Other

Archive for the ‘Real Estate Legal Articles’ Category

Sublease Office space in Vancouver can be a bargain at 30% off regular rates

Monday, May 4th, 2009FINTRAC – Proceeds of Crime Legislation regulations Info

Monday, May 4th, 2009Richard Chu, Frank O’Brien

Other

Taxman Audits puts mathematical quirk to work in spotting fudged returns

Thursday, April 30th, 2009Numbers start with 1 more often than with other digits

Glen Mcgregor

Sun

Canadians tempted to get creative with their income-tax returns might want to familiarize themselves with the work of Frank Benford before the Thursday night tax-filing deadline.

The Canada Revenue Agency is using a little-known statistical phenomenon named after the late American physicist to help identify which tax returns to examine more closely.

Benford’s “law” holds that in a series of naturally occurring numbers, the number 1 will appear as the first digit more often than other numbers. Whether the figures are street addresses, expense reports or tax deductions, the “loneliest number” leads off about 30 per cent of the time.

The number two occurs as the leading digit substantially less often, in about 18 per cent of real-life numbers.

Figures starting with a nine account for only five per cent of a typical data set.

A bank statement, for example, should contain far more entries for numbers like $1.70, $10.55 or $1,082 than those beginning with larger numbers, such as $6.50, $800 or $98.60.

The pattern may seem counter-intuitive but that’s what makes it a powerful tool for spotting expense-account fudgers and tax cheats. Someone who fabricates numbers tends to distribute them randomly, with an equal share of leading digits from one to nine.

When these kinds of numbers are crunched by a computer, sets that don’t conform to the leading-digit pattern can be easily spotted and singled out for closer examination.

Benford, who worked as engineer for General Electric, first tripped over this phenomenon in 1938, reportedly when he noticed certain logarithm tables in a textbook were more worn than others.

But only in recent years has the value of the pattern as an auditing tool been recognized by forensic accountants, in part because faster and cheaper computers allow first-digit analysis to be performed easily on large amounts of data.

The CRA says it is now using the first-digit rule in certain circumstances to combat what it politely calls “non-compliance” in tax returns.

“Benford’s law is a useful initial risk-assessment tool. However, it is never used in reassessments or in support of reassessments, which are done based on facts and tax law,” said spokesman Philippe Brideau.

While the CRA won’t say exactly how it employs Benford’s law, the agency has shown interest in using it to analyze corporate tax returns, says Mark Nigrini, a professor at the College of New Jersey and the leading expert on Benford-based tax auditing.

Two years ago, Nigrini spoke to CRA’s research division about his research and encouraged them to put the simple, but effective, technique to use in the field.

“They need to use all the new tools at their disposal,” he says. “It should be one of your tests, of many.”

Benford’s law is most effective at determining what sort of tax information is more prone to errors or fraud and how best to deploy auditors.

Nigrini says analysis of U.S. tax returns shows deductions for mortgage payments tend to follow Benford’s law closely, but claims for charitable contributions tend to be “very messy” when sorted by their leading digits.

“When people invent fraudulent numbers, they tend to avoid numbers that two of the same digit following each other – for example 155 or 773,” says Nigrini, who helps Ottawa-based CaseWare IDEA develops statistics software based in part on Benford’s law.

Benford’s law could be particularly useful as more Canadians file their tax returns electronically, without having to submit paper receipts to back up claims for childcare expenses, political donations and charitable contributions, among others.

© Copyright (c) The Vancouver Sun

Property transfer tax punishes the people

Wednesday, April 22nd, 2009Fiona Hughes

Other

The provincial election is fewer than three weeks away, and there are plenty of pressing issues facing British Columbians worthy of microscopic examination. But I’m feeling self-absorbed lately and devoting this week’s column to a tax that well, gets my goat and my goat’s mother. And it’s not the pesky little carbon tax or most any other tax for that matter. Try B.C.’s savings-account killer and rage inducer–the property transfer tax, a shameless cash cow.

