Other

Archive for the ‘Other News Articles’ Category

Vancouver is a global bargain – not as expensive as you think compared to Europe

Tuesday, July 1st, 2008Gateway Casino new 90,000 sf Grand Villa Casino in Bby will be the last destination Casino approved in the province

Tuesday, July 1st, 2008Casinos expansion capped by province as focus switches to betting on small-town bingo halls

Peter Mitham

Other

Sellers of restaurants in Vancouver are getting higher prices

Tuesday, July 1st, 2008Prices are soaring as eateries move to the top of investor food chain across metro Vancouver

Peter Mitham

Other

Las Vegas – Fewer tourists means more room for deals

Sunday, June 29th, 2008Better buys in Sin City

KITTY BEAN YANCEY

Province

The latest addition to Mandalay Bay is the Komodo Dragon lounge.

LAS VEGAS — Despite gloomy reports of tanking tourism and fuel-price flight cuts, Sin City is still dealing visitors a good hand.

Hotel occupancy fell 1.7 per cent from January through April vs. the same period in 2007, the Las Vegas Convention and Visitors Authority says. Gaming revenue was down 3.3 per cent in that period, and visitor spending has been on a downward trend.

But a building boom continues. The metro area will add about 20,000 more by the end of next year, Visitors Authority spokeswoman Erika Pope says. Flat visitation also means better buys for tourists.

Some notable Vegas trends:

Better hotel deals

Rates are “8 per cent to 11 per cent lower than last year,” VEGAS.com marketing vice president Bryan Allison says. “There are more value-adds, like food specials and gaming credits.” VEGAS.com has been offering deals such as $51.76 a night for two at Circus Circus in late July, including taxes and fees.

At the new Palms Place Hotel and Spa next to the Palms Casino Resort, a luxurious fully equipped studio in the glass tower where Jessica Simpson has a condo can go as low as $139 midweek. The Visitors Authority also has a full house of deals on its VisitLasVegas.com website.

Non-gaming lodgings

All but one of four hotels at the 67-acre CityCenter — a joint venture between MGM Mirage and Dubai World due by the end of 2009 — will be casino-less for visitors who hate walking through noisy gambling halls to reach rooms.

Adults-only party pools

They’re making a splash, especially with young visitors. The youth-friendly Hard Rock Hotel & Casino reports that revenues for Rehab, its popular Sunday pool party, increased 40 per cent from last year.

The new tops-optional adult pool at the Rio All-Suite Hotel & Casino promises lots of eye candy.

Hi-tech high jinks and sexy fun

At the new Wet Republic adult pool at MGM Grand, cabanas come with Xbox gaming systems and flat-screen TVs and are served by waitresses in bikinis made to fit them via a special body-scan system.

The Rio’s just-opened iBar boasts a halfdozen tables with Microsoft Surface computer-screen-like tops, which patrons use to order drinks, play games — even flirt with strangers at adjoining tables via instant messages and shared photos.

CatHouse, a restaurant/lounge in the Luxor Hotel & Casino, has a bordello theme and features a lingerie-clad model primping at a dressing table. More G-rated is the Komodo Dragon, making its debut today at Mandalay Bay’s aquarium.

“Tourism is our No. 1 driver,” VEGAS.com’s Allison says. “We’re all pulling together to keep it going.”

Mexico City -Its where the most warm-hearted people will charm you silly

Sunday, June 29th, 2008Colourful, noisy and crazy, it

Cheque-cashing issues in BC by fraudsters & scammers at Money Mart (Bills of Exchange Act) can be resolved by writing “for deposit to the account of the named Payee only” on the face of all cheques that you are concerned about

Friday, June 27th, 2008Don Cayo

Sun

Canada‘s establishment bankers have come up with a way for consumers and businesses to protect themselves from fraudsters who deal at Money Mart or other cheque-cashing companies that don’t belong to the Canadian Payments Association.

The problem, as regular readers will know, is that when someone cashes a legally stopped cheque at Money Mart — and this seems to happen a lot — the company often sues the issuer of the cheque, not the casher. This is true even in cases of obvious fraud, as in the frequent scenario where a scammer pretends to lose a cheque, then cashes both the original and the replacement.

