Take the 50-per-cent discount instead of hoping for leniency

Chad Skelton, with files from Denise Ryan

Sun

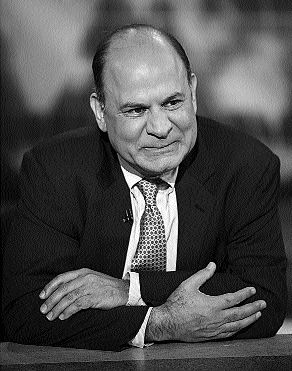

Dragan Milovanovic successfully fought and beat a parking ticket in Vancouver court. Photograph by: Steve Bosch, Vancouver Sun

For years, it was the secret parking enforcement the city didn’t want you to know: Fighting your ticket in court was worth it.

Not because you had much chance of winning — parking enforcement has a conviction rate any gang prosecutor would envy — but because, even if you lost, you could make a case for a reduction in your fine.

People put forward their best excuses — they were poor, they never had a ticket before, they’d learned their lesson — and the judicial justice of the peace would often give them a break.

Many people had $90 tickets knocked down to just $10 or $20. Others had their fines waived entirely.

Fine reductions became so easy to get that many people stopped bothering to fight their tickets at all, agreeing to plead guilty as long as they got to argue for a reduced fine in a process known as “disposition.”

Unfortunately for illegal parkers in this city, the party’s over.

Last year, the City of Vancouver changed its bylaws to create mandatory minimum fines for any municipal-offence ticket written after April 15, 2008.

In the case of parking violations, those minimums are the same as the face value on each ticket: $60 for sitting at an expired meter, $90 for stopping in a no-stopping zone and so on.

In other words, the best fine you can hope for by going to traffic court now is the same one you’d have to pay anyway. A fine, by the way, that is twice as high as the discounted rate if you pay your ticket voluntarily within the first 34 days.

Under the new bylaw, JJPs still have discretion to reduce a fine in cases of financial hardship.

But the onus is on you to prove it and it’s a tough case to make.

On a recent day in traffic court, JJP Colleen Proctor explained it to a roomful of defendants this way: “I’m talking about someone who lives on the street and has no ability to pay, not generally someone who owns a car.”

And if that’s not enough, while JJPs have more or less lost the discretion to reduce your parking ticket, they still have plenty of discretion to increase it.

Under provincial law, JJPs can increase any fine up to $2,000.

A fine that high for a parking ticket is almost unheard of, but it’s not unusual for someone — especially a repeat offender — to get dinged $100 or $150 a ticket.

Since last summer, the city has begun sending a court liaison officer to court with a printout of each offender’s history, so they can ask the JJP for higher fines for those with a history of parking illegally.

The new bylaw, combined with the court liaison program, has turned traffic court from a place where people once got a break to one where they often get stung for more than they bargained for.

Indeed, a review by parking enforcement of 587 guilty pleas in December and January found that, on average, drivers left court with a fine 15 per cent higher than they walked in with.

The change has been so sudden, and dramatic, that it has taken many people by surprise.

At traffic court on Feb. 11, May Joan Liu tried to explain away the eight expired-meter tickets her Hummer got in December, saying heavy snowfall and a flat tire made moving it impossible.

JJP Ken Yamamoto patiently explained to her that, no matter what her excuse, she’d have to pay the minimum fine on all eight: $480 in total, or twice the $240 she could have paid when she got them.

“I was given bad advice that if I went to court I would get a reduction or have it wiped out,” said Liu. “Now I wish I hadn’t come. I would have just paid it.”

Upset to learn the rules had changed, Pierre Nasr, in court on six separate tickets, asked Yamamoto if he could at least get a no-stopping ticket from January reduced from $90 to $45, the amount he could have paid without coming to court.

“The only time you get a 50-per-cent discount is when you pay it up front and that’s because they don’t have to do all this paperwork,” Yamamoto replied. “Coming to court and thinking you’re going to get a break on a fine is a fairy tale.”

(As it turned out, two of Nasr’s six tickets were from before last April, so he did get a small break on those: from $90 to $60 on one and $60 to $50 on the other.)