The tax is not mentioned in any of the platforms of the major parties and is unlikely to be an election issue, but it should be. This tax vexes plenty of Vancouver voters, and it needs more exposure. The PTT is an unfair burden that penalizes people when they’re making the biggest purchase of their lives.

Unchanged since it was introduced in 1987 by Bill Vander Zalm’s Social Credit Party, the tax generates about $1 billion in revenue in a good year. Even free-market loving Premier Gordon Campbell isn’t willing to give that up. Although the PTT seems at odds with the provincial Liberals’ competitive taxation principles, it also contributed greatly to his government’s much trumpeted surpluses thanks to B.C.’s out of control housing market.

The tax, a rate that is 129 per cent higher than the average for Canadian provinces, is calculated at one per cent for the first $200,000 and two per cent on the balance. First-time homebuyers are exempt–if the house or condo they’re buying is less than $425,000. If you buy a house that is $425,001, your property transfer tax bill will be about $6,000.

My interest in this topic stems from being on the hunt for a new home. My family recently sold our East Side house, which my partner and I bought three and a half years ago. Although we were first time homebuyers in 2005, we still paid $6,000 in PTT because the house, just like every house in Vancouver, was above the exemption limit.

Our small, 1947 fixer-upper near a busy street cost $425,000 in 2005. Our intention was not to flip it, but make a home for our small family and connect with our new community. Our lives have since changed. We added another child to our family and some time in the near future my mother will live with us.

We need a slightly larger house in a slightly better location–a block away would do. (The daily garbage, such as the recent three dirty diapers–one filled with poo–dumped in front of the house recently convinced me selling was the right decision even though I’m in a panic about finding a new home.)

I emailed questions on the PTT to the three main candidates (NDP, Green, Liberal) in my Vancouver-Kensington riding. NDP candidate Mable Elmore believes first-time home buyers looking for a detached house in Vancouver “are in fact looking for housing that falls under the $425,000 exemption.”

Elmore obviously hasn’t checked prices recently. Yes, the global economic slowdown has reduced prices, but Vancouver real estate still remains out of reach for most people. As of Monday, according to the MLS real estate website, the cheapest detached house in Vancouver was listed at $428,000 on East 41st near Victoria. The old timer is described as a “builder/ handy man alert” and listed as “land value only.” Translation: it’s a dump on a busy street.

Elmore says scrapping the PTT would result in an increase in income or property tax to make up for the province’s heavy reliance on the transfer tax.

“The advantage of the transfer tax,” Elmore wrote, “is that once the first time homebuyer is established and wishes to move to another home, their property will have most likely appreciated by a value far outstripping any tax they would have to pay when purchasing their next home.”

In any other province, perhaps, but not necessarily so in B.C.

Green candidate Doug Warkentin also supports the tax, saying it is designed to discourage property flipping. “Property speculation has a greater effect on affordability than any tax, so if this has a dampening effect, then it may actually be beneficial,” he wrote. “The benefit of this tax revenue to the home buyer is another matter, which is a question for any tax, and comes down to getting good accountable government.”

Warkentin noted however, that the exemption “should be tied directly to current housing prices so that most of the homes in any market qualify.”

Liberal candidate Syrus Lee said he would reply to my email, but didn’t.

I’ve lost out on this tax, but I feel sorry for first-time homebuyers who see houses advertised at $550,000 or more as “a great starter home.”

And wait until they need to move to a second home.

© Vancouver Courier 2009

Martin Wirick & Tarsem Gill appear in court accused of a $38.4M real estate fraud

Tuesday, March 3rd, 2009David Baines

Sun

Martin Wirick Photograph by: Ward Perrin, Vancouver Sun

Tarsem Gill Photograph by: Ward Perrin, Vancouver Sun

Former Vancouver lawyer Martin Wirick and real estate developer Tarsem Gill have elected to be tried by judge and jury on charges that they defrauded lenders out of more than $30 million.

The two men appeared briefly Monday before Vancouver Provincial Court Judge Joseph Galati with their high-profile lawyers, Richard Peck for Wirick and David Crossin for Gill, to make the election. Appearing for the Crown was veteran prosecutor Kevin Gillett.