As noted in previous columns, the Bills of Exchange Act, which is more than a century old, does include an arcane provision for “crossed cheques” that, in theory, offer some protection.

In law, crossing a cheque by drawing two parallel lines across the face of it means that only the recipient can cash it. In fact, this law is so little understood in Canada — though the practice is routine in places like the U.K. and Australia — that this is generally impractical. The lines are often misunderstood. They’re thought to void the cheque, not limit the cashing options so a third-party cheque-cashing company like Money Mart can’t sue the issuer if it’s rash enough to accept a properly stopped cheque.

Thus many people won’t accept such cheques, and tellers at many mainstream institutions don’t know enough to process them for payment.

In addition, the Canadian Payments Association, which represents banks, credit unions and trust companies, worries that the parallel lines could interfere with the electronic scanners that handle virtually all cheques these days. So I can see why it discourages crossed cheques, though I’d still advocate them if there weren’t a workable alternative.

Fortunately, however, there is a workable alternative.

True to its word, the CPA has taken this issue seriously since my first columns on the subject. On Thursday Roger Dowdall, the association’s vice-president of communications and education, wrote to me with a solution.

Dowdall cites a section of that same old Bills of Exchange Act that says, “When a bill (legalese for a cheque) contains words prohibiting transfer, or indicating an intention that it should not be transferable, it is valid between the parties thereto, but it is not transferable.”

He suggests writing “for deposit to the account of the named Payee only” or similar words on the face of any cheque you’re concerned about — for example, a post-dated cheque for work not done yet, or a payment to someone you don’t know very well.

“The phrase could be written on the memo line of the cheque, or at the top middle of the cheque (i.e. between the account holder’s information that is normally in the upper-left corner and the date, which is in the upper-right corner), provided that it does not interfere with any key information on the cheque, such as the name of the Payee, the amount, the date, etc.

“This wording would be clearly understood by all parties, and would therefore avoid the potential confusion resulting from crossing cheques.

“Financial institutions have reviewed this option and agree it is much more workable than crossing cheques would be.”

Dowdall’s solution is in line with what a number of readers have suggested over the months I’ve been writing about this issue. I did pass on some of those suggestions, though a bit timidly because I am neither a banker nor a lawyer and I didn’t know if any of these wordings had been legally vetted or tested in court.

I suppose a court challenge of Dowdall’s wording could still lie ahead. But if this solution is good enough for his group’s corporate members, it’s good enough for me. So that’s the wording that’ll I’ll use on the handful of cheques I write to strangers or limited acquaintances each year.

In fact, I see no reason why this phrase can’t be printed on my cheque blanks next time I pick up a new batch.

Meanwhile, there’s still every reason for MPs of every stripe to support the private member’s bill put forward two weeks ago by Vancouver East MP Libby Davies. It would put an end to Money Mart’s ability to routinely pursue people who are already victims rather than the scammers who victimized them.

While I hope and trust that businesses and consumers who see this column will take the recommended steps to protect themselves, it’s unreasonable to assume that the practice will be universally — or even widely — adopted any time soon. So Davies’s amendment will be needed for a long time to come.

© The Vancouver Sun 2008

New HGTV show using the Stagers & Dekora – a local Vancouver Staging Company decorates vacant properties to make them sell

