Pop Opera the latest call-up to Donnelly’s Big League roster

Malcolm Parry

Sun

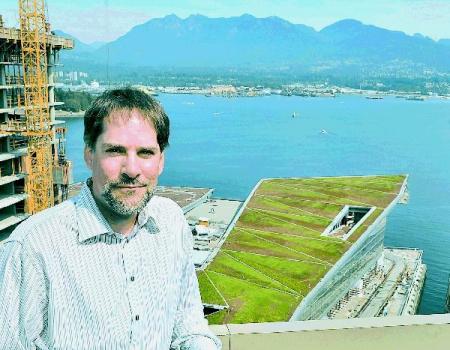

NINE CHEERS: Donnelly Hospitality Management founder-president Jeff Donnelly dreamed of becoming another Charlie Gehringer or Jackie Robinson. A second baseman in the Big Leagues, that is, and a pro athlete like his father, Brian Donnelly, who played defensive back for the 1971-74 B.C. Lions. But a signpost to the Langley-born, Surrey-raised 33-year-old’s real career was clear 20 years ago, long before he played two years of junior-college baseball in Mount Vernon, Wash. (he has dual Canadian-U.S. citizenship), hoping it would net him a scholarship to a major varsity. That’s when he spent after-school hours “picking up condoms and needles and cleaning up puke” from the bar of Vancouver’s then-Mr. Sport hotel, which his dad part-owned.

Until last week, Donnelly held 50- to 60-per-cent interests in five Vancouver nightclubs and four pubs that gross a reported $24 million annually. Then, those interests passed to the newly incorporated Donnelly Investments Ltd. in which Donnelly holds 70 per cent and three silent partners the remainder. Donnelly Hospitality Management Ltd. operates the nine facilities.

Last week, too, Donnelly opened his most glamorous property. That’s the 5,500-square-foot, 230-seat Pop Opera nightclub, located beside the downtown Birks store. He pays “in the mid-30s” per square foot for the premises, which cost a reported $1.8 million to acquire and renovate. Located smack-dab in the central business district, and somewhat remote from other nightspots, Pop Opera had earlier incarnations as the 1996 Hard Rock Cafe, Luce and — reflecting its West Hastings Street address — Dan Blaquiere’s Club 686.

Two other downtown joints should soon join Donnelly’s other club properties — Bar None, the Granville Room, the Modern, Republic — and the Bimini’s Tap House, Calling, Lamplighter and Library Square pubs. One will be a 65-seat lounge, he said. The other, a 375-seat club and attached 350-seat restaurant, should cost close to $5 million and be located in a new building by 2011. He “would love” to operate in the Hotel Georgia when Delta Land Development president Bruce Langereis completes a $300-million redevelopment of that iconic property.

He also wants a “dive bar,” like those once common in U.S. cities, where street-window liquor bottles had tags around their necks reading, say: “Single 55c, Double 80c.” He almost acquired one in Manhattan‘s Chelsea district recently, and regularly takes business partners and senior staff to inspect locales in that city, San Francisco, Las Vegas, Miami, London, Tokyo and — later this year — Berlin.

“I’m in London three or four times a year, and that is the epicentre of nightlife,” said Donnelly, who designs all his own properties. “But we are comparable [in Vancouver], and we do things better than they do in L.A. We’re more professional — our door work, how we pour drinks, how we design our clubs. Our bars are open until 3 a.m. And, in places like Boneta, Chambar, George and the Cascade Room, we have a really cool cocktail culture.”

There’s uncool culture, too. Donnelly learned that when a fatal shooting put the kibosh on Loft Six, a second-floor Gastown club he and Bimini co-owner Steve Jennings opened at a cost of close to $400,000 in 2001. More stringent security was in place by 2003, when he spent a reported $750,000 converting the nearby Cherry Bay into the Modern dance club. Then, in 2007, he leased Gastown’s Lamplighter pub from Dominion Hotel owners Eric Cohen and Tom Gautreau, and spent what may total $1 million renovating the 270-seat premises. Last week, city hall approved his application for a 40-seat patio on the hotel’s Abbott Street side.

