Imposing big-city ways on a small town rarely appreciated

Suzanne Morphet

Sun

These buildings are pointers to a fitting-in opportunity is small-town B.C. They are all buildings in which the ‘volunteer-volunteer-volunteer’ advice of one long-time Gulf Islander can be acted on by newcomers to a smaller community. The Creighton residence was built in the 1870s in Yale, in the Fraser Canyon, and is maintained and managed by the Yale and District Historical Society.

A courthouse completed in 1914 houses the Nicola Valley Community Arts Council, and its art gallery, in Merritt.

An old firehall is home to the Comox Valley Centre for the Arts, in Courtenay.

The Comox logging Company building was constructed in 1936 as a repair shop for trucks and trains and now houses the Ladysmith Waterfront Arts Centre operated by the Ladysmith and District Arts Councel.

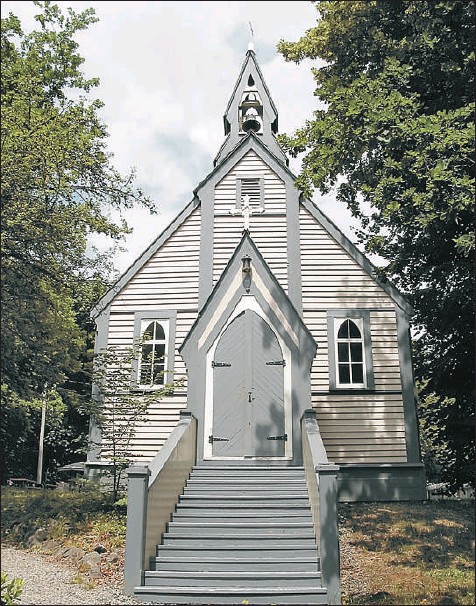

St. John the Divine Church is located next door to the Yale Museum. The Anglican church opened in 1853 and was renovated and repaired in 1953. Its exterior, in 2001, was restored to its original appearance.

After the excitement of finding your dream out of town property comes a reality, that other people share your new neighbourhood, perhaps people who’ve lived there a long time and view life differently than you do.

If all the time and energy you invested in finding and purchasing your property is going to be well spent, you need to learn — if you don’t already know — how to get along with the locals. After all, they were there first.

Pick any of the Gulf Islands and chances are you’ll hear horror stories of newcomers who want to “improve upon paradise,” in the words of one long-time Cortes Island resident.

Marcel Creurer recalls an American who purchased a home overlooking Cortes Bay and then objected to the appearance of a log ramp where locals tied up their boats.

“One day this guy, who comes [here] maybe two weeks out of the year, if that much, got into some regional district meeting and raised hell that this log ramp was interfering with his view and because it was not a legal ramp, they [the owners] had to remove it.”

“This sort of thing doesn’t go over too well,” adds Creurer, who says newcomers “are always bringing a little bit of the city life with them.”

His own neighbour was a case in point. After purchasing a property, Creurer says the first thing his neighbour did was survey it, “which is the thing you do in the city, right? And he found that the neighbour on one side had a fence that was about three feet on his property, so he made him move it.”

Creurer chuckles when he tells how the story ended; the man found that his own fence was 65 feet over the property line on his other neighbour’s side, “so he lost 65 feet on the other side!”

“But now, that guy has assimilated himself extremely well in the neighbourhood and is one of our best friends.” Creurer believes newcomers can “acclimatize” if they want to. His neighbour was able to build better relations with the locals simply by “being a nice guy.”

On Mayne Island, long-time resident Jeanine Dodds has three words of advice for newcomers: “volunteer, volunteer, volunteer!” In Dodds‘ experience — and she’s lived on the island since 1960 — newcomers often don’t realize that all the services are run by volunteers.

“Fire, ambulance, recycling, parks, our community centre . . . everything you see here. There are some paid people, but mostly they’re volunteer.”