Friday, June 27th, 2008The Stagers shows experts redesigning properties for sale

Lucy Hyslop

Sun

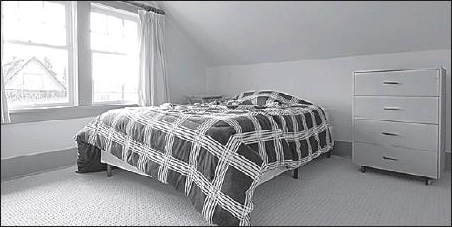

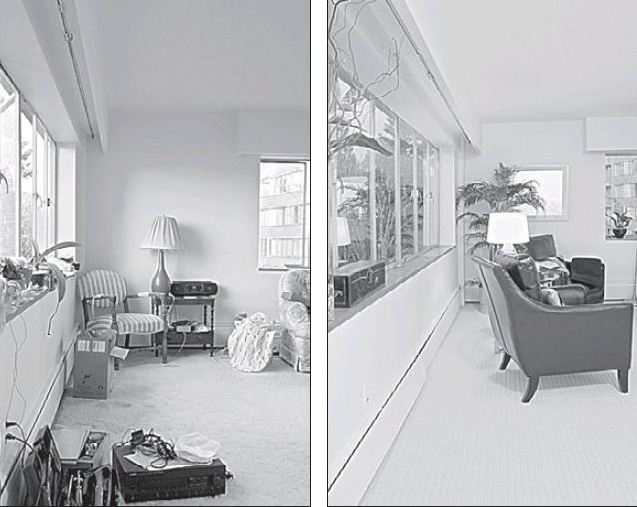

Episode 9 – The bedroom above is far more inviting after its ‘staging,’ below.

Episode 6 — the living room at left was cleaned up for its makeover (right).

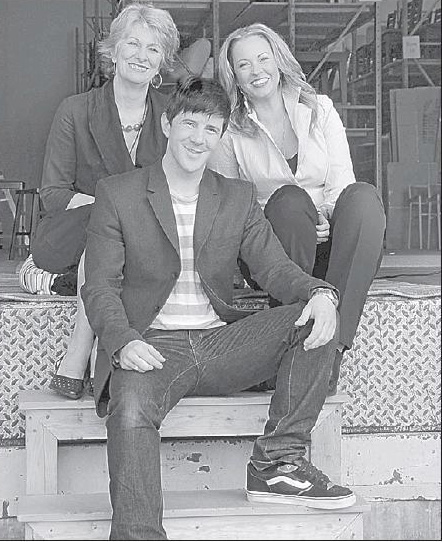

Maureen Powers (left), Matthew Finlason and Bridget Savereux.

Ron Sowden, owner of the Dekora, is a veteran of the film industry who moved over to ‘set decorating for the real-estate market.’

Diplomacy is needed in the world of home staging, where experts redesign rooms in a bid to make a property on the market sell quicker — and for more. “Eww, that’s gross,” a designer thinks of the tastes of one homeowner who’s right in front of him; “This is nice, this is great” is what comes out of his mouth.

Precious caught-on-camera confessions like this are why HGTV’s new show, The Stagers, starting July 1, makes for such riveting viewing. Much like Sesame Street sneaks in education at the same time as it entertains, viewers will pick up a raft of design tips just by following the creative day jobs of said designer, Matthew Finlason, and the other characters who work with Dekora, Vancouver‘s burgeoning home-staging firm.

The series is also a coup for the city: It’s the first time that HGTV has picked up a show for a national and U.S. audience (airing on July 22) that was shot entirely in Vancouver. From Dunbar to British Properties, from Kitsilano to Mount Pleasant, the city will be representing all types of homes (new condos to old properties, dated décor to weird layouts) throughout the entire continent. “We’re really happy about that,” says Cal Shumiatcher, executive producer at the series’ makers, Paperny Films. “There was no need to sanitize or hide Vancouver, but we don’t go out of our way to say Vancouver either, so we’ll say upscale neighbourhood, for example, rather than Shaughnessy. That way all audiences can relate to the show.”

Filming The Stagers was a “slam dunk,” Shumiatcher adds. “We didn’t have to fake anything,” he says. “In most of these shows you do have to fake the time pressure, for example, but it’s so real for home stagers — they genuinely have five days to dress up a house so all we really had to do is film them. All of the pressure and the drama are all real. It falls down to storyline and characters — we felt positive about both right from the start.”

Characters include the dynamic design duo of Maureen Powers and Bridget Savereux. A mother-and-daughter team with 30 years of experience between them, the pair suddenly had to juggle a film crew (wires, people, microphones) into the mix. “We’re used to having nobody there — just Bridget and I, which is nice and peaceful,” Powers explains, adding that they had to verbalize their decisions for the camera. “We’re so in tune with each other that we’re not used to talking about our design choices,” Savereux says, “but it was important to speak about things so that the public can get a lot of information and tips. If you’re a good designer you can explain it instantly. You have it in your mind.”

