Other

Archive for the ‘Real Estate Legal Articles’ Category

Additional Disclosure to Assist Consumers

Wednesday, October 10th, 2007The ins and outs of legal proxies

Sunday, July 22nd, 2007Tony Gioventu

Province

Dear Condo Smarts:

At our annual general meeting in June, a number of issues concerning proxies came up that made me rather concerned.

I am an owner, but two other owners on vacation asked me to hold their proxies to vote for the budget, the new council and a special levy for our roofing replacement.

When I registered I was told by the council that there could only be a maximum of one proxy per person and I would have to sign the other proxy over to a council member. I refused and demanded the proxies back, but they refused.

During the meeting, the president ended up with 10 proxies and used them to railroad his election back on council. Our manager never questioned any of the business and the minutes have come out to show none of the funny stuff.

Was the council right? Are we permitted to hold only one proxy?

— Mrs. G.N. Hodges

Dear Mrs. Hodges:

In B.C., we now have more than 30,000 strata corporations and close to 1.5 million strata-titled lots. Considering those numbers, proxies are a serious issue affecting everyone.

There are no such restrictions on the number of proxies people can hold. Most important though is that the written document is not the proxy.

You, the person assigned the proxy vote, is. The strata cannot direct how you vote, but the owner may have written specific instructions or limitations for you to follow.

Proxies must be in the required written form, but they need not be on the proxy form that the strata issues with the notice.

There is always a concern when one person holds enough proxies to influence the voting, but there is little the strata can do about that unless an unfair act is committed.

The registration process with proxies can be confusing at the best of times and proxy holders need to be prepared to provide personal identification for the purpose of certifying the proxy.

The proxy form is the property of the proxy holder, not the strata corporation, but don’t plan on using a fake proxy to sway the votes. The record will show your identity on the registration and you could be facing significant costs for the losses if you’re discovered.

Tony Gioventu is the executive director of the Condominium Home Owners Association (CHOA). Contact CHOA at 604-584-2462 or toll-free at 1-877-353-2462, fax 604-515-9643 or e-mail [email protected].

© The Vancouver Province 2007

Debit card system spawns a new breed of thieves

Wednesday, July 4th, 2007Critics debate safety of debit-card system as rise of electronic transactions spawns new breed of thieves

Sun

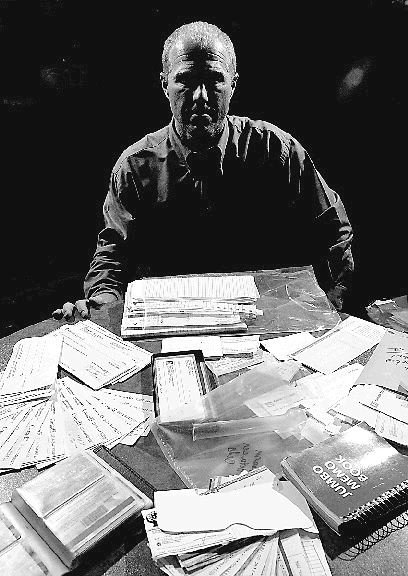

Edmonton Police Service Det. Allan Vonkeman displays confiscated cheques, bills, credit cards and miscellaneous personal identity stolen primarily from various apartment mailboxes in the city. Photograph by : Larry Wong, CanWest News Service

TORONTO – The problem of theft in Canada is no longer about teenage shoplifters, black-masked bank robbers or purse-snatchers. The rise of the electronic payments system has spawned a new breed of thieves who can clean out the bank accounts of unsuspecting victims with a simple swipe of a card.

The profits from these crimes frequently fund organized criminal networks, according to police forces across the country, which are grappling with the growing problem.

Often referred to under the broad category of “identity theft,” payment card fraud in its various forms presents a growing threat to Canadians — one the country’s banks, card issuers and retailers aren’t eager to talk about.

In some cases, hackers steal piles of customer information that companies store electronically, as was the case earlier this year with the high-profile security breaches at the Canadian Imperial Bank of Commerce and TJX Cos., the parent company of Winners and HomeSense.

Criminals also tamper with bank machines and debit card machines to electronically record a customer’s account information and make counterfeit payment cards. In other cases, employees — particularly at restaurants, gas stations and convenience stores — swipe a customer’s card through a small magnetic strip reader that records account information, and use it to make fake payment cards.

