Marc Saltzman

Sun

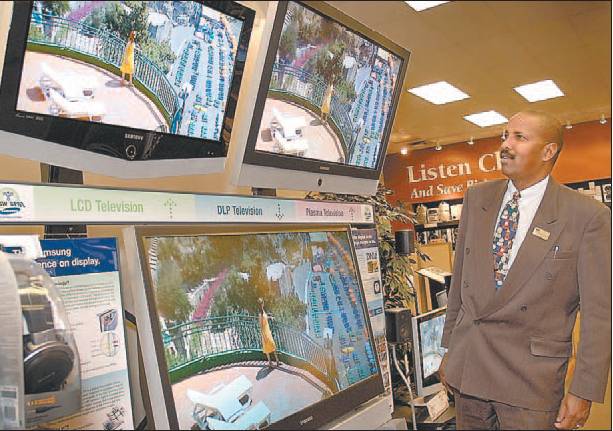

Panasonic’s plasma TV, TH50PX50 retails for %5,999 and is on a lot of wish lists

Sony’s 40-inch Bravia XBR LCD TV (Model # KDLV40CBR1) sells for $4,499

The 62-inch Toshiba 62HM85 Digital Light Processing, or DLP, TV ($3,499 www.toshiba.ca)

Rewind all the way back to 2003 and the big question among television shoppers was whether to invest in a HDTV-ready set.

After all, there was a significant price difference between high-definition TVs and those without, not to mention programming was, in a word, scarce.

Boy, have times changed.

Prices today are comparable between standard rear-projection and tube-based TVs and HDTV-compatible ones, while flat-panel television technologies are dropping in cost by about 45 per cent per year. And there’s plenty of high-def stations to choose from; Bell ExpressVU, for example, boasts 28 dedicated HDTV stations.

For the uninitiated, HDTV-ready televisions feature many more lines of resolutions (up to 1,080) than what older TVs display (525 lines). This results in a much sharper, more life-like picture. HDTVs also features a wider screen, which is more akin to a movie theatre (a 16:9 ratio, horizontal to vertical), opposed to the boxy 4:3 screens. Lastly, many HDTV programs also offer multi-channel surround sound (and in many cases, Dolby Digital) instead of mere left and right stereo audio.

So, today the new question isn’t whether to invest in a HDTV, but rather, what kind of HDTV to purchase? Plasma? LCD? Or rear-projection, such as DLP? The following is a brief look at the pros and cons for each decision, and recommended buys per category (note: prices may vary between retailers).

PLASMA TV:

What is it: Plasma TV panels contain an array of tiny cells, referred to as pixels, which contain phosphors corresponding to the colours red, green and blue; a mixture of trapped neon and xenon gases are then stimulated by an electrical current, thus producing a rich and vibrant picture to the viewer on the other side of the glass.

Pros: While some may disagree, plasma televisions produce the most lifelike image compared to competing technologies. Plasma TVs are also ideal for those looking for a big-screen experience (42-inches and higher), yet are still svelte enough to mount on a wall. These TVs enjoy a wide viewing angle (usually 160 degrees), so there’s not a bad seat in the room. Current-generation plasma HDTVs enjoy a long life at about 60,000 hours.

Cons: Compared to other TV types, plasma is usually the most expensive to invest in. Plasma TVs also suffer from phosphor “burn in” caused by static images left on the screen too long, such as a video game score that is always displayed. If this happens, you’ll forever see a “ghost” image burned into that part of the screen. Compared to LCD TVs, plasma televisions also use more power and tend to run hotter.

Our picks: Two award-winning 50-inch plasma TVs are Panasonic’s TH-50PX50 ($5,999; www.panasonic.ca) and the Pioneer PDP-5060HD ($6,999; www.pioneerelectronics.ca). A great value is HP’s new 42-inch PL4200N ($3,499; hpshopping.ca).

LCD TV:

What is it: Similar to your laptop computer’s monitor, LCD televisions use a “liquid crystal display” to produce a sharp picture. Liquid crystals are sandwiched between two panes of polarized glass, which are stimulated by an electric current and illuminated by fluorescent tubes housed behind the glass.

Pros: While generally smaller in screen size than plasma and rear-projection HDTVs, LCD televisions have its advantages: they are extremely thin (about 2-inches thick) and lightweight, so they can be easily mounted on a wall. They are also more energy efficient compared to other TV technologies. LCDs have exceptional contrast ratios and are ideal for rooms with ambient light (e.g. a family room with many windows). They also enjoy a wide viewing angle, at 170 degrees. They do not suffer from phosphor burn-in and enjoy long life-spans (roughly 60,000 hours).

Cons: Because big-screen LCD televisions are still very expensive, most consumers opt for the smaller-sized models (32-inches or less). Another downside is they often have a poorer refresh rate than plasma and rear-projection TVs, meaning they don’t typically handle motion very well — such as fast-paced sporting events — so be sure to try before you buy (rule of thumb: the lower the LCD TV’s response rate, the better).

Our picks: Sony’s 40-inch Bravia XBR LCD TV (model # KDLV40XBR1; $4,499; www.sonystyle.ca), Samsung’s 32-inch LN-R328W ($2499.99) and Sharp’s 32-inch Aquos LC32DA5U ($2,199).

DLP TV:

What is it: Based on the Digital Light Processing (DLP) technology from Texas Instruments, these rear-projection TVs offer a sharp and extremely bright display in a lightweight cabinet (less than 100 pounds). At the heart of every DLP projection TV is an optical semiconductor that can be considered the world’s most sophisticated light switch; this chip contains more than one million microscopic mirrors (each one less than one-fifth the width of a human hair) that sway back and forth to create the picture on the screen.

Pros: They’re not thin enough to hang on a wall like a picture frame, but with some as narrow as seven inches deep, they won’t take up too much space in the room, either. DLP sets are less expensive than their flat-panel counterparts, yet are usually larger in size and offer a brighter picture.

Cons: Aside from being thicker than the sleek LCD and plasma TVs, DLP sets contain a large lamp that will burn out after a few years (consumers must purchase and replace them). Also, viewers must sit farther back from DLP sets than flat-panel TVs or else the image may look pixilated; some DLP models may suffer from a “rainbow effect,” which can be best described as bursts of colour visible to some viewers.

Our picks: Go big or go home, as they say. Feast your eyes on the 61-inch Samsung HLR6164 ($3,799; www.samsung.ca) or 62-inch Toshiba 62HM85 ($3,499; www.toshiba.ca).

© The Vancouver Sun 2005