In one episode, they have to deal with a dated condo and a spiral staircase that comes into the middle of the living room. They rely on tactics (greenery or art work, for example) to divert the eye to a more interesting area. “You’re constantly trying to make things brighter and lighter,” Powers adds, “make the energy flow through space.” (For Powers, staging and feng shui are linked. “It’s an art that has been around for thousands of years — how to promote something, to make the best to attract energy — and that’s what you are also doing in staging,” she explains.)

“You really see the grit of how we have to handle the client when they are in the space, be sensitive to their needs and their connection to their home,” Savereux adds, “but we also have to be pretty clear about what the issues might be such as design problems, or lighting problems, or paint issues or whatever. At the end of the process though, owners are so ecstatic and the biggest stamp of approval is when we get a client saying that they wish they weren’t moving.”

The key areas, Savereux explains, are to neutralize, declutter, clean and depersonalize the space to that it appeals to as many people as possible.

The episodes show the designers head for Dekora’s 10,000-square-foot warehouse near Second Narrows Bridge, where there are endless rows of different styles of furniture to be hired out for the staging process. It’s a far cry from when co-founder Ron Sowden started with a small home garage full of stuff and a turnover of $88,000 in 2003, to recent projected sales of $2 million, a staff of 40 and a staging tally of more than 1,000 homes.

“Some people find it hard to imagine reconfiguring the space,” he explains, “and that’s why home staging works, because we don’t require them to imagine it — we show it to them. We take away the difficult leap from here’s what it is, to here’s what it could be.”

A veteran of the film industry where he designed sets for movies such as Paycheck and X-Men 2, he says his career naturally segued into home staging or “set decorating for the real-estate market.”

He also found life in front of the camera just as rewarding as behind the scenes. “It’s a totally different experience,” he quips, “but I turned out to be a natural ham.”

The Stagers airs July 1 on HGTV. Visit Dekora at www.dekora.com. The website for Balance 3 Living Design, Maureen Powers and Bridget Savereux’s firm, is www.livingdesign.ca.

© The Vancouver Sun 2008

Brentwood Mall in Burnaby has spent $1 Mill to renovate their bathrooms

Thursday, June 26th, 2008Nicole Tomlinson

Sun

Eighteen months ago the washrooms at Burnaby‘s Brentwood Town Centre got a million-dollar facelift.

Today, they have earned national fame. They’ve been named B.C.’s best in a national competition run by The Powder Room, an organization for people with overactive bladders.

The group rated 260 public washrooms nominated through a website.

One washroom in each province was awarded a seal of approval based on a rating program of factors such as accessibility, cleanliness and overall decor, as well as user comments.

At the Burnaby mall, the women’s washrooms are softly lit and fully automated, with deep shelves in each stall to stow shopping bags and elevated basins with high, shiny faucets.

But it was the “extremely relaxing” mothers’ room that really pushed Brentwood‘s amenities ahead of the pack, said Karen Boudreau, the mall’s marketing director.

Sunny yellow walls, black leather chairs, a microwave oven, a high-ceiling skylight and children’s toys make the area feel more like a family room.

“A lot of women with babies also have toddlers, so [the other child] can play while she’s nursing,” Boudreau said.

“When women have to nurse in a [normal] washroom, there are always people coming in. There can also be sanitary issues.”

At Brentwood, the usual lavatory amenities — a sink, change table and two toilets, one much closer to the floor than the other — are hidden behind a second door.

Boudreau said making shoppers comfortable when nature calls is just good business.

“The more relaxed they are, the longer they’ll stay and the more money they’ll spend,” she said.

Shoppers agree that a little bathroom bliss can go a long way.

“The last thing you want is a dirty washroom,” said Colin Robertson, who was visiting Vancouver from Scotland.

“[The Brentwood bathrooms] are nice and clean, they have nice tiles … better than the ones in Scotland.”

The facilities are checked every 20 minutes by food court staff for cleanliness, and thoroughly scrubbed each night after the mall closes.

“The bathrooms are nice, except sometimes the water splashes too much,” said Eleonora Vevacqua, a washroom attendant at Brentwood.

“I’m proud [of winning the award]. At least we know we’re doing a good job.”

MMC International came up with the design that won for Brentwood. The company that runs it, 20 Vic Management, was also in charge of washroom renovations at the other mall that was named a province’s best: Yorkdale Shopping Centre in North York, Ont.