“What we’ve found is that the criminals involved in this are involved in a wide spectrum of criminal activity,” said Insp. Barry Baxter of the RCMP’s commercial crime branch. “The profits generated from this go to drugs, weapons, prostitution, loan-sharking, lifestyle.”

But compared to company profits, fraud losses are minuscule. Less than half of one per cent of all payment cards were hit with fraud last year, according to Caroline Hubberstey, director of public and community affairs at the Canadian Bankers Association.

Losses represented one-10th of one per cent of the sales volumes of credit card companies, said Gord Jamieson, Visa Canada’s director of risk and security.

But if the problem of payment card fraud is under control, why is the financial industry so resistant to informing Canadians about how and when frauds occur?

In most cases, banks, payment card companies and businesses do not tell Canadians who fall victim to payment card fraud how and where their personal information was lost or stolen. Part of the rationale is that disclosing such information could jeopardize a police investigation, according to the bankers association.

But a major reason the industry wants to keep vital details from Canadians is they’re worried consumers will boycott the stores or banks where they got ripped off.

“What it could do is have an adverse impact on that merchant and future sales, their business and everything else,” Jamieson said. Banks and card issuers say consumers are more interested in knowing they’ll be compensated for losses than finding out where and how their personal information was lost or stolen by criminals.

Canadian banks, card companies and businesses say they should be able to decide whether to tell customers when their information is lost or stolen. Although the industry follows a voluntary code that encourages disclosure when the risk of fraud is high or imminent, there is currently no obligation to inform consumers when they suffer a security breach.

The industry’s complete discretion over breach notification, however, has raised serious alarm. Earlier this year, federal privacy commissioner Jennifer Stoddart urged a parliamentary committee to make breach notification part of federal privacy law. This would bring “increased attention on the part of organizations to the security in which they keep personal information and then to their duty to act swiftly and appropriately to help people,” she said.

Critics, however, say that argument is proof the banking, payment card and retail industry would like to keep the growing threat of fraud as quiet as possible to avoid scaring consumers away.

“Banks have their image and they would like to preserve it, so it’s not in their best interests for a major Canadian bank to go on the news and say they’ve been a victim of identity fraud,” said RCMP Cpl. Louis Robertson, head of the criminal intelligence unit at Phonebusters, a national anti-fraud call centre.

In the coming months, credit card companies will begin rolling out new cards that combine a secure microchip and personal identification number to reduce fraud. It’s a multimillion-dollar investment that will take several years to implement.

Many of the country’s major banks have also upgraded bank machines and online banking systems to reduce the incidence of fraud.

“You’ll see new strategies on [bank] machines — some obvious, some not so,” Hubberstey said. “This is a constant effort.”

© The Vancouver Sun 2007

It’s property tax time

Sunday, July 1st, 2007Other

Pet Bylaws & Form B’s must be read before subject removal

Sunday, June 10th, 2007Tony Gioventu

Province

Dear Condo Smarts: Can you please tell us what information is supposed to be included with the Form B information certificate? We received the Form B three days after we removed the subjects for the purchase of a townhouse.

Our sale is completing the first week of August and the rules that were attached with the form indicate that pets are prohibited.

We have two very dear dogs that we cannot part with. We read all the minutes and the bylaws and there was no such restriction.

Do we attempt to cancel the sale or is there some other remedy ? Could the strata corporation grandfather our pets?

Dear Jeffersons and all buyers: A Form B information certificate is simply a disclosure of information about a strata corporation for a specific date in history.

Many buyers falsely believe the form is valid for 30 or 60 days.

Financial status, rules, rentals, strata fees, court actions and municipal notices can all change within a day, so don’t rely on a Form B beyond the date it was issued.

Rules must be included with a Form B because they are not filed in the Land Title Registry. However, rules cannot apply to the use of a strata lot, and a rule that prohibits or restricts pets must be a properly ratified and registered bylaw to be enforceable.

The purpose of the Form B is strata-corporation disclosure of information about the strata business and its rules and bylaws. The form includes the amount of your strata fee; if there are agreements between the strata lot and the strata where you could be taking responsibility for the maintenance and repair of permitted alterations; approved special levies; projected deficits; contingency-reserve amounts; bylaw amendments or threequarter votes yet to be filed in the Land Title Registry; court proceedings; pending notified three-quarter resolutions; the number of units rented; and work orders issued by an authority.

Receiving the Form B after you close the sale is of little benefit to a buyer since considering the information in the form, the strata minutes, bylaws and financial reports would all be critical before you make the decision to buy.