Donnelly’s biggest at-bat was the 300-seat, 5,800-square-foot Republic that cost a reported $2.5 million. Running to 3 a.m. seven nights a week, Republic shares the city’s-busiest-club status with Granville Entertainment’s nearby Roxy cabaret, which will mark its 20th anniversary this month. Republic partially fills the role envisaged for Granville Entertainment principal Blaine Culling’s stillborn Pravda, which was to house a pub, club and restaurant in a new, three-floor Granville Street building. Republic’s new-built premises are owned by the area-landlord Bonnis family.

Another Culling property, the old Foghorn’s, turned out to be Donnelly’s springboard to the bigs. He paid $40,000 for it in 2001, renamed it the Granville Room, acquired a now-defunct pub licence and planned a $250,000 renovation (and $350,000 more since). Opposing the plan, his dad called a $117,000 loan he’d made to aid acquisition of neighbourhood-pub-pioneer Peter Uram’s Bimini’s Tap House two years earlier. Donnelly recruited partners Jennings, Steve Ogden and club-scene veteran Murray Kryski, all of whom still invest in his projects. The Granville Room never became a pub, but has minted money ever since. It also put Kryski onside to help him acquire 80 per cent of Bar None for “about a million,” and the remainder six months later.

Donnelly no longer plays second base. But he’s still showing that job’s range, pivoting skill and right-and-left quickness on the business diamond.

SHE SAW LONDON: Self-styled “pantie queen” Kathleen Staples has hung ‘em up. After 14 years, she’s sold her wholesale and retail operations for an undisclosed sum to general manager Lana Diaz, and jokes that she’s “looking for a job as a receptionist or an exceptionalist.”

It’s been quite a ride. In the manner of then-common flower sellers, Staples began by offering late-night restaurant diners not long-stemmed roses but knitted-silk lingerie. Sales of the China-made garments for men and women rocketed when she gave their otherwise-ordinary colours such catchy names as Silver Screen, Fade To Black and Sugar-Frosted Grape.

Carried by The Bay, other retailers, and via her own West Vancouver store and www.staplesonline.com website, Staples sold three million pairs of women’s panties alone. Held as she liked to display them, that number would stretch from here to Winnipeg. Let’s guess Diaz is now targeting St. John’s, N.L.

VAULTS TEMPO: Swiss bankers never blow their own — and especially their clients’ — horns. But the Yamaha Tyros II electronic keyboard appears to be different, especially for Adrian Hartmann, 65, who joined Zurich‘s Foreign Commerce Bank after plans to be a Swissair airline pilot fizzled.

“Music was always my second half,” said Hartmann, who likely upset 1960s bosses by playing his Gibson and Chet Atkins guitar in the country-and-western style. Not that earning $1,000 for a New Year’s Eve gig mightn’t have changed their views.

“Now, music has become my primary half,” said Hartmann — [email protected] — who was transferred to Toronto in 1978, and moved to Vancouver two years later for the chance to begin private asset management. Five years with a Cayman Islands-based money-management firm followed. In 1985, the FCB asked him to open a representative office in Vancouver, and he and wife Hedy have been here ever since.

She’s the dance-and-fitness instructor he met aboard a Lake Zurich cruise vessel in 1965, when he played for her staging of a fashion show.

She’s also the subject of A Woman Like You on Hartmann’s CD, Adrian: How I Sing & Play, Vol. 2. Many of the other 16 titles are Elvis Presley covers. But there’s another original, My Vancouver, Hartmann hopes may be a welcoming anthem for the 2010 Olympics. The song somewhat echoes late B.C. minstrel Evan Kemp’s cowboy-two-step style, albeit without the yodelling you’d think might come naturally to the Swiss.

“I hate yodelling,” Hartmann said, hitting the keys of his $5,400 instrument and breaking into a most unbankerly Don’t Be Cruel.

© The Vancouver Sun 2008