of 2007.

While the high prices will push first-timers out of the market, Pastrick added that there should still be “very substantial sales” among existing homeowners.

Pastrick said that while construction levels are high, the supply of existing housing units coming onto the market is down.

The Credit Union Central B.C. diverges slightly from the recent Canada Mortgage and Housing Corp. estimate for the province, which calls for housing construction to peak in 2006 and ease in 2007 and 2008 due to affordability.

However, CMHC regional economist Carol Frketich added that strong job growth so far this year, along with wage growth, will help keep the market at a high level of activity.

“[Pastrick’s forecast] is very much along the lines of my forecast,” Frketich added.

Pastrick predicts that markets outside the Lower Mainland, such as the Okanagan, Vancouver Island and Northern B.C. should also see stronger growth than the Lower Mainland. That is largely because housing growth in those regions started later and it is only within the last year that those regions posted solid job growth.

Pastrick released the Credit Union Central forecast two days after Bank of Montreal deputy chief economist Douglas Porter warned that Vancouver’s housing market was “flirting with” bubble territory.

However, Pastrick believes it would take an economic slowdown in the U.S., global recession, skyrocketing mortgage rates or a geopolitical shock such as another spike in oil prices to upset housing demand in the B.C. market and cause prices to decline.

The Credit Union Central forecast notes that while mortgage rates have risen, the posted five-year rate is stable at 6.75 per cent, and the Bank of Canada has signalled it has finished raising its key rate for the time being.

“This market will not undergo a correction because of prices alone,” Pastrick said. “I think something has to drive sales down.”

© The Vancouver Sun 2006