Regarding your pets, the strata corporation needs to be advised their rule prohibiting pets is not permitted or enforceable under the Act.

Tony Gioventu is the executive director of the Condominium Home Owners Association (CHOA). Contact CHOA at 604584-2462 or call toll-free at 1-877-353-2462,or fax 604-5159643, or go to www.choa.bc.ca, or email [email protected]

© The Vancouver Province 2007

Costly misunderstanding in strata rules

Sunday, May 6th, 2007Tony Gioventu

Province

Dear Condo Smarts: We purchased a townhouse in Langley before Christmas in a phased development. We seriously misunderstood what we were getting, and what our costs were going to be. As it turns out, the strata is almost 15 years old. We never considered we were part of the older section, so under new warranties we thought we were safe.

In March, we received an engineering report that shows the first 50 units built in the ’90s are leaky condos — and we have to pay for the special assessments of the leaky townhomes as well. Our inspectors didn’t investigate the older units, and no one advised us of the risks. Yes, we’ll qualify for a no-interest loan, but considering the payments, we may have to sell and take our losses. Please let people know the risks in a phased strata.

— Carol and Kevin

Dear Carol & Kevin:

It’s important to understand what phasing is and it’s important for buyers to read disclosure statements and get their questions answered before the deal is closed.

A phased development is a strata plan that’s built, developed and sold in groups over a period of time set out by the developer as part of its master plan.

It can be a few homes — 10 units divided into two phases, building and selling five at a time — or 500 homes with 10 or more phases.

Each phase sets out the proposed number of units to be built and when they are projected to be built and completed. Once each phase is ready for sale, the developer files the strata plan for that phase, which in turn creates the titles for each of the units.

Once the phase is registered and the strata plan is filed, it becomes a functioning part of the strata corporation. Strata fees are due on each lot, and each lot exercises voting rights.

(Bylaws regarding pets, rentals or age restrictions can only be amended once the final phase has been conveyed to the strata through its AGM, or if the developer grants permission in writing to adopt such bylaws and the strata votes in favour by 3/4 vote. In a strata with many phases being built over years, it could be a long time before restrictive bylaws can be imposed.)

When purchasing in a phased development, ask how many are still to be built and when they will be finished. You may be in a development that will be under construction for a long time, or at the end of a phase with an already well-developed community.

Once the final phase is complete, all units from all phases are one strata and share all the common expenses, liabilities and use of facilities.

Review the history of the strata, minutes and financials to ensure it is well maintained and serviced and there are no scary surprises, or you may pay for years of use, neglect and dispute.

© The Vancouver Province 2007

Secure Electronic Digital Signature software developed by a Vancouver Company Recombo Inc

Thursday, December 7th, 2006Peter Wilson

Sun

It’s 11:38 p.m. You’re at home and the phone rings. That contract you’ve been working on all day is now ready for your signature.

How do you get that contract signed and get it back for a midnight deadline?

Or you work in the human resources department and you have to get everyone to sign off on a new sexual harassment policy.

But you’ve got 2,000 employees and if you send out a memo and have everybody return it you’ll need an entire new filing cabinet just to handle the paperwork, to say nothing of keeping track of it.

The answer to these dilemmas is using e-mail to either gather or apply secure electronic signatures, said Mike Gardner, CEO of Vancouver-based Recombo Inc. His company’s new Waypoint 2.0 — which integrates with Microsoft Outlook and Salesforce.com — lets companies do away with the old pen and ink method of signing documents.

Using a secure digital signature you could whip that document back before the deadline or get all those harassment memos signed and returned electronically, said Gardner.

“A secure digital signature has the full legal weight of a regular signature,” said Gardner, who added there is some confusion on the matter in Canada because what’s known as a digital signature — not the secure digital signature used by Waypoint — can only be issued by authorities listed by the Treasury Board Secretariat.

“Actually, the Treasury Board Secretariat doesn’t list anyone as certification authorities yet,” said Gardner.

But under federal PIPEDA (Personal Information Protection and Electronic Documents Act) legislation, he said, the secure electronic signature is allowed for commercial use.

The question that is always asked by those unfamiliar with secure electronic signatures, said Gardner, is just how do you know that the person signing electronically is really who he or she purports to be.

To confirm digital identities Waypoint uses eIDverifier from Equifax Canada

If you’re a potential user, you will provide eIDverifier with personal information and will then be asked a series of questions based on private financial information stored by Equifax Canada which only you should be able to answer.

