B.C.’s large construction plans increase for the 17th straight quarter

Derrick Penner

Sun

Builders and developers piled another $3.3 billion worth of planned large construction projects onto British Columbia‘s Major Projects Inventory between June and the end of September ballooning the list to $135.1 billion, the province said Tuesday.

There are now 843 projects on the list, which is compiled quarterly by the Ministry of Economic Development. Some 417 projects valued at $53.4 billion are already under construction. It is the 17th straight quarter the inventory has increased.

The third-quarter list, for the three months ending Sept. 30, includes projects that have been announced but have since been put on hold, which stood at 33, the same number on hiatus at the end of the second quarter.

That compares with $40 billion worth of work underway from a list that totalled $109 billion at the same period a year ago.

Minister of Economic Development Colin Hansen said the inventory “is the best indicator of real, tangible [economic] activity for the years ahead.”

Hansen added that the size and time span of the inventory offers hope for the B.C. economy after the 2010 Olympics, although some economists predict a softening following the Games.

“Most of these projects take us well into the next decade,” Hansen said.

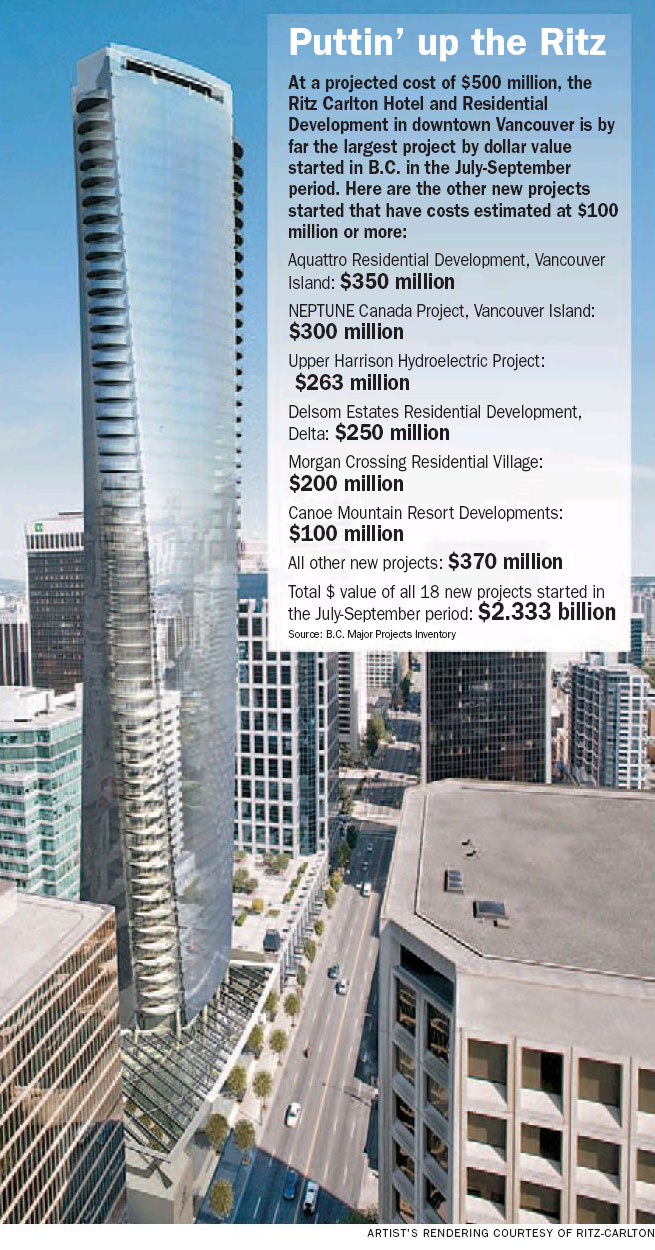

Vancouver‘s Ritz Carlton Hotel and residential development on Georgia Street, at a $500 million value, was the biggest new project to start construction in the third quarter.

Cloudworks Energy’s $263-million run-of-river hydroelectric development is the next biggest piece of work to get underway.

Manley McLachlan, president of the B.C. Construction Association said the breadth of work available on the project list is comforting. The inventory isn’t dominated by either residential building or industrial projects.

The fact it is growing, rather than shrinking “supports the observation that we’ve had for quite some time. To call this a boom now is almost a redundant comment.”

However, while the inventory is evidence that high levels of construction are likely to continue for some time, which helps the skills-starved construction industry recruit new workers, its ballooning size provides its own problems.

“The real challenge though, is are we going to continue to be able to manage that growth over the long term,” McLachlan said. “And I think the verdict is still out.”

Some of the rising dollar value in the inventory list reflects the inflation in construction costs, McLachlan added, as high demand for buildings — and not jus in B.C. — drives up the prices for materials such as steel and concrete as well as labour.

The fact that project developers continue to make plans for new buildings, McLachlan said, is hopeful evidence “that we haven’t perhaps reached the breaking point where owners are saying ‘this is way too much, we’re going to delay our project until something changes.’

“We haven’t reached that point, and I don’t know where that point is,” although McLachlan said shortages of skilled workers have extended the schedules of some projects.

Hansen said he believes the growth in construction in B.C. is manageable. While construction costs are increasing, that growth hasn’t had too deep an impact on B.C.’s overall inflation rate, which would be a bigger concern.

“Companies are reaching out and are finding workers,” Hansen said, “and I see very few projects cancelled or delayed because of skill shortages.”

The value of projects on hold dropped $1.9 billion in the third quarter to $9.6 billion.

The inventory compiles the list from public sources and tracks capital projects worth more than $20 million or more in the Lower Mainland south west region and $15 million or more elsewhere in the province.

© The Vancouver Sun 2007