Benchmark house price up 12 per cent on last year, to a record $711,245

Derrick Penner

Sun

Squamish home Bill Keay/Vancouver Sun Files

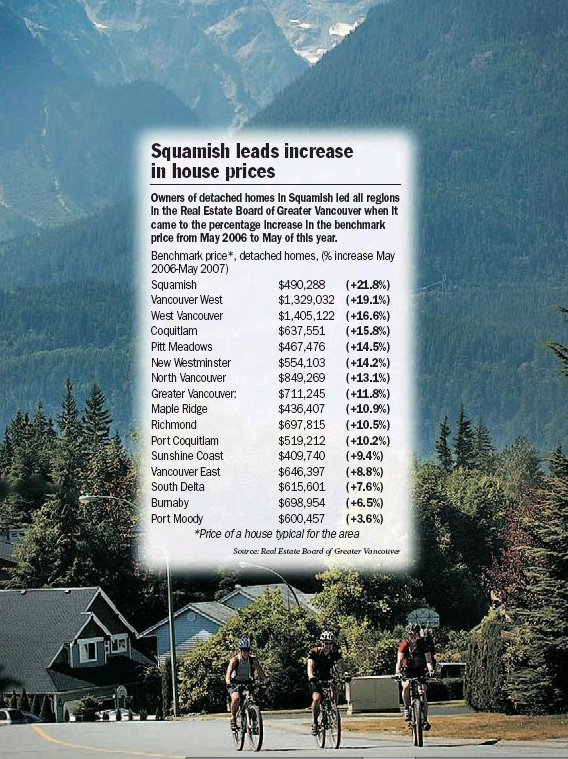

Lower Mainland real estate markets continued simmering rather than boiling in May with enough heat to push Greater Vancouver’s so-called benchmark price for a single-family home to a record $711,245.

A higher number of unsold homes on the market is moderating conditions.

The benchmark refers to a typical property, and Greater Vancouver’s new typical price represents a 12-per-cent increase in price from the same month a year ago.

Multiple Listing Service-recorded sales in Greater Vancouver did edge up 2.3 per cent to 4,331 compared with May 2006. The inventory of unsold homes, however, was up 23.4 per cent over the same month a year ago.

In the Fraser Valley, MLS sales declined four per cent to 2,152 units compared with May a year ago. Valley inventory, now at 8,381 units, is up 52 per cent compared with the same month last year.

The Fraser Valley’s average single-family home was $521,444 in May, a 12.6-per-cent increase from a year ago.

That prices keep rising is no surprise to Tsur Somerville, a real estate expert at the University of British Columbia, since “we know whenever markets slow down, activity slows down before prices slow down.”

Somerville, director of the centre for urban economics and real estate at the Sauder School of Business, added that a year ago, real estate prices were rising at a 16- to 20-per-cent clip, so 12-per-cent price growth “suggests the market has simmered down a little bit.”

Robyn Adamache, a market analyst for Canada Mortgage and Housing Corp. said her forecast still calls for sales to slow through the rest of the year, along with price growth.

“Prices tend to be sticky on the way down,” she added.

However, from the perspective of buyers who jumped into the market in May, Ian Webb and his wife Carleen Jurincic, the slowdown wasn’t as evident.

“The pace, I use frantic to describe it to other people,” said Webb, a local lawyer.

Webb added that they got back into the market to trade up from their condominium at Granville and 11th Avenue because his parents sold their house to downsize and passed substantial cash gifts to their three children.

However, it was a stressful five-month search to find the $990,000 coach house they’ve purchased. Houses they liked were listed on a Wednesday and sold by Saturday or Sunday night, he said.

The couple eventually sold their condo first so that they wouldn’t have to make offers conditional on selling their existing property.

“We’re very relieved to be out of that search for a place where you’re having to drop everything to go look at a listing and consider making an offer on the spur of the moment for massive amounts of money,” Webb said.

Lorne Goldman, the couple’s realtor at MacDonald Realty, said a lot of buyers are coming to the market with help from parents, with inheritances or with equity from property they own.

He added that rental income is becoming a more important consideration and a lot of new east-side Vancouver houses are being built with two basement suites.

“The price-point has not yet had a significant impact on sales,” Goldman added.

Somerville said in a high-priced market, there will always be a certain number of buyers who can pay top dollar. At the lower end of the market, buyers re-adjust their sights.

Greater Vancouver recorded 1,789 condominium sales in May, up 1.6 per cent from a year ago, with a benchmark price of $358,428.

The condo price represented an 11.5-per-cent gain.

“When you look at affordability [measures], especially on condominiums, [Vancouver] doesn’t look that horribly overpriced,” Somerville added. “People make adjustments in high-priced markets.”