Personal exemption up, minimum tax rate down, child credit in effect

Gillian Shaw

Sun

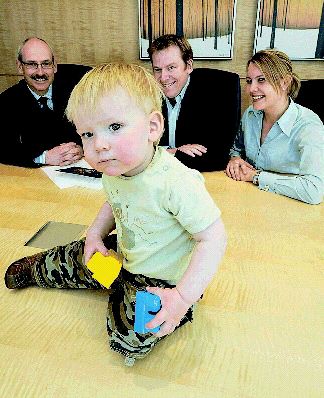

Mike Fahrmann (left) of KPMG talks with Killian Ruby and Catherine Harrison about their taxes and the effect 15-month-old son Sam Ruby has on them. Photograph by : Ward Perrin, Vancouver Sun

Killian Ruby and Catherine Harrison are $300 ahead this tax year thanks to a new credit for their baby Sam.

Right off the bat, Sam makes the family eligible for a $2,000 non-refundable child tax credit, a new measure introduced for the 2007 tax year that will see their taxes drop by $300.

When he’s big enough to kick a ball, if he takes up playing soccer or another activity Ottawa deems will help him keep fit, his parents could claim up to $500 a year until he reaches the age of 16 under the new children’s fitness tax credit. That could reduce the taxes they pay by another $75.

Then there is the universal child care benefit, which could be clawed back depending on their income levels, child care expenses that can be deducted, registered education savings plans (RESPs) in which the government adds 20 per cent on the first $2,500 contributed every year and which allow education savings to grow tax free.

“For parents who can afford it, and admittedly that is not everybody, you get free money from the government, and the money increases tax free,” KPMG tax partner Mike Fahrmann said. “That’s a decent one for Catherine and Killian; if you are going to save for education, you might as well do it in a tax-effective manner, and it is like a 20-per-cent automatic return on the first $2,500.”

Early this week, more than 10 million of the roughly 25 million Canadians who are expected to send in tax returns had yet to file, leaving tax preparers and the Canada Revenue Agency bracing for a last-minute rush to beat the deadline which hits at midnight on April 30.

Even though that’s a lot of laggards, there have been more early filers this year, perhaps encouraged by some new tax credits, as well as measures that are boosting refunds and leaving more money in Canadian pockets.

The average refund going out so far this year is $1,393, up from $1,219 around the same time last year.

“We have roughly half a million more tax returns in this year than we did at the same time last year,” said CRA spokesman Bradley Alvarez, who said an increased number of people filing online plus tax software that helps people plug in figures and see their potential refund may be helping.

“You don’t have to worry about mailing it,” he said. “And there is an added incentive if you are playing around with it and say, ‘Hey, I’m getting a refund,’ it makes it that much easier to just file your return.”

Among other changes this year are:

– A $2,000 tax credit for dependant children under the age of 18.

– Pension income-splitting that allows taxpayers to transfer up to 50 per cent of their income that is eligible for pension income credit to a spouse or common-law partner. There is also a $2,000 non-refundable pension income credit, which is not new this year but you can shelter the first $2,000 in qualifying pension income. It doesn’t include Canada Pension Plan, Old Age Security or Guaranteed Income Supplement payments.

– The minimum tax rate has been reduced to 15 per cent from 15.5 per cent for income up to $37,178. While the measure wasn’t introduced until last fall, it was made retroactive to January 1, 2007. That’s worth about $240 in tax savings, and depending on what adjustments your employer made in tax withholdings, you may be eligible for a larger-than-expected tax refund if you overpaid for the year.

– The personal exemption has been increased to $9,600 from $8,929 — that’s the amount you can earn before tax kicks in.

When it comes to tax filing, some people just procrastinate; others who owe money are loath to write a cheque until the last possible moment.

“The biggest piece of advice is make sure you file by April 30,” Fahrmann said. “Suppose you owe $1,000 in taxes and you decide not to file on time. You have just cost yourself a five-per-cent penalty. The better strategy is to file whatever you can, so at least you’ll avoid the penalty.”

The last possible moment before incurring a five-per-cent penalty on any money owing — in addition to a one-per-cent-per-month interest charge — can come several ways: If you file online, you have until the midnight deadline; if you mail in a return, it must be postmarked before the midnight deadline; if you don’t trust technology or the post office, you can hand deliver your return.

“Our kiosk will be open at Surrey and drop boxes at 1166 West Pender in Vancouver,” Alvarez said. “There will be people on site — there is a drop box and we empty it on an on-going basis.”

Even if you haven’t managed to scrounge together all those slips of paper you need to file, or you have no idea where you’ll find the money to pay your tax bill, it’s best to meet the deadline. That missing tuition slip, the soccer team receipts, the RRSP receipt that’s fallen out the back of the drawer can all go in later.

If you owe money, the bill only climbs faster if you ignore the deadline.

© The Vancouver Sun 2008