Vaughn Palmer

Sun

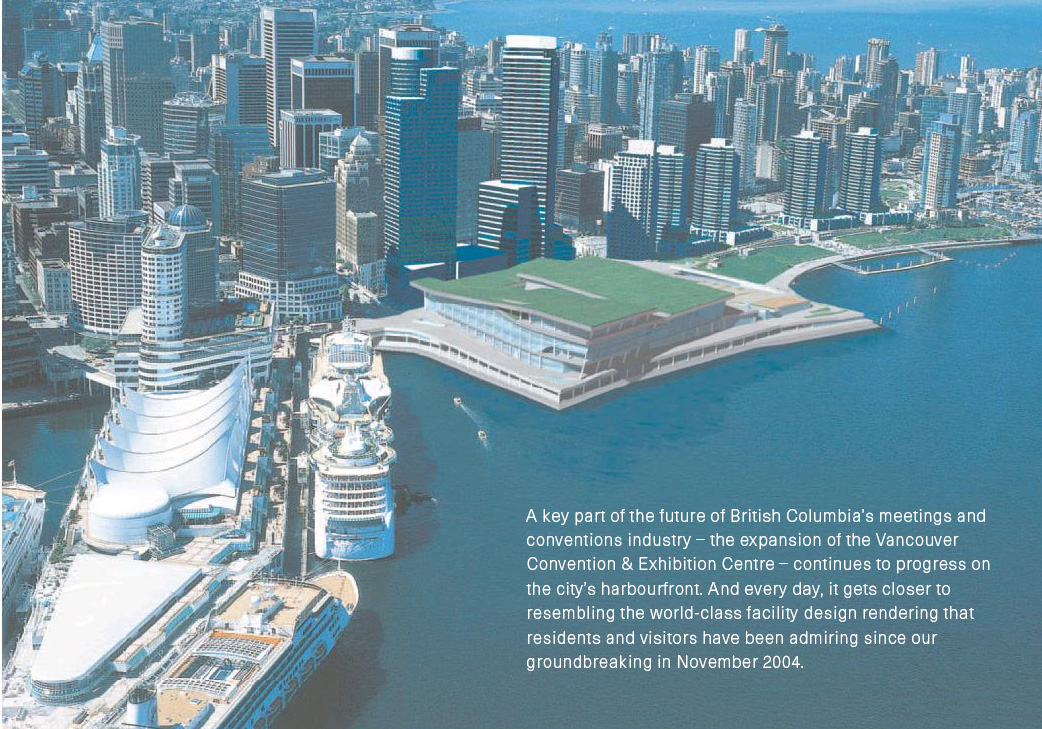

VICTORIA – The year began with the B.C. Liberals promising to get a handle on the Vancouver convention centre expansion project.

Yes, they’d promised to do that before. Vowed it could be built for $495 million. Swore up and down that $565 million, then $615 million was the absolute limit.

But this time they were serious. The cabinet minister for the project, Stan Hagen, was as firm as could be. “One number,” he demanded from the project managers.

Not a range. Not another estimate. One number.

Hagen soon learned there is no easy way to firm up costs on a project that was grounded from the outset in the budgetary equivalent of swampland.

The B.C. Liberals launched into the convention centre expansion with no reliable analysis of the cost of building something that size over water. No good sense of rising prices for labour and materials. No firm grasp of the scope of the project, which kept changing — to this day.

They also agreed to an open-ended construction contract, putting provincial taxpayers on the hook for every dollar of rapidly inflating costs.

One number? By the time the legislature convened for the spring session, the best Hagen could say was that the cost would be “in the range of $800 million,” a desperately vague estimate that drew well-deserved sneers.

Halfway through the session, with nothing new to to say about the quest for the one, true number, Hagen announced a shakeup at the board of directors of the convention centre expansion.

Shunted aside, Ken Dobell, Premier Gordon Campbell’s man of many hats. Incoming, David Podmore, fresh from the property development industry. Hagen also appointed a couple of other new directors, saying the government wanted “a little more construction experience” on the board.

Construction experience — on a board overseeing one of the biggest construction projects in the province? Where do the Liberals get these notions?

The session ended and spring gave way to summer, but still the rumours persisted that the Liberals were having to face up to one more overrun on the convention centre project.

Then came the press advisory for Wednesday’s fiscal double header — release of the public accounts for the most recent budget year at 10 a.m., release of an update on the convention centre finances at 11:30 a.m.

The public accounts dropped the first shoe. On April 11 of this year, the cabinet approved a revised budget of $771 million for the convention centre project.

But that decision came after the March 31 end of the budget year, so it was recorded in the public accounts as a “subsequent event.”

Nor was that the end of the saga. For, as Finance Minister Carole Taylor advised reporters, after the public accounts were completed and printed, she’d learned of another upward revision in the convention centre budget.

Call it a subsequent “subsequent event.”

The new number was $883 million, Taylor said. In the space of three months, the budget had climbed by another $112 million, to a level that (recalling Hagen’s earlier circumlocution) was more “in the range” of $900 million.

The provincial share (after deducting fixed contributions from the federal government, Tourism Vancouver and minor sources) is pegged at $541 million, up from $203 million when the project was announced.

Don’t reach for the calculator — the overrun is 167 per cent.

The Liberals had major concerns about how the latest numbers would go down with the public, judging from the way they staged the second of the two press conferences.

Hagen led off with an account of the project’s virtues that fell just short of suggesting it ought to displace the Taj Mahal from the list of the seven new wonders of the world. Podmore followed with a prediction that anyone seeing the finished product will say “Wow! that’s really something.”

Together they promised that the convention centre will be successful, wealth-producing and something British Columbians can embrace with pride.

Neither added “unlike the fast ferries,” but that is surely what they were thinking.

Both insisted Wednesday’s announcement also marked the end of the budget overruns.

Podmore said he locked down the budget by negotiating a fixed price on the main construction contract. It was “a tough negotiation,” he conceded, given that the builder, PCL construction, was holding most of the cards.

But the price was now fixed. “I’m putting my neck on the line here,” he told reporters. “I won’t be back for any more money.”

Almost lost in Wednesday’s announcement was the news that they’ve quietly increased the scope of the project by another $40 million — “enhancements” according to Podmore.

More evidence of the lack of discipline that has characterized this project from the outset. One more reason why I wouldn’t take the new number to the bank just yet.

© The Vancouver Sun 2007