Once your identity is established you’re issued a public key (something akin to your bank card number) and you create your private key (the equivalent of the PIN for your bank card) which acts as your password.

Using that private key you can sign documents and have them accepted — depending on limitations in various jurisdictions across Canada — as legally valid.

“We’ve been focusing on the leasing market because leasing is a great area where lots of transactions are happening, particularly on commercial leases where you generally have a master lease and then you have a series of sub leases underneath the master,” said Gardner.

He said that using secure electronic signatures speeds up commerce significantly.

“These days you negotiate entire deals over e-mail. You’re back and forth with the document over e-mail and then, at the 11th hour somebody says okay now we’re complete with this agreement, could you just print it off and fax it to me.”

© The Vancouver Sun 2006

In-suite laundry needs building permits, permission

Sunday, September 17th, 2006Tony Gioventu

Province

Dear Condo Smarts: We live in an older apartment (now condo) building in Nanaimo. There has always been a central laundry facility on the first floor that served all of the owners. Now two owners on the third floor have installed washers/dryers and installed venting without permission. This strangely seems to coincide with owners on the first floor complaining about soap suds in their toilets. Can owners alter their own plumbing and electrical without the permission of the strata corporation?

— John & Lilly

Dear John & Lilly: Owners may make alterations to their strata lots without the permission of the corporation that do not change the structure of the strata lot, or affect the common facilities, as permitted in the bylaws.

Basically this means decorating, no more.

Critical in your case is your third- floor owners altered and damaged the building exterior by coring vents through the building exterior systems, which are common property, as well as part of their strata lots. All these actions required the written permission of the strata corporation and building permits.

So in this case the strata council needs to proceed with bylaw enforcement.

Options include fining the third-floor owners in accordance with your bylaws and requiring the strata-lot owner to restore the unit and common property to the same condition as it was prior to the alteration. Many older buildings have shared laundry facilities. While they are not always convenient, they are economical both for the strata and the residents, and they greatly reduce the risk of dryer-related fires in strata lots and washing-machine flooding over multiple floors. [email protected]

© The Vancouver Province 2006

Assignment GST & PPT taxes – Questions & Answers

Monday, August 28th, 2006Other

|

|

|||||||||||

|

INDUSTRY UPDATE Bottom line is that there is a rebate of 36% of the GST for properties up to $350,000 whether it is owner occupied or rented. The rebate reduces as the purchase increases and there is no rebate on properties over $450,000. The rebate is available for both owner occupied and tenant occupied properties (rental rebate is not available if owner is entitled to claim an input tax credit which means the developer who rents units is not entitled to the rebate). To claim the rental rebate the owner must have entered into a lease agreement. The “transitional rebate” applies to transactions where the contract was entered into prior to May 3, 2006. In this situation you pay the 7% on closing and then claim the 1% rebate. Most developer will allow you to claim the new housing rebate as part of closing, that is you only pay the “net” GST but they require payment based on 7% less rebate and the buyer claims the transitional rebate after closing. If you are leasing the developer will require payment of the full GST and the owner then claims the rebate directly. |

|||||||||||

| Quiz Time: I have written an assignment agreement on an existing new development contract. The contract price with the developer is $500,000.00 + GST and the assignment price is $700,000. On which price does my client (the assignee) pay GST? On which price is the Property Transfer Tax payable on? |

|||||||||||

|

The price on which GST is payable is the original price on the contract between the developer and the buyer who is now the assignor (the person who is assigning the contract). So in this case GST would be paid on the $500,000. The GST department is aware of this but have not to date addressed it with any changes. This was confirmed to me by Richard Bell, Bell Alliance one of today’s meeting sponsors. Our BC government was more on top of the revenue opportunity and they changed the rules so that they now apply PTT (Property Transfer Tax) to the price on the assignment contract which in this case is $700,000. That means the Assignee (the person taking over the contract from the Assignor) will pay PTT on $200,000.00 more than would have been paid on the original contract of $500,000. It is very important as the licensee in these contracts that you make the buyer fully aware of the GST and PST considerations. They should confirm the exact amounts with their conveying Notary or Lawyer. To be wrong in this area can have some rather serious consequences to the licensee should a complaint arise. We also advise that you leave the calculations to the clients Notary/Lawyer as this is a part of their closing duties; to calculate, collect and submit both of these taxes to the BC and Federal revenue agencies. The duty of the licensee is to make the client aware of the applicable taxes and then point them to the qualified third party for the details before they remove their subjects. Richard Bell, Partner |