Wirick, tall and gaunt, was dressed in a rumpled black nylon jacket and dark blue pants. Gill was also casually dressed in a windbreaker, khaki pants and running shoes. Neither man said anything in court.

Crossin requested a preliminary hearing, which he estimated would take eight days. He said the hearing “won’t necessarily be a full preliminary,” suggesting it will focus on certain issues.

The judge asked the parties to return to court on Thursday to set a date for the hearing. Due to scheduling conflicts with the various lawyers, it may be many months before it is held.

In August, Wirick and Gill were charged with two counts of fraud and theft against 77 different homeowners, and two counts of fraud and theft against lenders in 30 different loan transactions. Wirick was also charged with two counts of uttering false documents and Gill with one count of possession of stolen property.

The total amount of money alleged to have been unlawfully taken from homeowners and lenders exceeds $30 million.

The B.C. Law Society has already deemed that a fraud has occurred. Its special compensation fund, which insures clients for lawyer fraud, has paid out $38.4 million in claims on account of Wirick’s dealings on behalf of his client Gill. Whether their conduct amounts to criminal fraud will be determined by the court.

Gill’s method of operation, as described in the law society’s Benchers’ Bulletin, was to develop a property and sell it to one of his nominees. The nominee would arrange a mortgage on the property and then sell it to an innocent purchaser.

The purchaser, in turn, would arrange financing from his lending institution and forward the money to Wirick on his undertaking to pay off the original mortgage loan and register a new first mortgage. But rather than disburse the money as promised, Wirick simply paid the funds to Gill and his Vanview group of companies.

In many cases, Wirick would provide false discharge documents, and a portion of the purloined money would be used to keep the original mortgage payments current, so neither the purchaser nor the original mortgage lender would be any wiser.

The new mortgage lender, meanwhile, naturally assumed he had obtained a first mortgage against the property. But since the original mortgage hadn’t really been discharged, he was actually in second position.

In some cases, this process was repeated, enabling Gill to mortgage the property many times over and generate more money than it was worth. Eventually the scheme collapsed, revealing a tangled web of transactions, mortgages and competing claims.

When the scheme was uncovered in May 2002, law society officials took over Wirick’s practice and audited his books and records. They found that, from January 1998 to May 2002, $52.7 million passed through Wirick’s trust accounts to Gill and his companies.

Of this amount, $32.6 million was used for development and construction costs; $12.5 million was paid to lending institutions to keep mortgages up to date, including those that should have been discharged; $3.2 million was paid to Gill and related parties and only $600,000 to Wirick.

After the scheme was discovered, Wirick resigned from the society and subsequently declared bankruptcy. Since then he has been working at KoKo’s Gourmet Pet Food in North Vancouver. Gill has continued to develop properties in the Vancouver area.

© Copyright (c) The Vancouver Sun

The reno tax credit: how it works

Friday, February 27th, 2009UPGRADES Dos and don

Criminal checks online

Friday, February 13th, 2009How to fact-check your significant maybe

Ethan Baron

Province

Go ahead, fall in love. But don’t forget to check for skeletons in the closet.

You don’t want to end up being someone’s bloody Valentine.

Tomorrow marks the first Valentine’s Day on which a new online investigative tool has been available to British Columbians. It’s never been so easy to find out if the person who makes your heart throb should make you run for your life.

Meet “Justin,” your best defence against Cupid’s whims.

B.C.’s court services have put the “Justin” provincial court-records system on the Internet. Go to Court Services Online.

Leave the court location blank, so the search covers all B.C., plug in a name, and up comes the criminal history. You can find out if your significant maybe has been charged with a crime, when and where they appeared in court, and what the result was if there has been one.

First-degree murder, sexual assault, uttering threats, criminal harassment, theft, drug-dealing — you can get it all. Justin even shows speeding tickets.

Now, this search works best if your love interest has an unusual name. Search for Mike Smith or Jennifer Jones and you’re going to get a lot of different people. It helps if you know the person’s middle name. You can narrow it down if you know their age — go to the “participants” tab and you’ll get a year of birth for the accused.

