Get good medical insurance before you go south

Paul Luke

Province

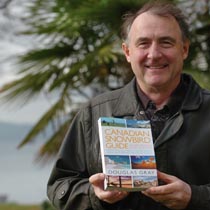

Doug Gray at English Bay with the new edition of his book The Canadian Snowbird Guide.

The greens loved your putting that morning. In the evening, you sipped tea and listened to classic Meat Puppets on your iPod as the Arizona twilight swallowed the desert.

You’d been having one of the best days of your life until your chest started to hurt.

Funny how an emergency quadruple bypass operation can ruin a snowbird’s day.

Funny how a $250,000 bypass procedure at a U.S. hospital can ruin an underinsured snowbird’s finances.

Canadians stoked with an absurdly ebullient loonie will likely stay longer and spend more as their annual migration to U.S. and Mexican sunspots begins, Vancouver author Doug Gray says.

Gray, an inveterate traveller himself, has no problem with sybaritic whims.

But a big-leisure lifestyle carries big responsibilities, says Gray, who has just released a fourth, updated edition of his book The Canadian Snowbird Guide: Everything You Need to Know About Living Part-time in the USA & Mexico (John Wiley & Sons, $26.99).

Snowbirders who want to keep dreams from becoming nightmares will pay close attention to customs and immigration laws, tax issues, estate planning and money management before taking flight, Gray says.

Arranging adequate insurance — medical, car and home — should be a top priority, he says in an interview.

“People face a huge risk in this area,” Gray says. “Without supplemental coverage for out-of-country medical emergencies, you could be financially devastated.”

At best, provincial health plans will cover only a small chunk of the bills if you get hurt or sick while you’re abroad.

B.C.’s medical plan, for example, will pay a cap of $75 a day for a hospital stay, Gray says. But the daily cost for a stay in a U.S. intensive-care unit can be $10,000 US.

A quadruple bypass could ding you a quarter of a million dollars, he says.

Frost fowl should comparison-shop for out-of-country coverage, looking at features and benefits.

They must also do their best to ensure any claims they do make will be accepted. That means thoroughly explaining pre-existing medical conditions. Changes to your condition or medications must be submitted in writing before leaving Canada, Gray says.

“Not fully disclosing pre-existing ailments or changes to medical condition are two big reasons why claims are denied,” Gray says.

Car insurance is another area where snowbirds may stumble.

Gray urges Canadians heading to the litigation-minded U.S. to boost their third-party liability coverage to between $5 million and $10 million.

“If you have, say, $1 million or $2 million in coverage, that may not cut it if you’re responsible for an accident and there’s a judgment against you,” he warns.

Getting covered for accidents with

uninsured or underinsured motorists is also critical, Gray says.

If a person in either category causes an accident, then your insurance covers a claim up to the limit of your own third-party

liability coverage.

Snowbirding, despite its growing appeal to bewrinkled boomers, is not for everybody. Canadians wintering abroad may be

surprised by the cultural isolation they experience, Gray warns.

Those curious about the lifestyle should take it step-by-step, starting by renting for about a month, Gray advises in his book.

If the experience meets your expectations, you should then do a risk-reward analysis to ensure out-of-country ownership keeps your financial security intact.

For those who plan sensibly, snowbirding can enhance the quality of their retirement. The strong loonie, coupled with the lower cost of living in the U.S. or Mexico, means snowbirds may come out ahead financially, Gray says.

You can buy a used mobile home in a park that meets all your needs for about $5,000 to $8,000 at the end of snowbird season in April. Rents for mobile-home/RV pads start at $250 a month.

Amortize that over 10 years and it starts getting affordable, he says.

“Even taking into account the cost of your out-of-country emergency medical insurance, you could be breaking even or paying just a bit more than if you stayed at home in Canada all winter,” Gray writes.

– – –

FIELD GUIDE TO SNOWBIRDS

– Doug Gray, author of The Canadian Snowbird Guide, defines a snowbird as a person who spends more than a month each year in a sunny southern location.

– Western Canadian fowl prefer California and Arizona; for Central and Atlantic Canadians, it’s Florida and Texas.

– About two-thirds of Canada’s snowbirds will head south over the next three or four weeks, Gray says. The remaining third will take flight in early January.

Both groups typically return before the end of April.

– Numbers are on the rise. Last year, 517,000 Canadians spent at least 30 nights in the U.S., up from 415,600 in 2003, Statistics Canada says.

– Mexico is heating up as a snowbird destination. About 700,000 Americans and Canadians live in Mexico year-round or part-time, according to the Mexico Tourism Board.

Popular retirement havens for Canadian and American birds are Guadalajara, Lake Chapala, San Miguel de Allende, Cuernavaca, Oaxaca and Guanajuato.

– An updated edition of Gray’s Snowbird Guide hits bookstores around the end of the month but can be ordered online now.

– More information on out-of-country issues is available at snowbird.ca.

— Paul Luke

© The Vancouver Province 2007