Financial crisis in the U.S. taking hold of market psychology, analyst says

Derrick Penner

Sun

Greater Vancouver closed March with its slowest first-quarter for sales since 2001, Canada Mortgage and Housing Corp. analyst Robyn Adamache said Wednesday in an interview.

Both the Greater Vancouver and Fraser Valley real estate boards reported Multiple Listing Service sales off 2007’s pace, with inventories also climbing, which Adamache said is consistent with her forecast for the market to moderate.

The ability of buyers to afford homes at Vancouver‘s high prices is still one of the factors constraining sales, but Adamache suspects that uncertainty sparked by news about the financial crisis in the United States is also taking hold of the market psychology.

Tsur Somerville, director of the centre for urban economics and real estate at the Sauder School of Business at the University of B.C., added that his sense is that the market psychology has shifted from “unmitigated optimism” to caution, given what has happened in the U.S.

“People are cognizant of risks to real estate in a way that, two years ago, they weren’t entertaining,” Somerville added.

However, in speaking to Greater Vancouver’s numbers, Adamache added that while supply and demand in the market are balancing out, the ratio of sales to new listings being added to the market still favours sellers by a significant margin.

Also, Adamache said, on average, homes are selling for 98 per cent of their list price, which is also consistent with a seller’s market.

“[Sales are] still very high by historical standards,” Adamache added. “The other reason, other than [low] mortgage rates is that we’re still expecting the two big fundamentals [of] job growth and population growth to continue strong this year.”

Adamache is still forecasting that price gains will slow into single digits as the year unfolds, though she doesn’t believe they will reverse into a correction this year or next year.

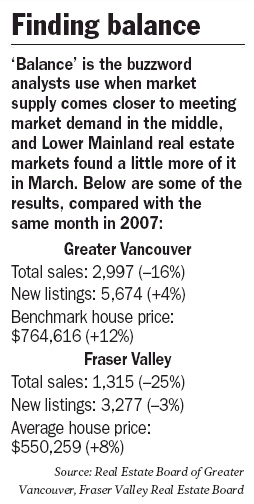

In Greater Vancouver, realtors saw 2,997 sales through the Multiple Listing Service in March, compared with 3,582 in March 2007. New listings added to the market in March were up four per cent to 5,674 compared with the same month a year ago.

Prices, however, remain elevated with the benchmark price of a so-called typical single-family home hitting $764,616 in March, 12 per cent more than March 2007.

In the Fraser Valley, property inventories hit a 10-year high in March, the Fraser Valley Real Estate Board reported, with total active listings up 27 per cent to 9,361 units compared with a year ago, although new listings in March were down from the same month a year ago. MLS sales in the Fraser Valley of 1,315 units represented a 25-per-cent decline from the same month a year ago.

The March average price for a single-family home was $550,259, which is up 8.1 per cent compared with the same month a year ago.

Kelvin Neufeld, president of the Fraser Valley Real Estate Board, said he doesn’t get the sense that his clients are any more nervous than they have been about buying.

He added that investors see the market slowing down, so they sense that now is a good time to sell, which is driving some of the listings. Buyers, Neufeld said, are still in the market, but are taking more time to make decisions.

Scott Russell, first vice-president of the Greater Vancouver board, added that the amount that central banks are cutting key interest rates, and the effect that will have on lowering mortgage rates, should help bring more buyers into the market.

© The Vancouver Sun 2008