Asus pins future on small but mighty laptop

Michelle Kessler

USA Today

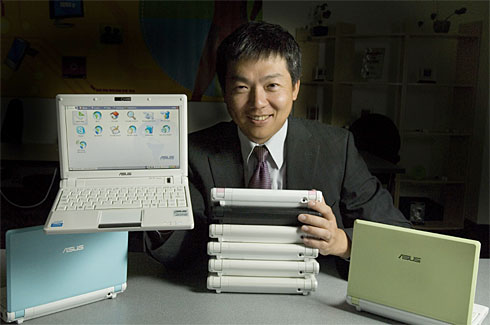

Asus North America President Jackie Hsu with Asus Eee PC Series computers at company offices in Fremont, Calif. The small laptops start at just $299.

FREMONT, Calif. — Asus plans to be the No. 3 laptop maker in the world in six years.

Pretty ambitious, considering that many Americans probably have never heard of the Taipei, Taiwan-based company.

Asus’ big goal rides on a tiny product: a hugely successful, itty-bitty laptop called the Eee PC. It’s a bit larger than a tissue box, weighs just 2 pounds and starts at the bargain-basement price of $299.

There’s nothing quite like it on the market. Buyers — many of them early adopters — are snapping up Eee PCs almost as fast as Asus can make them. The company expects to sell nearly 2 million in the first six months of the year. They’re available at Best Buy, Amazon and many local retailers.

This week, Asus launches a $549 version with a bigger screen and more features. A desktop version is on the way, probably this summer, says Jackie Hsu, president of Asus’ U.S. division. More Eee products are on the drawing board.

The company has helped create a new type of computer — a laptop that’s both small and inexpensive, says tech analyst Bob O’Donnell at researcher IDC.

Asus made 81% of the laptops that sold for less than $500 last year, but its good times probably won’t last, O’Donnell says. Just about every PC maker is considering its own tiny, inexpensive laptop. That means that little Asus — the No. 9 PC maker in the world — could soon face competition from giants Hewlett-Packard, Dell and Acer, he says.

The market will grow, but not fast enough to generate numerous big successes, O’Donnell says. “Asus has gained a lot of mindshare … for such a little company. But they’re going to be under a lot more pressure.”

Big leap for small laptops

The market for sub-$500 laptops was marginal until 2007, when 430,000 were sold, O’Donnell says. That number is expected to jump to 3.6 million this year, with the vast majority of sales in the USA and Asia.

That’s a surprise. Cheap, small laptops were rare until a non-profit group, One Laptop Per Child, started cranking out student-size computers in 2007 that sold for about $200. They were designed for a limited market, mainly schools in developing nations. So were similar computers from a rival project, Classmate PC.

In the USA, Japan and other developed nations, most small laptops remained high-end business models that sold for a premium. Lenovo’s 2.4-pound IdeaPad U110 starts at $1,899, while Sony’s (SNE) 1.2-pound Vaio UX starts at $2,500, for example.

Asus changed that. It took the same low-cost model employed by OLPC and used it to create a computer that shoppers in developed countries wanted to buy.

Hsu says few tech-savvy Americans would use the Eee PC as their primary laptop. One midrange, $399 model has a 7-inch screen and a keyboard that feels cramped to adult hands. Its 900-MHz Intel Celeron processor is much less powerful than those found in most laptops. And its 4-GB hard drive is only as big as Apple’s (AAPL) smallest iPod. But it’s just fine for e-mail or simple Web surfing — which makes the Eee PC a great backup laptop to take on the road, Hsu says. It’s also a good gift for kids or elderly parents, he says.

Asus tried to compensate for the Eee PC’s technical shortcomings with an easy-to-use interface that appeals to this audience. The original Eee PC offered games, Web browsing and other features on a simple screen layout, based on the open-source Linux operating system. The company later released a version running Microsoft’s Windows XP.

What’s ahead for Asus

Asus’ parent company, AsusTek, used to be best known for making motherboards, a crucial if unsexy component in every PC.

AsusTek also manufactured computers for Apple, Sony, Hewlett-Packard and others behind the scenes. That’s fairly common. Many brand-name companies focus on design and marketing, and hire outside factories to do at least part of the manufacturing.

AsusTek also sold laptops under its own name. But that market was limited, partly because its manufacturing customers didn’t want the competition.

AsusTek addressed that issue this year by becoming a holding company, with three separate firms underneath. Pegatron makes components and does manufacturing for other companies. Unihan makes plastic computer cases and other parts. And the renamed Asus builds products it sells under its own name, such as the Eee PC.

The change hasn’t alienated manufacturing customers so far, Hsu says. “We think it’s OK. Orders haven’t fallen,” he says.

Asus has also rolled out cellphones, Global Positioning Systems (GPS) and home networking gear. It’s considering expanding into any product that combines computing, communications and electronics. “We want to grow,” Hsu says.

But rivals will soon start moving onto Asus’ turf, says tech analyst Martin Reynolds at researcher Gartner. One potentially huge threat: Apple. The company behind the iPod “has been looking really hard at the future,” Reynolds says. “You could see Apple notebooks getting really low in price.”

It’s unlikely that Asus will be able to win by cutting costs. Even cheap laptops cost about $200 to make, O’Donnell says. (Asus’ non-Eee laptops sell for an average price of $1,250.)

Hsu, a longtime Asus executive who came to the USA last year, already knows how to sound like an American business leader. “We hope to see more competitors come in. We want a big pie,” he says.

The question is how big the pie will get. O’Donnell says many companies are overestimating it.

But O’Donnell and others agree that the PC market will never be the same again. “Low-cost laptops are here to stay,” Reynolds says.