Public meetings start discussion of choosing a sustainable future

Randy Shore

Sun

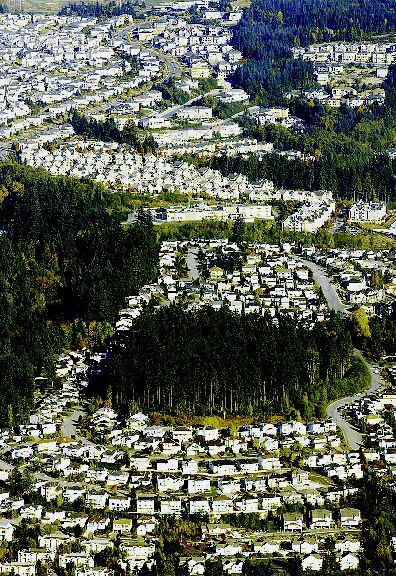

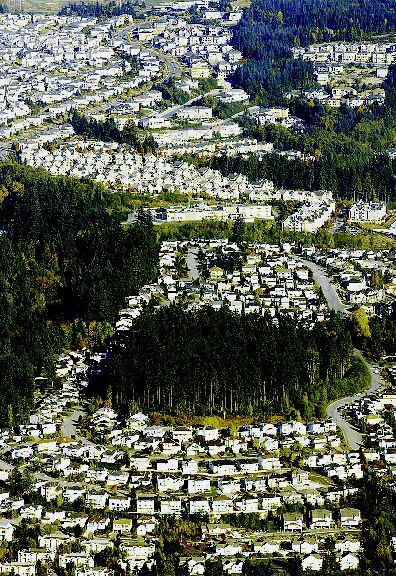

Vancouver Sun Files / Urban sprawl is demonstrated by the streets of Coquitlam rising to the Westwood Plateau. Photograph by : Stuart Davis

Metro Vancouver has a hit a wall.

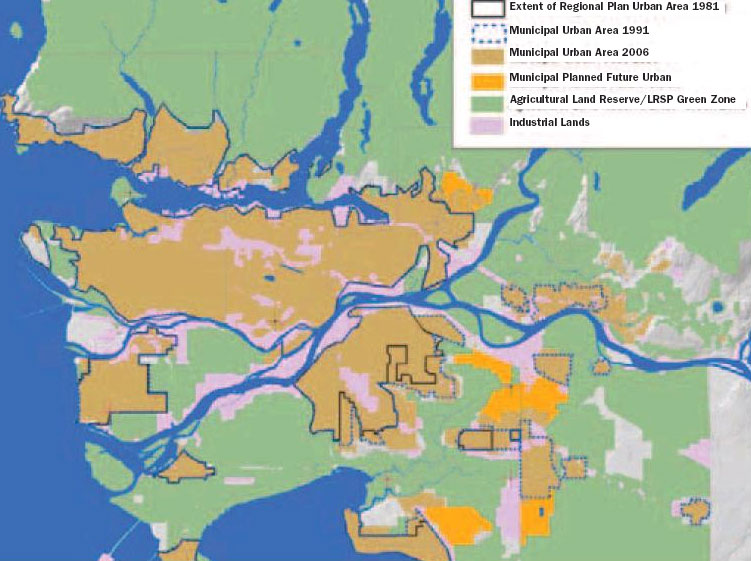

Boxed in by parks, watersheds, mountains, ocean and protected agricultural land, the region faces a very different kind of growth and home ownership — landless and compact.

Metro Vancouver, that layer of government known until recently as the Greater Vancouver Regional District, is embarking on an extensive round of public consultation on a plan for the city’s next phase of growth, a period that will see changes in how we live, where we work and how we will get from one to the other.

The new growth plan under development is the successor to the Livable Region Strategy that has been guiding municipal decision-makers for the past decade.

The growth strategy amounts to a shared vision of the region we would like to live in and is used by municipal planners and councils to shape their land-use planning and decide how they will compel or encourage builders to create compact, efficient town centres and to limit wasteful sprawl.

The physical transformation started 20 years ago, at a time when 75 per cent of new homes could be described as a house with a yard and a fence — the homes that most of us grew up in. Today, only 25 per cent of new homes fit that description, said Metro Vancouver regional development manager Christina DeMarco.

The combination of increasing residential density and traffic congestion has already begun to shape the area in more sustainable ways. When getting around is difficult it has a number of effects:

– People take transit more, 26 million transit trips per month.

– Businesses and retailers move out to suburbs where people live.

– Demand for affordable living spaces close to jobs goes up, giving rise to high-density in downtown Vancouver and around Burnaby‘s SkyTrain stations.

