Jonathan Fowlie

Sun

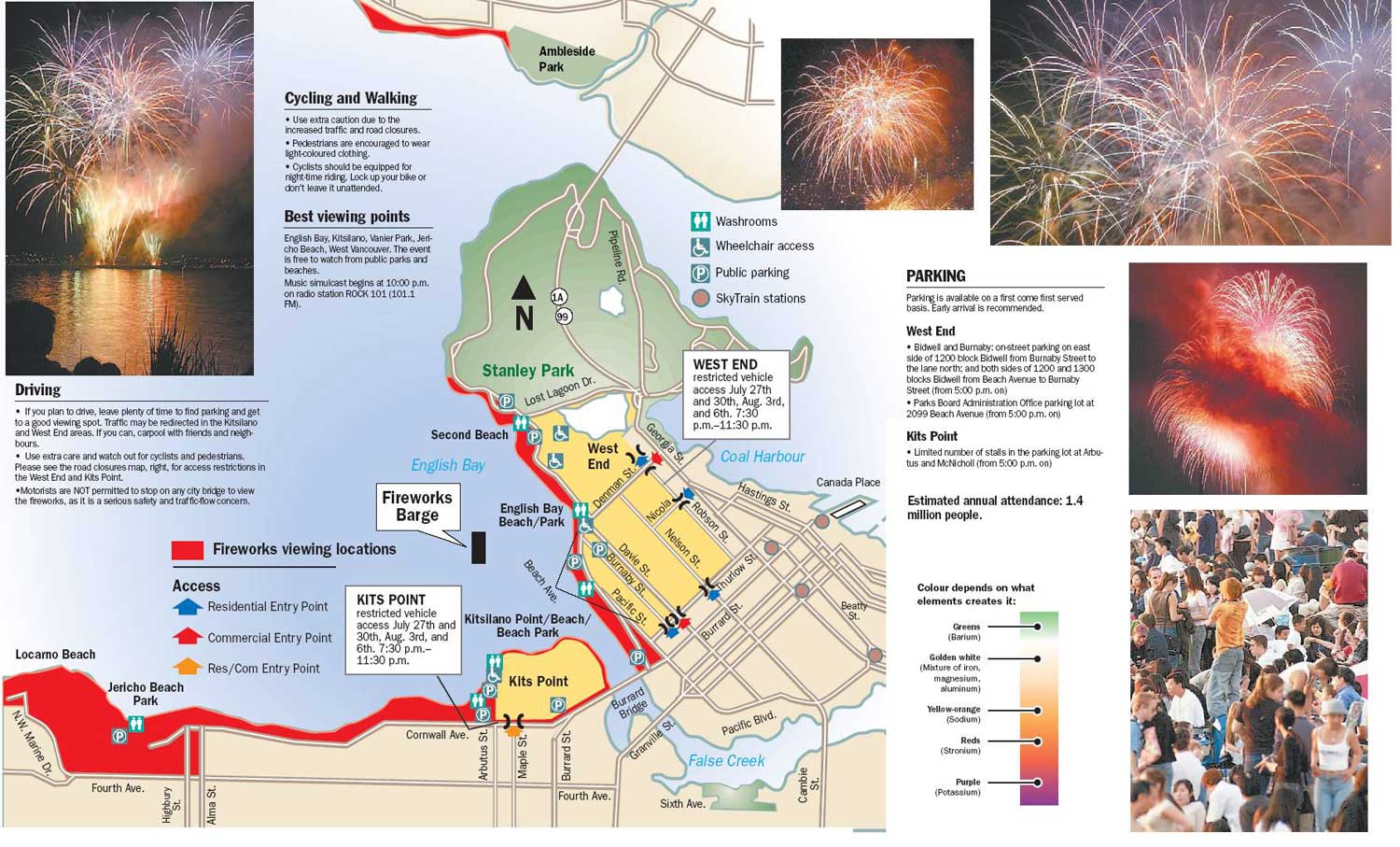

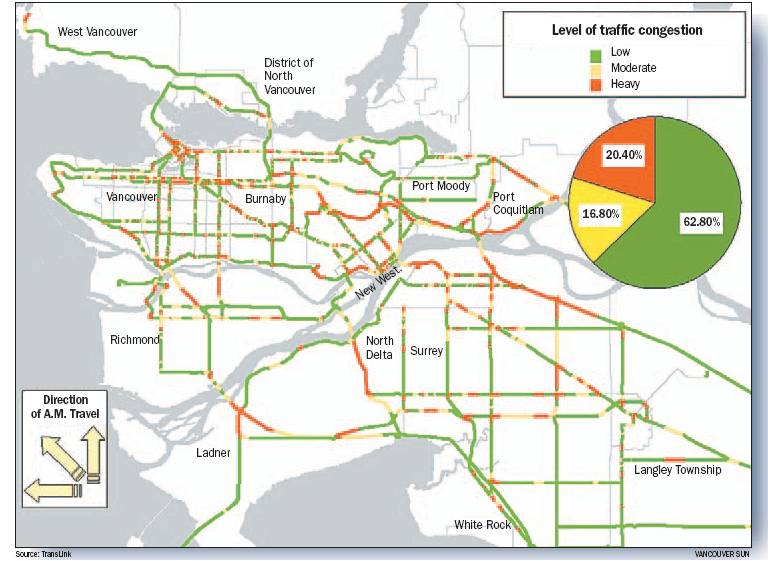

Fighting your way to work Traffic congestion is a fact of life for most commuters, but not all routes in the city are equally backed up. This map shows levels of congestion during an average morning rush into the city. About 63 per cent of the roads are clear, but most people still see delays.

LOWER MAINLAND I Who knew one car could cause so much chaos?