Almost miraculously, two service station washrooms were named best in their provinces: Aldersyde Petro Canada in Aldersyde, Alta., and Lincoln Irving Big Stop, Oromocto, N.B.

The survey is intended to raise awareness of overactive bladder, a chronic condition that causes the urge to urinate even when the bladder isn’t full, The Powder Room said.

The condition can be a side effect of some medications. Pregnancy, obesity and menopause can also cause overactive bladder.

A complete map of user-rated Canadian restrooms can be found on the organization’s website, www.powderroom.ca.

© The Vancouver Sun 2008

U.S. troubles raining on our parade

Thursday, June 19th, 2008No recession here but experts split on U.S. economy’s fate

Alia McMullen

Province

TORONTO — Things are looking up for the Canadian economy following its dismal first-quarter contraction. But the country’s close trade ties with the United States will likely keep forecasts on shaky ground this year.

Economists expect Canada to skirt a recession this year as downside risks to the economy subside. However, risks to the outlook are high because economists are divided on the fate of the U.S. economy.

“The message from economists for 2009 is that the U.S. economy will either stagnate or surge back to life, which is of no use for those trying to get a handle on U.S. economic prospects,” Beata Caranci, director of economic forecasting at TD Financial Group said in a quarterly report.

She said economic forecasts varied because of the numerous shocks hitting the U.S. at once.”It is unprecedented to have a collision of an oil-price shock, a two-year decline in home prices and a credit crisis,” she said, adding the duration of credit crunch was the most uncertain factor.

Caranci said a number of supportive domestic factors — such as jobs, wages and house price growth — should help the Canadian economy expand by about one per cent in 2008 after contracting 0.2 per cent in the first quarter. But gross domestic product would likely remain below a predicted 1.4 per cent rise in the U.S.

She said Canadian growth would continue to suffer from falling exports and lower investment as a result of tighter credit conditions, while high oil prices would have a mixed impact.

“The biggest negative influence on the Canadian economy will continue to flow from the export sector, which has already contracted for three consecutive quarters.” This would not improve until the U.S. economy begins to show signs of a sustained improvement in second quarter of 2009.

© The Vancouver Province 2008

Bill would protect consumers from cheque fraud

Tuesday, June 17th, 2008Bal Brach

Sun

OTTAWA — A private member’s bill introduced in the House of Commons Monday would require that cheque-cashing services protect the rights of consumers in the same way as banks and other mainstream financial institutions.

The goal of the bill, put forward by Vancouver East New Democrat MP Libby Davies, would be to prevent victims of fraud from being victimized a second time when they are unable to stop a payment to a con artist.

Under current law, if a person puts a stop-payment order on a cheque because of fears the cheque may have been written to a fraudster, and the fraudster cashes it at a cheque-cashing service, the service is entitled to sue the person who wrote the cheque, rather than the fraudster who cashed it.

That’s what happened to 71-year-old Stan Green, who was looking for a contractor to do some work on his Vancouver home. After he struck a deal with the man to do the work for $1,000 in February, he gave the man a postdated cheque for March 1.

When Green figured out before that date that the contractor was a con artist, he put a stop to the payment.

But it was too late and the fraudster had already cashed the cheque at a cheque cashing outlet. The service had threatened to sue Green to recover the funds, but has since reconsidered.

“It’s utterly absurd and unfair that the law victimizes consumers trying to protect themselves,” said Davies.

“The bill I’m introducing today prevents the cashing of cheques by a cheque cashing business when a cheque has been cancelled by the person who wrote it,” she added.

“That puts the onus on these businesses to make sure cheques they are cashing have not had a stop payment put on them.”

Under Davies’ proposal, the rights of consumers would be protected at cheque-cashing services in the same way as they are if a stopped cheque is taken to a bank or credit union to be cashed. In cases where such cheques get past the institution’s safeguards, the institutions themselves are obliged to accept responsibility and take the loss.

“Cheque-cashing services will have to conduct . . . due diligence in determining whether to cash a cheque,” said a report on the issue that was commissioned by Davies from the Library of Parliament.

© The Vancouver Sun 2008