Derrick Penner

Sun

British Columbians are making compromises and relying on financial help from families, but are still getting into the province’s escalating property markets, according to a national real estate firm.

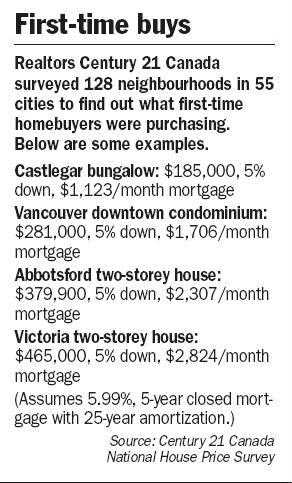

Century 21 Canada, on Tuesday, released results from a survey of its brokers on first-time buying.

The firm points to Statistics Canada numbers on home ownership, which show the rate at which people are buying their own property is growing faster than the population.

However, particularly in B.C.’s high-priced markets, the buyers aren’t getting exactly the property they want where they want to live.

Century 21 Canada president Don Lawby, in an interview, said buying habits are changing because “that’s just the reality of the marketplace today, for first-time buyers especially.

“They may have the great desire to have a wonderful lot and a detached home, but their financial wherewithall won’t allow that.”

Settling for locations that are less desired is something Christina Pughe, a mortgage-development manager at Vancity credit union is familiar with. Recent clients, a young couple, bought an apartment in Pitt Meadows when they really wanted to live in Richmond. “That’s a long commute,” she said.

Pughe added that a colleague worked with four clients who wanted to live in Vancouver, but bought in Surrey.

Lawby added that once first-time buyers do find properties, more are coming to the transactions with pre-inheritances or low-interest loans from parents, and are looking for help from mortgage brokers to navigate the complicated options available to them.

Kevin Lutz, B.C. mortgage manager for the Royal Bank, said 75 to 80 per cent of his bank’s first-time borrowers in B.C. are taking mortgages with 40-year amortizations, and a higher proportion are coming with less than a 25-per-cent down payment.

In Vancouver, Julie Jaggernath, director of education at the Credit Counseling Society, said her office is “a little bit busier than we were last year,” with clients including those who have gotten in over their heads buying property or upsizing their homes.

“We’re also seeing people spending about 70 per cent of their income on housing and housing-related costs,” Jaggernath said. “That’s a lot.”

Her advice to prospective homebuyers is to spend a year pretending they’ve already bought. So if they are paying $1,000 in rent, and expect to take on a $3,500 mortgage payment, try to set aside the difference to see if they are willing to make the sacrifices it would take to do so.

© The Vancouver Sun 2007