White sand, impossibly blue skies and hot weather: it’s all a tourist could want

Janet Vlieg

Sun

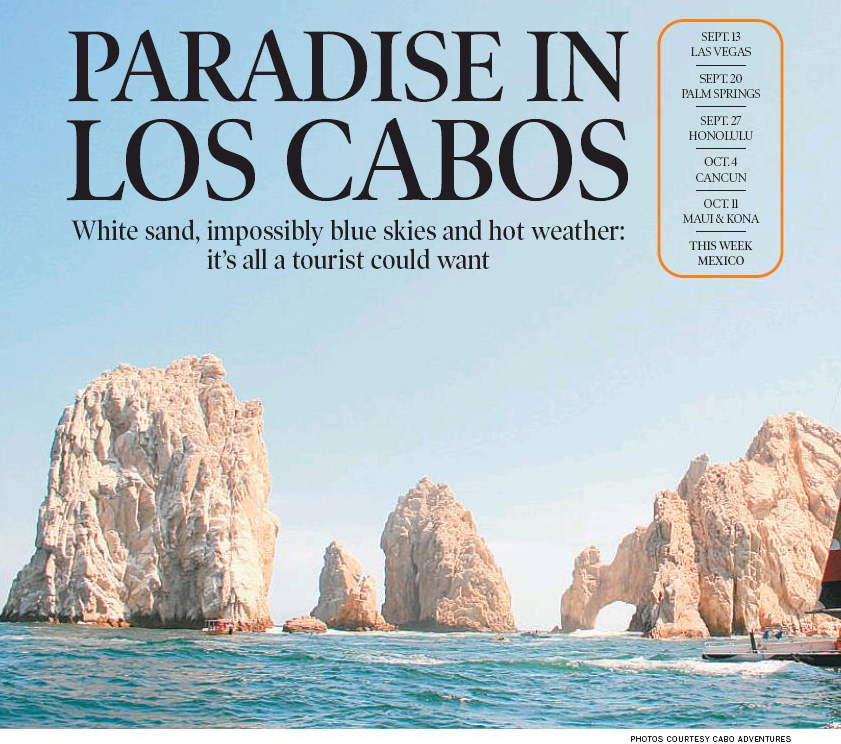

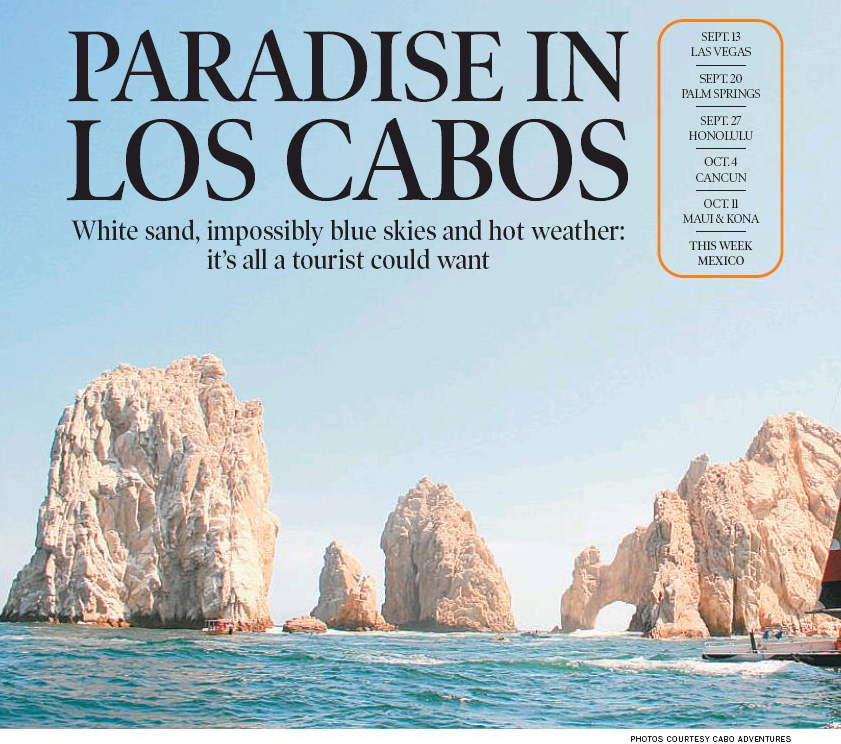

The west coast of Mexico, bordering the Pacific Ocean, offers sweeping vistas. Tourists on a retired America’s cup sailboat flide past the famed Lovers Arch in the Sea of Cortez, near Cabo San Lucas.

Janet Vlieg is greeted by a dolphin in the pool at Cabo Adventures, in Cabo San Lucas, Mexico

LOS CABOS, Mexico – Who would have thought the highlight of a trip to Mexico would be a kiss from a dolphin?

Good holidays are laced with surprises and a friendly dolphin headed the list of memorable encounters during a recent week in Los Cabos on the Baja California peninsula.

Dolphins were not among my great expectations for this trip. Mexico’s hot sun and wide beaches have lured my family south on several winter vacations, so I booked this trip anticipating a poolside lounger, a good book and more than one frosty drink.

White sand, impossibly blue waters, sunshine, 30 C-plus temperatures — Canadians know what they want when they seek out a winter vacation hot spot. A non-stop flight, an all-inclusive package, and relief from bulky parkas and icy streets.

Los Cabos (Spanish for “the cape”) stretches from San Jose del Cabo in the east to Cabo San Lucas on the western tip of Baja California, where the Sea of Cortez meets the Pacific Ocean. Along a busy four-lane highway connecting the two towns is the Tourist Corridor, a 32-kilometre string of five-star resorts, luxury hotels, exclusive villas and upscale condo projects.