Aside from hoping for a break on your fine, the other reason for going to traffic court is that you believe you’re innocent of the offence, or are hoping the parking officer doesn’t show up.

Parking enforcement manager Ralph Yeomans said his department works hard to coordinate its staffing schedule with traffic court to make sure officers are working on the days they’re due in court.

Overall, the department has a no-show rate of about 10 per cent, Yeomans said.

But that doesn’t mean 10 per cent of offenders get off scot-free.

If someone has a dozen tickets, it may be impossible to find a day when all 12 officers who wrote the tickets are on shift. In such cases, the trial may go ahead with only 10 officers available.

Two of the tickets may be dismissed, said Yeomans, but the rest go ahead. And when a case goes ahead, it usually results in a conviction.

Statistics compiled by the city suggest fewer than six per cent of those who plead not guilty are successful in having their tickets overturned.

“Most of these people convict themselves when they get on the stand,” said Shayne Jankowski, parking enforcement’s court liaison officer.

That’s because many people confuse an excuse — they just ran into the store for some milk, they didn’t have change on them — with a defence.

On Feb. 12, Alan Katowitz, caught parking in a permit zone in Kitsilano, told the court he had lived in the area for more than 20 years and, while he usually has a permit, he couldn’t afford one this year.

Katowitz said he was just dropping off some groceries and wasn’t planning to be in the spot for very long.

Verdict: guilty.

Joseph MacKinnon, facing a ticket for an expired meter, said he didn’t think it was right that parking meters didn’t take nickels or pennies.

Verdict: guilty.

Every so often, though, someone does win a case.

Contractor Dragan Milovanovic got ticketed and towed after being caught in a temporary no-stopping area near the Shangri-La construction site last September.

Milovanovic told the court the temporary signs weren’t there when he parked his truck in the morning, and he suspects they were only put up that afternoon.

“My personal opinion is I’m not guilty,” he said, since he had no way of knowing what he was doing was illegal.

The officer who ticketed him couldn’t say exactly when the temporary signs went up.

Proctor, the JJP hearing his case, said she couldn’t convict him if he had no way of knowing he was parking illegally.

“There aren’t many defences to traffic tickets,” Proctor said. “However, what you’ve told me certainly raises a doubt in my mind.”

JJP Joanne Arnsten, meanwhile, acknowledged that the bigger picture is that parking generally is a problem in city cores, but added that the position of the bench is that “you need to address that with the city, not in traffic court.”

Arnsten said that, in many cases, she thinks people just want to be listened to.

“People genuinely want an opportunity to explain why they got that ticket,” said Arnsten, whose case list averages between 60 and 70 per day. “They often take it as a personal affront.”

She suggests alleged offenders try to have a conversation with the parking officer who gave them their ticket before entering court. Whoever ticketed you will have the opportunity to make a recommendation to the judge, to corroborate your story, even to suggest an outright dismissal.

Parking Secret No. 12: Just because there’s no chalk on your tires doesn’t mean you’re necessarily safe in a two-hour parking spot. Instead of chalking, some parking officers log the position of each car’s tire air valve in their hand-held computers. If the position hasn’t changed by the time they come back around, they know your car hasn’t moved. Other officers put a small stone on top of each tire or check tailpipes for signs of condensation.

Parking Secret No. 13: When the time runs out on your parking meter, you always get a two-minute “grace period,” regardless of whether you paid for four minutes or an hour. During that grace period, the meter will display a solid “000” instead of a flashing “0000” and you will not receive a ticket. However, the grace period also means if you tell an officer the meter just ran out, they know if you’re lying.

Parking Secret No. 14: You can get a ticket even if your meter is fully paid. Along several rush-hour routes, such as Robson, a meter will accept your change even though you’re not allowed to park there between 3 and 6 p.m. Stickers on each meter warn parkers of this fact, but dozens of paid-up parkers are still ticketed and towed every weekday.

Parking Secret No. 15: There are no parking enforcement officers working on either Christmas or New Year’s Day. Vancouver police will respond to complaints about serious safety violations, but your chances of getting a ticket for anything else on those two days are virtually zero.

© Copyright (c) The Vancouver Sun