Customer feedback can be considered a gift when it prevents clients from shopping around

Daryl -Lynn Carlson

Sun

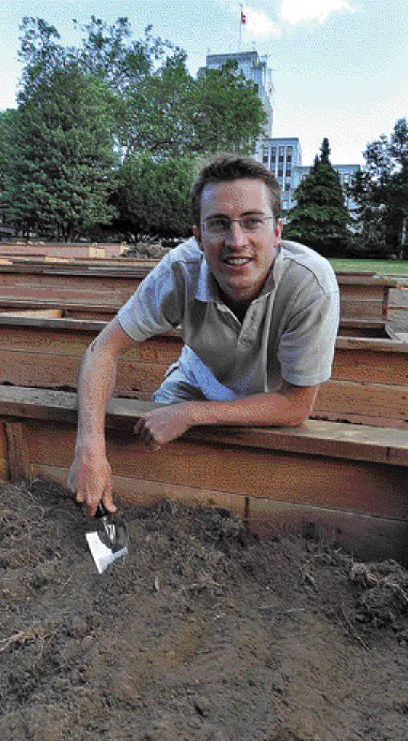

Reduced consumer buying power coupled with fewer resources at most businesses prompts a poignant question: What can be done to maintain or even grow sales without spending money? Tyler Gompf has the answer: Deliver outstanding customer service.

Twelve years ago, he had a bad experience shopping for a stereo, a significant investment for a 22- year-old, and left the store emptyhanded.

He ended up enlisting the help of his brother Kirby, who is younger by a year, and the two came up with a computer program for consumers to communicate with companies about customer service for the benefit of both the business and the buyer.

That was the beginning of Tell Us About Us Inc. Winnipeg-based TUAU has flourished; its 60 employees process upward of 300,000 customer feedback surveys and data every week for more than 100 corporate clients, most of which are based in the United States.

In the past year, smaller businesses are recognizing the value of customer service as a means of sustaining profits. “Companies, instead of investing their budgets into marketing and attracting new customers, are really trying to focus on retaining the ones they have,” Mr. Gompf says. “It’s more important now than ever for smaller operators to have a program where they can listen to the customers and respond.” During tough economic times, client loyalty is crucial and each customer’s feedback or comment should be treated as a “gift,” he says.

TUAU has a complement of services that can be tailored to a business based on its size and budget.

Those include customer surveys, mystery shoppers, live operators to field complaints, employee surveys and research.

It introduced a Small Enterprise solution for independent businesses in 2008.

At the Business Development Bank of Canada‘s Entrepreneurship Centre, customer service has become a key focus since the economy soured last fall. “Every customer now expects a very high level of service. You have to return your calls quickly, you have to follow up and you have to follow through on what you say you will do,” says Theodore Homa, managing partner of BDC’s Montreal consulting division. “If you help your clients, basically you’re helping yourself.” Coaches at the centre recently assisted a young printing company experiencing a slowdown in business by urging the owners to call clients and ask why they haven’t been ordering services. “Some companies are not at ease doing this,” Mr. Homa says.

But even if clients don’t need more product, there could be smaller services to sell and the communication will be valued in the long term, he says.

“People don’t speak to each other anymore,” he says, noting younger entrepreneurs in particular are comfortable communicating via text messages or email rather than actually meeting to talk. “But some customers want ‘high touch’ rather than high tech and in those cases, you have to get out and see them.” This requires business owners to know who their customers are and what they expect in terms of communication and service.

“There’s not one approach for all clients,” Mr. Homa says. “But if you learn to help your clients, basically you’re helping yourself.” Eric Fraterman runs Customer Focus Consulting and says good customer service starts in the workplace culture and with the employees who are the face of a business to the public.

His services emphasize the “People Service Profit Chain” through which “to make good profits, you have to give great service and to give great service, you have to hire the right people and treat them well.” Once a customer service environment is achieved, businesses must respond in a meaningful way to ensure the initiative succeeds, Mr. Fraterman says. “Everybody is under pressure, they’re running ragged and their fuses are shorter so the margin for forgiveness is much smaller, which means managing complaints in a meaningful way is very important.” Appeasing a customer who complains doesn’t have to involve giving away product although it’s up to the business to creatively determine what they can do within their budget to resolve problems.

Customers who complain constitute only about 4% of disgruntled customers, says Ray Miller, author of That’s Customer Focus, a four-book series and workplace training program offered through Toronto-based The Training Bank.

Most disgruntled customers will keep silent and simply take their business to the competition.

Research shows achieving a 5% increase in customer loyalty can ultimately contribute from 25% to 125% directly to a business’s bottom line in the long term.

© Copyright (c) The Vancouver Sun