Cabo San Lucas after dark is the place to be for clubs, live music, dancing and bars, whose drink deals fuel the kind of fun that spills out into the streets. With names like Cabo Wabo, Margaritaville, the Giggling Marlin and El Squid Roe, bars around the marina pack in the partiers every night until the wee hours.

These high-energy pockets of night life near the Cabo San Lucas marina are well separated from the luxury enclaves that attract the more discriminating tourist.

If you prefer to wander through art galleries and artisans’ shops after a leisurely dinner, then San Jose del Cabo is your kind of town. It offers a quieter immersion in the culture of Mexico‘s Baja, with graceful avenues of old colonial architecture.

San Jose also boasts one of the Baja’s finest authentic Mexican restaurants, Casianos. Food and service is as expertly presented as any top Canadian restaurant, enhanced by the warmth of the wait staff. With infinite patience and passable English, they respond confidently to questions about the menu and the wine list.

Families with younger children considering a Los Cabos vacation for the first time may want to stay at an all-inclusive resort, avoiding restaurants away from their hotel. A package vacation provides families a week of pampering for the parents with enough activity to keep the kids happy. Keeping it simple — and safe.

That’s my thought as I check into the all-inclusive Dreams Los Cabos Suites Golf Resort and Spa. As advertised, it is located “on the ocean” midway between Cabo San Lucas and San Jose del Cabo. And it more than lives up to every superlative in the vacation brochure.

What’s the first thing a tourist does in a place like this? Throw on a bathing suit and head down to the ocean. Waves are crashing on shore, huge and magnificent, the only sound on an almost deserted white beach.

Entry into the ocean is prohibited. The currents off the Pacific Ocean and the Sea of Cortez are too dangerous for any level of swimmer. To reach the swimmable beaches along the Sea of Cortez, you need to take a cab or shuttle from your hotel.

A water taxi from the Cabo San Lucas marina will take you to the famous Lovers Beach near the iconic El Arco on Land’s End, a much-photographed arch-like rock formation in the Sea of Cortez.

Checking out several beaches, I discover the term “swimmable” is questionable even at the most popular beach, Playa Medano in Cabo San Lucas. The foaming waves are the kind that kick-start the adrenalin in buff teen boys and girls smart enough to wear shorts over their bikini bottoms.

In lieu of access to the ocean waves, resorts offer elaborate pool facilities, water slides, spas, whirlpools and expansive infinity pools whose ambience and design make you feel you’re adrift in a tropical sea — without the danger, of course. You get the idea: you’re so busy getting wet you forget all about wanting to stick your toes in the ocean.

With thousands of tourists, time-share owners and day-trippers pouring in from almost 500 cruise ships a year, Los Cabos is a playground for North American visitors, particularly Americans from California, Texas and southwestern states.

“The actual population of this area is really only a few thousand Mexicans who are from here,” explains Paulo, a tour guide. “The rest of the people are all visitors or temporary workers.”

Higher wages in Los Cabos, compared to other Mexican tourist centres attract the best students turned out by Mexico‘s universities, as well as some from countries such as the United States, Canada, Australia and New Zealand.

Locals speak proudly of the American celebrities who have spent time in their region, such as Madonna and Brad Pitt, about the tycoons who have bought property there, like Donald Trump, and about the movies that have been shot there in recent years, like Troy and The Heartbreak Kid.

None of that impresses a deflated Canadian who wants to experience the ocean. And that’s where the kissing dolphin comes to the rescue.

In a large, deep pool under a brilliant blue sky, dolphins and their trainers welcome small groups of visitors into the salt water at Cabo Adventures, located on the marina in Cabo San Lucas. Smiles break out all around as we learn hand signals to communicate with these lovable creatures. As friendly as the family dog, the dolphins engage the visitors in little games and allow us to hitch rides around the pool.

Moral of this story: when you can’t swim in the ocean, let a dolphin kiss your cheek.

IF YOU GO

– BEST BET FOR SIGHTSEEING: A four-hour desert safari explores the authentic Baja away from the tourist bubble on the beach; www.caboadventures.com

– BEST BET FOR COUPLES: A romantic stay at an ultra-private resort like One and Only Palmilla or Las Ventanas al Paraiso — both world class in luxury; adults-only pools and patios.

www.oneandonlyresorts.com or www.lasventanas.com

– BEST BET FOR FAMILIES: Dreams Los Cabos Suites, an all-inclusive resort on the Corridor, with spacious suites and organized activities.

– BEST BET FOR SINGLES: Pueblo Bonito Rose, right on lively Medano Beach and within walking distance of the Cabo San Lucas marina, the hub of nightlife action.

– BEST BET FOR REGIONAL CUISINE: Casianos restaurant in San Jose del Cabo (www.casianos.com).

A visit to Mexico offers a chance to try outstanding wines that are not exported to Canada.

Look for names like Monte Xanic or L.A Cetto, vineyards from the Valle de Guadalupe in the northern Baja.

– BEST BET FOR REGIONAL INDULGENCES: Plaza Mijares in the centre of San Jose del Cabo offers the best shopping for high-quality folk art and Mexican silver.

ENTER TO WIN FREE TRAVEL

You can win a share of $100,000 in travel dollars from WestJet Vacations this fall. Six readers will each win $16,666 worth of travel, which can be used towards WestJet Vacations packages or WestJet flights. More than 50 destinations are available to choose from, including Mexico, Hawaii, Florida, California, Nevada, Arizona, Jamaica, Barbados, the Bahamas and the Dominican Republic.

To win, find the Fly Free game board in the paper each Friday, from Sept. 12 to Oct. 17. Then, collect six game pieces from inside the paper every other day of the week. Stick those game pieces on the game board and submit your entries.

Go to www.vancouversun.com/flyfree for more information and for details on winning extra daily and weekly travel prizes.

© The Vancouver Sun 2008