|||||||||||

|

|

|||||||||||

| Three options regarding releasing assignment amount

With regards to the release of the Assignment Amount to the Assignor here is a brief explanation of the three options available:

|

|||||||||||

|

|

|||||||||||

| Assignment contract Q&A

Since the latest standard forms were released, several questions have been raised. These answers were provided by Ed Wilson, of Lawson Lundell LLP, who donated more than 60 pro-bono hours on this project. Ed has been the Canadian Bar Association , BC Branch’s representative on BCREA’s Standard Forms Committee for the past ten years. Q. Why do Clause 5.16 of the new Assignment of Contract of Purchase and Sale (ACPS) (New Development) and Clause 4.13 of the ACPS (Non-Developer) provide that the Assignor will pay GST? A. That section provides: GST: The Assignment Amount is inclusive of any GST payable with respect to the Assignment Agreement, and the Assignor shall remit any GST payable. Clauses 5.16 and 4.13 address the GST payable under the ACPS—not the GST payable under the original Contract of Purchase and Sale. When an assignee assigns a Contract and charges an Assignment Amount (the “profit” or “flip fee”), GST may be payable on the Assignment Amount. Whether GST is payable on the Assignment Amount largely depends on the nature and intention of the Assignor. If this is an isolated transaction, and the Assignor entered into the Contract of Purchase and Sale intending to close on the transaction, the Assignment Amount is probably not subject to GST. If the Assignor entered into the Contract with the intention to flip the Contract, then the Assignment Amount is subject to GST. Since whether the Assignment Amount is subject to GST depends on the nature and intention of the Assignor, the ACPS is structured to provide that the Assignment Amount includes GST. If the ACPS is subject to GST, the Assignor will have to remit the GST. For example, an Assignment Amount of $50,000 includes GST of approximately $3,000, so the “profit” is $47,000. If not subject to GST, the entire $50,000 is profit. In any event, the Assignee has paid to the Assignor GST payable and, under the Excise Tax Act, the Assignor is responsible to remit the GST to the Canada Revenue Agency. As the Assignee has paid the GST to the Assignor (who is liable to remit it to the Canada Revenue Agency), the Assignee has no further liability with respect to the GST. Q. Who remits the GST? A. If the assignment is subject to GST, except in certain uncommon situations, the Assignor will have to remit the GST to the Canada Revenue Agency. Therefore, any Assignor has to consider whether the assignment is subject to GST and they should get legal or accounting advice in this regard (see Clause 5.22 (New Development) and Clause 4.19 (Non-Developer). If the assignment is subject to GST, the Assignor (or their legal or accounting advisors, if so retained) will have to complete the appropriate forms and remit the GST to the Canada Revenue Agency. If the assignment is not subject to GST, then there is no GST to remit and no form to complete. If the Assignor wants to net a specific amount from an assignment that is subject to GST, they will have to ensure that the Assignment Amount includes a sum to cover the GST. For example, if the Assignor wants to net $50,000 after paying the GST, the Assignment Amount will have to be increased to $53,000. It should be noted that Clauses 5.16 and 4.13 have nothing to do with the GST under the original Contract. If the Contract is for a new home, that Contract is subject to GST, which is paid on closing. The GST under that Contract is forwarded to the developer on closing and the developer remits the GST to the Canada Revenue Agency. Q. Shouldn’t Clause 5.2 of the ACPS (New Development), which provides that the Deposit will be held in trust pursuant to the Real Estate Services Act (RESA), instead refer to the Real Estate Development Marketing Act (REDMA), since it deals with deposits that relate to projects over five units? A. The Deposit referred to in Clause 5.2 is the Deposit under the Assignment Agreement, not the deposit under the Contract. For example, a Contract to buy a $500,000 unit could provide that the deposit of $50,000 is to be paid to a lawyer in trust. Depending on the nature of the project, it may be subject to REDMA, in which case the lawyer would hold the deposit on behalf of the developer subject to the terms of REDMA. If the deposit was paid to a REALTOR®, the REALTOR&! reg; would hold it subject to the provisions of REDMA, but also subject to the provisions of RESA (i.e., as a stakeholder). In the case of the deposit with respect to the Assignment (e.g., the Assignment Amount is $100,000, but a deposit of $10,000 is paid until the Assignee removes his subject when he increased it to the full $100,000), the REALTOR® would hold that deposit pursuant to RESA (i.e., as a stakeholder), not pursuant to REDMA. Q. What is a deposit (protection) contract? A. The “Deposit PROTECTION Contract” referred to in Clause 2 of the ACPS (New Development) is provided for under REDMA (see s. 19(1)). It allows the developer to make use of the deposits placed by purchasers in new projects. Under REDMA, the deposit normally must be held by a lawyer, notary or REALTOR® until titles are raised (see s. 18(1) of REDMA). However, if a deposit protection contract is in place, the deposits may be released to the developer to fund the construction. A deposit protection contract is a contract between the developer and an insurance company, wherein the insurance company agrees to refund the deposits to the purchasers if the developer fails to complete the project. The deposits are paid as usual into a lawyer’s or REALTOR®’s trust account, and the insurance company issues a policy in favour of the original purchaser. As construction proceeds, the lawyer or REALTOR® holding the deposit is authorized by the insurance company to release ! portions of the deposits in draws to the developer to fund construction. This significantly reduces the developer’s cost of borrowing. If the original Contract is assigned as contemplated by the ACPS, the insurance company will insist on having a release signed by the original purchaser and the developer, stating that the original purchaser releases the insurance company of all liability under the deposit protection policy and they have assigned their interest in the deposit monies to the Assignee. If the insurance company does not get the release, the closings may be held up. The question (“Is a deposit protection contract in place?”) is asked on the ACPS to flag the issue for the parties. If the answer is yes, the REALTOR® should get the form of release from the insurance company (the name of the insurance company will be in the REDMA Disclosure Statement), so the REALTOR® can have it signed when the ACPS is firm. Edward L. Wilson Phone: 604.631.9148