If you’re still not sure, you can visit the registry of the court that handled the case, and ask for whatever files are publicly available.

Justin is an excellent new tool to protect yourself from heartbreak, or worse. But, with so many liars, cheats, thieves, con artists, perverts, sociopaths, psychopaths, drug addicts, drunks, deadbeats, derelicts and even gangsters among us, you need additional Cupid-control.

Facebook can be a treasure-trove of personal information, especially if someone doesn’t limit access to their profile, or if you and the other person have become Facebook friends.

Vancouver public-relations consultant Nicole Hall, 24, met a man from Regina while on vacation in the Dominican Republic. Travis assured her he was single. Although Hall typically checks Facebook before dating someone, she was on vacation and let her personal rules slide. But before she flew home, she agreed to Travis’s suggestion that she add him on Facebook. Back home, she checked his profile, which showed he was “in a relationship.”

“He basically flat-out lied about his relationship status,” Hall says. “He’s kind of a sleazebag and not really someone that I would ever really want to associate myself with again.”

Even without access to someone’s profile, you can usually see who their friends are, unless they’re one of the few Facebook users who restrict that from public view. Are his friends smoking joints and throwing gang signs? Are her friends flaunting prison tattoos and drinking straight from the whiskey bottle? You may want to cancel that coffee date.

This Valentine’s Day, listen to your heart. Then go online, and get a second opinion.

© Copyright (c) The Province

Justin” Provincial Court Records now on the net

Friday, February 13th, 2009How to fact-check your significant maybe

Ethan Baron

Province

Go ahead, fall in love. But don’t forget to check for skeletons in the closet.

You don’t want to end up being someone’s bloody Valentine.

Tomorrow marks the first Valentine’s Day on which a new online investigative tool has been available to British Columbians. It’s never been so easy to find out if the person who makes your heart throb should make you run for your life.

Meet “Justin,” your best defence against Cupid’s whims.

B.C.’s court services have put the “Justin” provincial court-records system on the Internet. Go to Court Services Online.

Leave the court location blank, so the search covers all B.C., plug in a name, and up comes the criminal history. You can find out if your significant maybe has been charged with a crime, when and where they appeared in court, and what the result was if there has been one.

First-degree murder, sexual assault, uttering threats, criminal harassment, theft, drug-dealing — you can get it all. Justin even shows speeding tickets.

Now, this search works best if your love interest has an unusual name. Search for Mike Smith or Jennifer Jones and you’re going to get a lot of different people. It helps if you know the person’s middle name. You can narrow it down if you know their age — go to the “participants” tab and you’ll get a year of birth for the accused.

If you’re still not sure, you can visit the registry of the court that handled the case, and ask for whatever files are publicly available.

Justin is an excellent new tool to protect yourself from heartbreak, or worse. But, with so many liars, cheats, thieves, con artists, perverts, sociopaths, psychopaths, drug addicts, drunks, deadbeats, derelicts and even gangsters among us, you need additional Cupid-control.

Facebook can be a treasure-trove of personal information, especially if someone doesn’t limit access to their profile, or if you and the other person have become Facebook friends.

Vancouver public-relations consultant Nicole Hall, 24, met a man from Regina while on vacation in the Dominican Republic. Travis assured her he was single. Although Hall typically checks Facebook before dating someone, she was on vacation and let her personal rules slide. But before she flew home, she agreed to Travis’s suggestion that she add him on Facebook. Back home, she checked his profile, which showed he was “in a relationship.”

“He basically flat-out lied about his relationship status,” Hall says. “He’s kind of a sleazebag and not really someone that I would ever really want to associate myself with again.”

Even without access to someone’s profile, you can usually see who their friends are, unless they’re one of the few Facebook users who restrict that from public view. Are his friends smoking joints and throwing gang signs? Are her friends flaunting prison tattoos and drinking straight from the whiskey bottle? You may want to cancel that coffee date.

This Valentine’s Day, listen to your heart. Then go online, and get a second opinion.

