College Heights neighbourhool prices fall two per cent from 2007

Derrick Penner

Sun

The city of Prince George, in the grips of a forestry downturn, was the weak spot in a major realtor’s semi-annual survey of real estate prices.

The city of Prince George, in the grips of a forestry downturn, was the weak spot in a major realtor’s semi-annual survey of real estate prices.

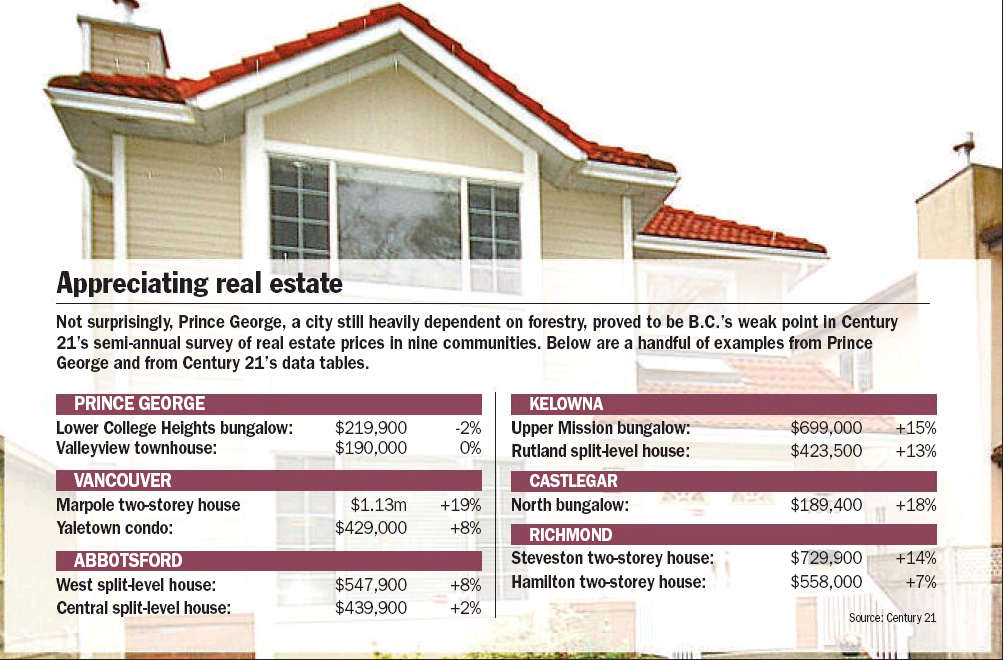

Century 21’s 2008 spring national house price survey showed that the price of a typical bungalow in that city’s lower College Heights neighbourhood dipped two per cent year over year to $219,000, and showed no change in another subdivision at $190,000.

“Any communities significantly affected by an industry that has a softening, real estate in those communities would suffer,” Century 21 president Don Lawby said in an interview.

However, the Century 21 survey did conflict with B.C. Northern Real Estate Board statistics which showed the average Prince George house price up six per cent to $246,839 so far this year.

Dan Seibel, with Century 21’s office in Prince George, said that while the town’s mills are cutting shifts, “the rest of the economy is looking good, if half the [projects] happen that have been announced.”

Century 21 collected the information for its survey by canvassing its offices and asking realtors in select locations to pick the sale of a property considered representative of a neighbourhood’s typical housing, and then calculate change in value using comparable sales and listings.

Lawby added that market strength “all relates to strength of the economy and consumer confidence.”

And in that respect, confidence in much of the rest of the province is still holding up.

Among the other 22 neighbourhoods in nine communities that Century 21 surveyed, the low point was two per cent price growth in both Prince George’s Heritage subdivision and Central Abbotsford, the high point was 19 per cent in the Marpole neighbourhood on Vancouver’s west side.

Robyn Adamache, a senior market analyst at Canada Mortgage and Housing, said that while B.C.’s economy is still strong overall, real estate markets have slowed.

Sales during the first quarter of this year declined 14 per cent across the province, Adamache added, and new listings were up 12 per cent hitting the highest level since Canada Mortgage and Housing first started keeping statistics in 1980.

Adamache attributed the slowdown in part to consumer worries in the face of bad economic news in the U.S. and central Canada.

The rise in listing activity, she added, is due to “homeowners feeling that same sort of nervousness, thinking ‘I’d better put my home on sale now rather than later.’ “

However, the rise in listing activity has so far not caused the inventory of unsold homes to overwhelm demand.

Adamache noted that across B.C., prices during the first quarter were still up 14 per cent compared with the same quarter a year ago.

Lawby said sales volumes in most markets across Canada have slowed as economic growth eases, but “prices in the spring of 2008 are strong and stable nearly everywhere across the country.”

Century 21’s canvass of 198 neighbourhoods in 66 cities across Canada turned up nine locations where prices dropped and 21 communities where prices remained flat. Prices increased in the remaining 167.

Lawby said some of the Alberta locations that saw price decreases were overbuilt with developers banging up units at the same time significant numbers of residents put their houses up for sale to realize their equity gains and move out of the province.

“We’re not going to have anywhere as near a strong market in unit sales as we had last year . . . probably down seven per cent or so across the country,” said Lawby. “The economy has performed very well . . . it may go down a bit, but it’s not going to go down to where it’s going to affect the real estate market in a significant fashion,” Lawby said.

HOUSE PRICES SOFTEN IN CENTRAL CITY

© The Vancouver Sun 2008