Derrick Penner

Sun

Slowing British Columbia real estate sales are shaving a slice off a sizable chunk of the provincial economy.

The B.C. Real Estate Association released a report on Tuesday estimating that the 102,000 homes sold through the Multiple Listing Service in 2007 accounted for almost $2 billion in value for the provincial economy, and supported some 28,000 jobs.

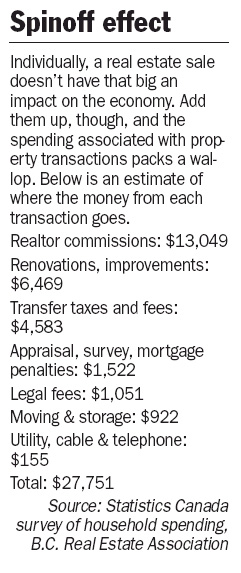

Each sale transaction, the report estimated, triggered $27,751 in spending from real-estate commissions, renovations, legal fees, moving costs and taxes.

However, with 2008 real estate sales 24 per cent below 2007 levels, logic suggests the drop in activity is denting that economic impact.

Cameron Muir, the B.C. Real Estate Association’s chief economist, said it is difficult to extrapolate how much of a dent the decreased activity is creating.

“Common sense would dictate that there is an impact to the economy,” Muir said in an interview, “[that] this money isn’t being spent because [there are] fewer home sales.”

The B.C. Real Estate Association for 2007 estimated that every 100 MLS home sales generated $2 million for the economy and supported 28 full-time jobs.

Muir added that it is difficult to say categorically that every 100 fewer sales in 2008 will pull the equivalent amount out of the economy. He said the estimate cannot account for consumer decisions to spend money they would have poured into a real-estate purchase in other ways.

However, the waning of sales in B.C.’s real estate sector was a big factor in Central 1 Credit Union’s (formerly Credit Union Central B.C.) decision to downgrade its forecast for provincial growth.

“More or less, those [economic] multipliers work both forward and backwards,” Central 1 economist David Hobden said in an interview, referring to the B.C. Real Estate Association estimates.

A drop in real estate sales means fewer commissions paid to realtors, and commissions generated the biggest spin-off — $13,049 per transaction on average — from the $27,751 that a typical transaction generates.

“If sales are off substantially this year or next, then commission income is way down, there is less employment in the sales aspect,” Hobden added, which will trickle down into less consumer spending and investment activity.

Fewer sales would also be translated in less finance and insurance activity, lower expenditures on home furnishings that usually accompany sales, and less tax revenue collected both from the lower level of property transfers and income taxes paid by participants in all these areas, Hobden said.

Hobden added that upturns and downturns in housing markets have an even bigger impact on economic growth.

“When [the housing market] is booming, it’s really going great guns,” Hobden said, and when it slows, it tends to drop off by significant amounts.

Combine that with the fact that housing is a relatively large piece of the economy, “makes [its] contribution to growth amplified.”

Central 1 Credit union, in its latest forecast, reduced its expectation for economic growth in B.C. to 1.5 per cent this year and 1.8 next year, compared with 3.1 per cent in 2007.

The figures for spending on real-estate transactions came from the Statistics Canada’s survey on household expenses, which Muir said BCREA updated to reflect 2007 levels.

Muir then commissioned B.C. Statistics to run that figure through its B.C. input-output model to calculate a total impact on the B.C. economy.

© The Vancouver Sun 2008