Dodds, who is one of two elected trustees for Mayne Island, understands that people buying property for week-end escapes or summer holidays want to relax and may feel they’re contributing to the community simply by supporting local businesses. But in her view, that’s not enough.

“You’ve got to become part of the community. You don’t have to do it every day. These [volunteer] services have slots, but you could come on a Saturday morning and put in two hours at the recycle centre.

If you happen to be a paramedic, book some time to be an ambulance driver.”

Dodds thinks this is especially important in the summer, when the population of the island doubles.

“Everybody is so burnt out by the end of August. The people you see waiting on your table also have other hats they wear, they have numerous involvement in the community.”

If locals are not as welcoming as newcomers might like, it may be due to factors other than burn-out.

On Saltspring Island, for instance, growing interest by outsiders has pushed land prices up to the point where people who were born and raised on the island can no longer afford to buy into the market. Jean-Paul Martin, a project manager for Three Point Properties, which has two new developments in Ganges, says that can affect the way locals view newcomers.

“Looking at purchasing land is pretty remote for a lot of people, so there may be a bit of resentment in terms of newcomers with more money coming to the island.”

Don Keith “sensed the same thing” when he moved to Saltspring Island last fall from Kelowna, after purchasing a townhouse in Bishops Green, one of Three Point Properties’ new developments. The first week he was there, the local newspaper carried a story about the locals not wanting any more trees cut down to make room for development.

However, Keith says he’s had no problem adjusting to life on a small island and fitting in with people who’ve lived there a long time.

“People are very friendly and open, there’s certainly lots of opportunities to volunteer. I volunteered for therapeutic [horseback] riding this year and really enjoyed it.” He also volunteered at the high school and hopes to resume a teaching career that he took early retirement from, a few years ago.

After all the traffic, noise and pollution in Kelowna, Keith finds life is simpler on Saltspring, which doesn’t have a single stoplight.

“It’s totally delightful to be able to walk down — and I can walk — down to the dock and buy a crab for $10 and bring it home and cook it up for company and they think that you’re in heaven.”

Still, he says the island is not for everybody. “It is a quiet community. . . you can be terribly isolated here. If you’re used to a large social network, you might probably find it isolating because there’s only so much running around downtown you can do.”

To help potential buyers decide if the island is for them, Three Point Properties offers week-end tours of the island with a focus on their two new developments, Bishops Green and Bishops Walk.

Sales manager Graham Bavington tries to give people a feel for what it would be like to live there. “Nothing’s required of anyone, no seminar or anything. . . . It’s a great opportunity to meet their neighbours before they buy, get immersed in the island life.”

“We want to avoid any buyer’s remorse, or any sort of ‘Gee, I didn’t realize it was this isolated’, or ‘I didn’t realize that I was in for that extent of island life,” adds Jean-Paul Martin. “We try to give them a pretty good idea of what they can expect, exactly what the island lifestyle entails.”

On Cortes Island, Marcel Creurer advises newcomers to arrive with an open mind, because islanders tend to be more liberal than people in the city. And if a conflict develops, talk it over. A few years ago tensions between oyster farmers and upland residents — some of them newcomers — escalated, so the Cortes Island Seafood Association, of which Creurer is the director, threw an oyster party for everyone on the island.

“Ever since we did that, the whole situation changed dramatically,” he says, noting that the sixth oyster festival was successfully held earlier this year. “It has become a major annual event, and a lot of people are now involved in organizing it, a good portion of whom are not oyster people. It has gone a long way in bringing the island together.”

On the other hand, Creurer says newcomers have to be realistic about how much locals will adapt to suit them.

As he told one newcomer: “You can’t expect to buy a piece of property at the end of an airport runway and then expect them to change the flight paths for you.”

Suzanne Morphet is a photojournalist in Victoria and contributor to a new book, The Vancouver Island Book of Everything, to be published this summer.

© The Vancouver Sun 2008