Working people ‘cashing in on low mortgage rates’

Derrick Penner

Sun

The decline of Lower Mainland real estate markets, which started with falling sales more than a year ago and saw prices drop as the global recession developed, levelled out in May.

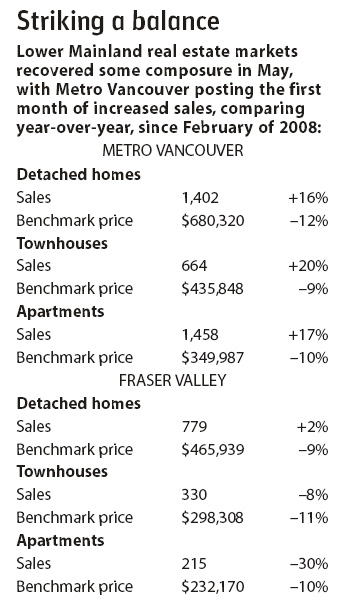

Metro Vancouver recorded its best year-over-year sales increase in May since February 2008 with 3,524 sales reported through the Multiple Listing Service, 17 per cent higher than the 3,002 sales recorded in the same month a year ago.

The so-called benchmark price in Metro Vancouver, averaged across property types, hit $506,201 in May, which is still 11 per cent below the same month in 2008, but higher than the $484,211 recorded in January.

Metro Vancouver‘s inventory of unsold homes in May stood at 13,641, a 16-per-cent decrease from a year ago.

In the Fraser Valley, realtors recorded 1,501 MLS sales, which was still six per cent below the 1,599 sales recorded in May 2008, but “the closest we’ve been to a balanced market since early spring last year,” Paul Penner, president of the Fraser Valley Real Estate Board said in a new release.

The benchmark price for a detached home in the Fraser Valley hit $465,939 in May, some 9.3 per cent below May of 2008, but higher than the $460,229 recorded last month.

Fraser Valley‘s inventory of unsold homes stood at 10,047, a 10-per-cent decline from the same month a year ago.

Tsur Somerville, director of the centre for urban economics and real estate at the Sauder School of Business at the University of B.C., said it is important to remember that May 2008 was the month when sales started their steepest descent.

So while May’s sales figures improved, they were still off about 20 per cent from the hot sales years of 2007 and 2006.

“What we’re seeing here is essentially [sales] recovering from the trough, but are still where [they] should be, which is way below the peak,” Somerville said.

He said consumers don’t necessarily believe the economy has recovered, but they do think the worst has passed, and those with jobs now have enough confidence to cash in on extremely low mortgage rates to buy homes.

“That is a much more positive place than where we were last summer, where bad news was starting to explode all around us,” Somerville said.

Carol Frketich, regional economist for Canada Mortgage and Housing Corp., added that for many employed, prospects have improved.

“When we look at what’s happening in the economy and labour market, clearly we are in a period of slowdown,” Frketich said in an interview.

She said wages and salaries in B.C. have crept up four per cent so far this year, and “those people who have jobs are buying homes.”

© Copyright (c) The Vancouver Sun