© Copyright (c) The Province

Los Angeles Foreclosure Alley Video – A must view

Tuesday, February 10th, 2009Other

Were you burned by the assessment ‘freeze’?

Friday, January 23rd, 2009Our data will make it easy to determine if you should consider appealing

Don Cayo

Sun

Exclusive data allow owners to determine if the assessment on their home or business is fair and whether they should appeal. Photograph by: Glenn Baglo, Vancouver Sun

Win, lose or draw? Until now, there was no way to figure out how this year’s property assessment roulette will end when your tax bill finally arrives in July.

Now The Vancouver Sun is providing exclusive data, in this column and on our website, that make it easy to determine if the assessment for your home or your business is fair, or if you should consider appealing it.

Today’s column focuses on homes. I’ll be writing again on Saturday about the implications for businesses, many of which have a lot more money at stake.

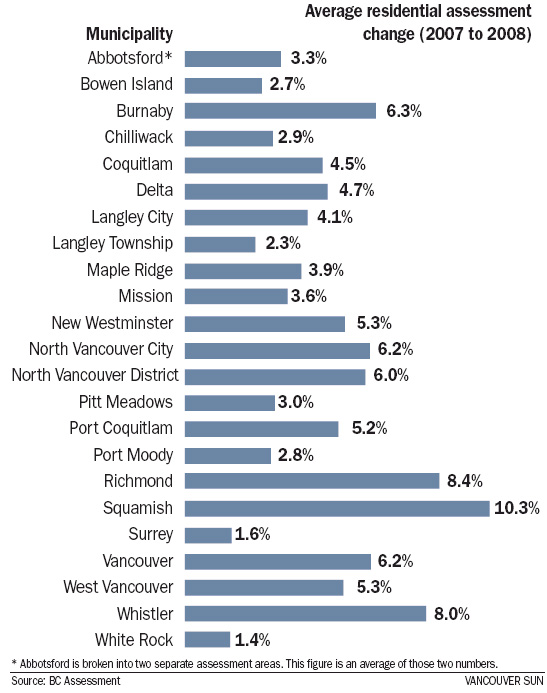

The difficulty stems from a provincial decision to base 2009 property taxes on the lower of the last two annual assessments. Now, at The Sun’s request, BC Assessment has calculated the average impact in places across the province. By comparing the reduction in your assessment to the average in your community, you can tell if you have a lesser break, an equal break or a better break than others.

B.C. real estate prices have dropped in recent months, but many properties were holding their value, even gaining, in July when the second of these two assessments was done. Thus, for well over 80 per cent of all property owners, the lower of the two assessments is the one from 2007.

This means most tax bills will be based on lower values than they would have been without the intervention. But it doesn’t mean most tax bills will be lower.

The key is, how does your assessment compare with others in your community? If it went down by the average amount, the impact on your tax bill will be nil. If it dropped more than average, you’ll pay less than you would have. And if it dropped less than average or came in higher than in 2007, you’ll pay more.

Let me offer my own example.

The assessment for my West End condo in Vancouver is just one per cent less than it would have been without the provincial meddling. Meanwhile, Vancouver residences as a whole are reduced 6.25 per cent on average.

In other years, the biggest tax increases hit those whose property gains the most. So there’d be a break for me and my neighbours whose property values are similarly stalled. And for many other neighbourhoods — much of east Van, for example — that are also below average. (In general, “affordable” properties and neighbourhoods lost value first, so they’re most apt to lose as a result of this policy.)

But this year, thanks to the provincial meddling, the breaks go to the ritziest homes and neighbourhoods — to owners of the properties that gained the most in value. This isn’t fair. Yet — despite government lip-service to tax fairness — the odds of winning an appeal are anybody’s guess. It’s uncharted territory.

Usually appeals hinge on one thing: does the assessment reflect fair market value? But fair market value is no longer the point: the 2009 assessments are the product of political manipulation.

It’s quite right to argue that if this gives others a big break, it’s only fair that you get one too. But can you convince the politically appointed panel of amateurs who hear the appeals? Who knows?