GST/HST New Housing Rebate |

|||||||||||

Can the strata stop rentals?

Sunday, August 20th, 2006BYLAWS: Some — like age restrictions –don’t apply to everyone

Tony Gioventu

Province

Dear Condo Smarts:

We purchased a townhouse in the Shuswap region for summer family use and as a rental investment.

The strata corporation have now passed a bylaw that prohibits all rentals, and an age restriction of 55 years and over for all owners and visitors.

This is recreation property and the developer told us we would never have any restrictions and could do what we wanted.

Can the strata prevent us from renting our home or restrict the age of visitors?

— Gail and David Sorens, Calgary

Dear Gail and David:

There is no such designation as “recreation property” that sets up special exemptions or exclusions for investors.

If the strata bylaw that has been created is enforceable, you might not be able to rent your unit any more.

However, rental bylaws do not apply to family members who are parents or children of the owner or the owner’s spouse.

Age restrictions apply to residency, so the bylaw that regulates the age of visitors may not be enforceable.

Once a strata is created, it operates under the Strata Property Act, Regulations and Bylaws like any other strata.

There is no special treatment for recreation property, so you may be bound by the strata bylaws with no exemptions.

Exploring this subject further, some unique instances exist that are “resort classifications” where restrictive covenants limit or regulate the periods an owner can use their property. Occasionally, in ski resorts and isolated locations, the covenants also require that the properties must be available for rentals throughout the year to ensure a supply of accommodations.

In this case, rental and age bylaws may be prohibited by previously existing land-use covenants.

Recreation strata properties are a hot investment in B.C., but before investors buy, they should clearly understand what they are buying.

The same recreational investment might also be another owner’s permanent residence, so if you plan on a rental investment, inquire with the strata how many owners are permanent residents and how many people rent their units. That will give you a clue to what the next few years of strata life may look like.

Here are a few critical questions to ask before any deal is signed. Is the strata properly insured? Is there a winter/off season caretaker or manager for security and emergencies? Are the buildings properly winterized? Is waste effectively managed? Does the strata own and operate their own water systems? Who collects the fees and manages the business affairs for the strata? Are there special services, recreational vehicles, a marina, boat storage, moorage, aircraft hangar or snowmobile storage sheds? Who gets to use them? Is there a cost? Who owns and insures them?

Don’t forget, recreation properties may also have different taxation status, including paying GST on strata fees, depending on the type of business operations in the strata.

Tony Gioventu is the executive director of the Condominium Home Owners Association (CHOA). Contact CHOA at 604-584-2462 or toll-free 1-877-353-2462, fax 604-515-9643 or e-mail [email protected].

© The Vancouver Province 2006