Almost 7,000 drivers delayed in one morning; bridges up and down the Fraser River overflowing with idling cars and a SkyTrain system packed almost to capacity with a mix of regular commuters and those who, until that very moment, had considered themselves almost allergic to public transit.

At exactly 3:01 a.m. last Monday, the driver of one car set off a virtual disaster by cutting off a semi-trailer truck on the approach to the south end of the Port Mann bridge, causing the truck to jackknife and smash into a concrete divider.

The westbound lanes of the bridge were closed for nearly four hours as workers tried to clean up the fuel that had spilled from the truck, a delay that caused ripples of congestion throughout the region.

The crash highlighted the fact that for commuters driving across the Port Mann bridge — as well as those on several of the Lower Mainland’s busiest routes — congestion is a fact of life. And with one car being added to the region’s roads every 23 minutes, planning models show congestion could increase by a whopping 118 per cent by the year 2021 unless something is done.

“This causes alarm,” Clark Lim, a senior transportation engineer with TransLink, said Friday as he pointed to a slide showing a hypothetical model of future congestion in the Lower Mainland.

As he explained that model, a deadpan Lim showed a frightening 850 kilometres of roads that would be congested across the Lower Mainland by 2021 if we opted to immediately stop improving the region’s transportation infrastructure.

Of course, as Lim was quick to point out, that is not the plan.

From the Richmond-airport-Vancouver transit line to the proposed Golden Ears bridge across the Fraser the region will continue to build and improve its infrastructure, but as planners look to the future they have much to consider.

Current data show some of the most congested routes in the Lower Mainland being those leading to bridges in and out of the city, and on those roads where two major routes come together, such as during the morning rush hour on the westbound Mary Hill bypass.

Conventional wisdom may suggest the solution lies in expanding the bridges and adding more lanes — increasing supply to meet demand — although experts and planners say it is not that simple.

“You have to build, but you have to do it in a way that is strategic,” said Lim, citing the cautionary cliche: Yesterday’s solutions are the problems of today.

“We have to be careful about this,” he said, expressing an opinion shared by several experts.

“The traditional approach we have used in the past of basically building new lanes will not work anymore,” said Tarek Sayed, a transportation expert and professor of civil engineering at the University of British Columbia, citing cost issues, lack of space and environmental concerns as some of the leading factors standing in the way of such a solution.

Instead, he said, we have to find ways to make the existing system more effective.

“The only solution will be applying some advanced technologies, and also trying to reduce demand,” he said.

Sayed explained the implementation of new technologies — such as crash detectors, roadside traffic advisories for drivers and intelligent signal light systems — has reduced congestion by as much as 35 per cent in cities around the world. When coupled with programs aimed at getting people out of their cars, such as toll systems and improved transit, Sayed said, several other cities have shown there are ways to manage the problem without adding more lanes.

Lim added to this that knowing what causes the problems can go a long way to finding a solution.

For example, he said, 60 per cent of all congestion can be attributed to incidents such as crashes and roadside breakdowns. What’s more, he added, when traffic is heavy, an incident that is cleared away in under five minutes can still cause up to 20 minutes of congestion.

“Once you interrupt that flow it causes a chaotic reaction,” he said. “It’s a compound effect.”

Lim said there are things planners and engineers are working on to help decrease congestion, but that in many ways it is up to drivers to maintain a steady flow.

“One simple thing that doesn’t cost anything is paying attention,” he said, explaining that people who do things such as brake too quickly or delay before pulling away at a green light all contribute to congestion.

“If people understood how they influence the whole system we could make for a much safer system,” he said.

For people to change their ways, however, experts say people need to overcome a huge barrier; they need to realize they are not perfect.

“Right now people have a reputation of themselves of: ‘I’m an excellent driver.’ Almost everybody,” said Leon James, a professor of psychology at the University of Hawaii specializing in what he calls “driving psychology.”

“Obviously that can’t be true,” he said with a laugh.

James, 67, said he believes people learn aggressive driving habits from their parents, video games and movies at a very early age, and that it takes months, if not years, to get rid of that aggression.

To do that, he said, people need to observe what is going on in their minds while they drive.

“Instead of having this pure reputation of ourselves as an excellent driver, we actually need to witness ourselves and then you start noticing you are crazy in your head,” he said.

“The things you are thinking [while you are driving] are so bad you wouldn’t want to say them out loud to anybody,” he added.

James said that when he began studying his own driving habits he was surprised at the kinds of things that were going through his head.

“Rage, like I’m going to tear you apart,” he said, explaining what he used to think while driving.

“I’m going to slap you to death,” he continued. “I’m going to hang you by your fingertips. I’m going to smash you with my big tank. Things like that. I thought I was crazy.”

As he got others to track their own thoughts, however, James realized he was not alone.

“Most people, they try to be aggressive, competitive, annoying and hostile instead of helpful, supportive, peaceful and cooperative,” he said.

“They feel ‘I’ll be a schmuck if I let [other drivers] walk all over me,” he added. “That’s irrational thinking.”

To change his own behaviour, James said, he spent almost five years focusing on fixing his road rage one element at a time.

For example, he said, he would spend entire drives training himself not to get angry when people cut in front of him, and instead worked to anticipate their actions and to alter his own course to give them proper space.

“Now I like driving,” he said, adding he has almost completely changed his approach.

“It was a struggle that helped me in the rest of my life, my marriage, my teaching,” he said. “It’s not just a driving personality makeover, you also start to look at the fact that anger is the most common way that we manage people and things all day long,” he said.

Of course, this Zen-like approach to gridlock may not work for everyone.

Thankfully, for those who can’t grasp the idea of relaxing on the road, and of working with other drivers as opposed to against them, people like Lim and Sayed are working to find ways to make sure the future is not filled with mornings like Monday.

© The Vancouver Sun 2005