Simple bungalow now gobbles up 71 per cent of income

Anne Howland

Province

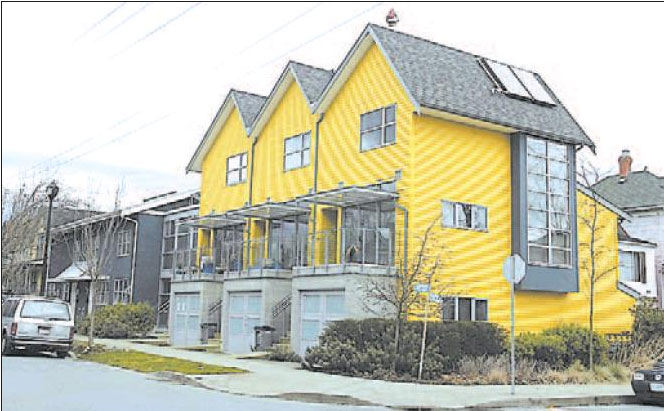

Despite the city’s efforts at so-called ecodensity, such as this development in Strathcona, Vancouver housing is the least affordable in Canada. NIC PROCAYLO FILE PHOTO – THE PROVINCE

OTTAWA — The cost of owning a home in Canada is getting a lot more expensive in every housing type, every province and every major city — and that’s putting a bigger squeeze on household budgets.

A report released yesterday by RBC Economics shows that home-ownership costs continued to climb steadily in the second quarter of 2007, eroding affordability for condos, townhouses, detached bungalows and two-storey homes.

“In the second quarter, Canada‘s housing affordability experienced one of the largest and most broadly based quarterly deteriorations since the mid-1990s,” said Derek Holt, assistant chief economist with RBC. “Higher house prices, mortgage rates, utilities and property taxes all combined to drive the countrywide deterioration.”

The affordability report measures the proportion of pretax household income needed to pay the costs of owning a home.

The standard condo remained the most affordable during the quarter, at about 29 per cent of income. A standard townhouse followed at 33 per cent, a detached bungalow at 41 per cent and a standard two-storey home was the least affordable at 46 per cent, the report said.

The affordability measure for a detached bungalow in Vancouver was 71 per cent; Toronto, 45 per cent; Calgary, 45 per cent; Montreal, 36 per cent; and Ottawa, 31 per cent.

“Allocating more than 35 per cent of the paycheque to housing is akin to squeezing the blood supply,” said Adrian Mastracci, portfolio manager with KCM Wealth Management Inc. “First-timers are painfully aware of the costs of affording even a starter condominium.”

Laurie Campbell, executive director of Credit Canada, said devoting about 30 per cent of pretax income to housing costs is comfortable for most people.

“Many people are house-poor because they want the Canadian dream of homeownership,” she said.

Cal Lindberg, president-elect with the Canadian Real Estate Association, said many Canadians have taken on bigger mortgages because of the strength of the housing market.

“I’m sure that there are a lot of people that are stretched just trying to get in or to move up to that bigger house or the house with a view,” he said, adding it is incumbent on both buyers and lenders to remain cautious.