Even without this uncertainty, I suspect many homeowners won’t bother to appeal when they factor in what they might win — in my case, about $150 — and what their time is worth.

Certainly the number of appeals seems likely to be down. Assessment experts like Paul Sullivan of Burgess Cawley Sullivan tell me they’re busy with regular customers, but not so many new ones. And BC Assessment says it has seen fewer appeals so far than in a normal year.

“People won’t understand how hard they’re hit until their tax bills arrive in July,” Sullivan said. And, with a Feb. 2 deadline to file an appeal, “that will be too late.”

The average percentage of reduction in residential assessments around the Lower Mainland and the Capital Region is in the single digits. Since the size of the hit depends on the gap between the change in your assessment and the average number, I’m guessing this policy won’t hit many of the region’s homeowners with extra costs of more than a few hundred bucks.

The story may be different in the Okanagan and the Interior. There, average changes are typically in the double digits and, in places like Revelstoke, Sparwood and Cranbrook, over 20 per cent.

If you own property in one of these communities, or if you’re one of the relative handful with a property that decreased in value between July 2007 and July 2008, you could potentially be hit hard.

Sullivan reckons that each percentage point of spread between your “break” and your community’s average will add roughly one per cent to your tax bill when it arrives in July. So if the figure is four per cent for your assessment and 10 per cent for the average, your bill will be about six per cent higher — $120 on a $2,000 bill — than it would have been without provincial interference.

Homeowners will have to look at their own numbers to decide if it’s worth appealing. But businesses face much larger costs, especially in the Lower Mainland. More on that Saturday.

HOW YOU COMPARE

The table on this page may be enough to let you figure out if you’ll fare well or be hammered by the change to property assessment practices this year.

Homeowners from outside the Lower Mainland and business owners should consult The Sun’s interactive web page. It lists averages for both business and residences in most B.C. communities, and it includes a calculator to help you figure out the percentage of change on your property.

However, if you know this number and if you have a residential property in the Lower Mainland, all you have to do is check the chart on this page and compare your percentage to the average for your community.

If the two figures are nearly the same, the new policy will have no impact on you. Your tax bill will be close to what it would have been without the new rules. (This doesn’t mean it will be the same as last year — that depends on whether your council increases or controls its spending. And it’s a safe bet they’ll increase it.)

If the change in your property’s value was less than average, you’ll pay more than you would have. And if your change was more than average, you’ll get a break. In both these cases, the wider the gap the greater the impact.

SHOULD YOU APPEAL YOUR PROPERTY ASSESSMENT IN LIGHT OF THIS YEAR’S ‘FREEZE’?

In a normal year, homeowners whose property went up in value faster than others in their city would end up with a bigger-than-average increase in their municipal tax bill. But this year the B.C. government decided to allow property owners to use the lower of the last two year’s assessments as the basis for their 2009 property tax bills.

That means — for this year only — homeowners whose property values went up faster than average are actually better off than those with more modest increases. To find out whether you’re better or worse off under the assessment changes — and to help you decide whether or not you should appeal — follow these two easy steps.

STEP 1

Calculate the percentage increase or decrease for your own property assessment between July 1, 2007 to July 1, 2008, using the assessment notices you received from BC Assessment. To calculate the increase/decrease, subtract your July 1, 2007 property assessment from your July 1, 2008 assessment. Then divide that number by your July 1, 2007 assessment and multiply that number by 100. For example, if your 2007 assessment was $500,000 and your 2008 assessment was $550,000, the math would work like this:

$550,000 – $500,000 = $50,000

$50,000 / $500,000 = 0.10 x 100 = 10%

STEP 2

Look up your municipality in the accompanying chart to see what the average property-value increase was in your community. If the increase in your assessment is greater than the average, you’re better off than most. However, if your increase is smaller than average, you are worse off as a result of the policy change. If the value of your property actually went down between 2007 and 2008, you are particularly worse off. You have until Feb. 2 to file an appeal to BC Assessment, which you can do online or by going to your local assessment office.

© Copyright (c) The Vancouver Sun