Even Surrey, the bad boy of suburban sprawl, is changing its ways, according Mayor Dianne Watts. The city is reaching the edge of buildable space for single-family residential development and has taken steps to preserve its undeveloped industrial land.

“The future is going to look very different,” Watts predicted. Surrey, Langley, Abbotsford and Coquitlam last month signed a sustainability accord in an attempt to ensure that the last raw land in the metro area is developed sensibly.

“Those high-growth communities need to produce 250,000 jobs between now and 2031,” Watts said. “We need to resist the pressure to turn those industrial lands over to residential development.”

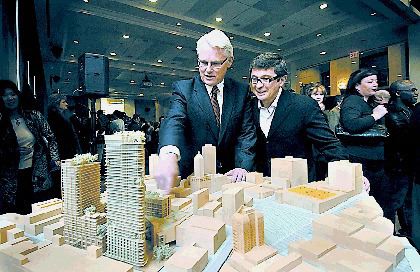

But people still need places to live. In Surrey that means developing their own little Manhattan, a still mostly unbuilt city centre that Watts envisions as a forest of office and residential towers with commercial space at street level. Fifteen such towers are already under application, she says.

The former GVRD and its predecessor organizations have stuck to the vision of “cities in a sea of green” since the 1940s, SFU lecturer and five-term Vancouver city councillor Gordon Price said, and every growth strategy since that time has been an iteration of that basic concept. “It’s a good one.”

But driving long distances for work and play on a daily basis is no longer a viable lifestyle.

“Climate change is the gun to our heads,” said Price. “And I guess you could say that peak oil is too.”

The province’s Gateway plan is the spanner in Metro Vancouver’s sustainable growth machine, he said.

The planned freeway expansion and the twinning of the Port Mann Bridge is meant to reduce traffic congestion and speed the movement of goods in the region. But it could undo the greatest achievement of decades of planning, Price said.

Traffic congestion has helped spur job growth in the outlying municipalities and regional town centres. Transit use is high, people are choosing to live closer to work and car ownership is actually decreasing in the City of Vancouver. Metro Vancouver is the only Canadian city to achieve a reduction in the length of the average commute.

Watts argues that Gateway, which includes a perimeter road intended to move truck traffic off Surrey‘s urban arterials, is needed to accommodate the movement of goods from the port, the border and across the Fraser River. And she says that Surrey is committed to halting the kind of sprawl that critics fear will result from the freeway expansion.

That light rail and buses across the Fraser could be incorporated into the bridge plan makes Gateway more palatable, she says.

How the municipalities that make up Metro Vancouver move toward greater sustainability is the subject of a just-released 24-page document called Choosing a Sustainable Future for Metro Vancouver and it will all be up for discussion at a series of public meetings to be held around the region beginning today through Dec. 11.

The guide is available at www.gvrd.bc.ca/growth/strategy-review.htm.

How the region will absorb one million more people and generate 400,000 more jobs is the topic. Discuss.

SAY YOUR PIECE

Metro Vancouver‘s Growth Strategy Review tours the region.

PUBLIC MEETINGS

Burnaby/New Westminster

Nov. 14, 7 to 9 p.m.

Metro Vancouver head office,

4330 Kingsway, Burnaby

Vancouver

Nov. 19, 7 to 9 p.m.

Vancouver Public Library

350 West Georgia St.,

Vancouver

Pitt Meadows/Maple Ridge

Nov. 21, 7 to 9 p.m.

12150 – 224th St.

Maple Ridge

Northeast sector

Nov. 22, 7 to 9 p.m.

Port Coquitlam

Recreation Complex

2150 Wilson Ave.

Port Coquitlam

North Shore

Nov. 28, 7 to 9 p.m.

Harry Jerome Recreation Complex

123 E. 23rd St.,

North Vancouver

Richmond

Dec. 5, 7 to 9 p.m.

Richmond Cultural Centre

180-7700 Minoru Gate

Richmond

Surrey/Delta/White Rock

Dec. 6, 7 to 9 p.m.

Newton Rec. Centre

7120 – 136 B St.

Surrey

Langley

Dec. 11, 7 to 9 p.m.

George Preston Recreation Centre,

20699 – 42nd Ave.

Langley

Special meetings

(registration required)

Future of the Region Sustainability Dialogue

Nov. 28,

11:30 a.m. – 2 p.m.,

SFU Morris J. Wosk Centre for Dialogue,

580 West Hastings St.

Vancouver

Sustainability Breakfast

Dec. 5, 7:30 – 9 a.m.

Canada Export Centre

602 West Hastings St.

Vancouver

Source: Metro Vancouver

© The Vancouver Sun 2007