North America’s fastest-growing crime like ‘Wild, Wild West for the bad guys’ in easy-credit age

Janice Tibbetts and Carly Weeks

Sun

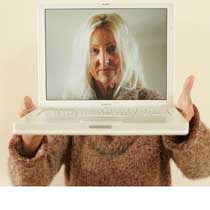

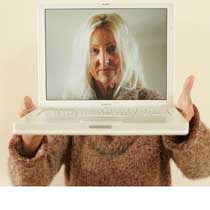

Barbara Stafford’s identity was stolen two years ago. The Whitby, Ont. resident is still mystified that someone was able to steal almost $20,000 using a bogus driver’s licence. Photo illustration Malcolm Taylor/Canwest News Service

OTTAWA — There’s nothing safe about the life you live — unless you use only cash.

Otherwise, you are at risk of becoming a victim of identity theft.

It’s the fastest-growing crime on the continent, fuelled by a technological explosion, an economy hooked on easy credit, consumers who treat their identities cavalierly, businesses that don’t take adequate security measures to protect personal data, and a justice system that has been slow to respond.

With a bit of personal information — as little as a name, address and birthdate — a thief can use someone’s good name to siphon money out of their bank account or exploit their credit worthiness to rack up credit-card charges.

“It’s like the Wild, Wild West for the bad guys,” says Edmonton police Det. Bob Gauthier.

“I always joke that when I retire I’m going to do credit-card fraud. It’s such a lucrative business and it’s too easy if you know what you’re doing.”

Although definitions vary, identity theft — also called identity fraud — involves someone using another person’s personal information for financial gain.

Surveys suggest there are some two million to four million Canadian victims, but nobody knows for sure because nobody really keeps track.

What is known is that debit and credit card fraud hits the wallets of Canadians constantly and costs the economy about $1 million a day, according to Insp. Barry Baxter of the RCMP’s commercial crime branch.

Debit card fraud losses totalled $94.6 million in Canada in 2006, the Interac Association reports. Canadians reported $291 million in credit card fraud losses last year to Visa, MasterCard and American Express. Fraud involving fake or counterfeit payment cards made up 49 per cent of those losses, while “card not present” transactions, which include Internet, phone and mail-order purchases, accounted for 30 per cent.

Even so, says Baxter, the losses are a drop in the bucket compared to how much banks, card issuers and businesses reap from the use of plastic.

Canadians are among the world’s most frequent users of credit and debit cards, helping banks and businesses save money by making more services electronic and cutting labour costs. Electronic payments boosted the Canadian economy by 25 per cent over the past two decades, representing $107 billion of the economy’s $437-billion growth from 1983 to 2003, according to a study sponsored by Visa Canada in 2004.

Canadians also spend more money when they pay with plastic. Credit and debit cards are the main reason Canadians have increased personal spending by $60 billion in the past 20 years, says the study, conducted by economic consulting firm Global Insight Inc.

Consequently, the country’s financial institutions and businesses recognize that if consumers suddenly lost faith in the electronic payments system, there would be a serious hit to the economy.

“I think there’s acknowledgement that if there is a loss of confidence and faith, that you don’t want that to happen, and that is why you work hard to maintain that confidence,” said Caroline Hubberstey, director of public and community affairs at the Canadian Bankers Association.

The criminals range from petty thieves to organized crime gangs. Spouses rip off ex-spouses and there have been cases of parents taking out credit in their children’s names. In B.C., it’s become a crime of choice for methamphetamine addicts.

“It’s an easy way to pay for their drugs,” says Sgt. Ken Athans of the Vancouver Identity Theft Task Force, one of the few concentrated efforts in the country.

“For some it’s not about the drugs, it’s about the lifestyle. Some guys can live a $10,000-a-day lifestyle. A few ladies we’ve targeted, it’s about the buying, the shopping, the Juicy bags and the Gucci sunglasses.”

Identity theft sprouts in many forms. A store clerk, recruited by organized crime, can “skim” a customer’s bank or credit card by running it through a hidden, illegal machine, enabling the data to be downloaded onto a fraudulent card.

“Dumpster divers” can rummage through trash looking for personal information or discarded credit-card offers to use themselves or sell for money.

“Shoulder surfers” will steal a peek as prospective victims fill out forms that request their social insurance numbers or birthdates.

Small-time thieves will swipe mail from outdoor boxes and sell the goods to fraud rings or one of the thriving Internet black-market sites that buy and sell personal information.

There are also scams such as “phishing,” in which a thief sends a mass e-mail that appears to be from a reputable company requesting information. An offshoot, dubbed “vishing,” happens when a crook phones and leaves a voicemail requesting a call-back.

U.S. studies report that up to 80 per cent of thefts still occur the low-tech, old-fashioned way, such as by sifting through trash or stealing mail.

That’s what happened to Paul Lima, a Toronto writer and consultant, who considers himself one of the lucky ones because he caught on after only a week or so that he wasn’t getting any mail.

“The penny dropped,” Lima said, when his mother phoned late last November to see if he received his birthday card and a cheque for $50. He had not.

That’s when it dawned on him that he hadn’t received other cheques he was expecting from his clients. So he called Canada Post, which told him someone had changed his address about 10 days earlier.

Lima suspects somebody used a phoney driver’s licence to divert his mail to a Toronto post office box. He said he spent weeks cleaning up the mess — closing his bank account and opening a new one, cancelling his credit cards, contacting his clients to ask them for new cheques, calling the police, and asking a credit agency to flag his credit rating so it wouldn’t be mud.

Equifax and Trans Union, Canada’s two major credit-reporting agencies, say they each receive approximately 1,400 to 1,800 Canadian identity theft complaints every month.

The numbers, however, cannot be independently confirmed because there is no federal clearinghouse, as there is in the United States.

Businesses are not required by law to report when thieves hack into their systems. Banks, which have the best picture of the true scope of credit card and debit card fraud, don’t have to share their information with anybody.

Financial institutions and cellphone companies have been accused of being major culprits in allowing identity theft to thrive because they don’t want to drive customers away by screening them too vigourously.

“The banks just write it off as the cost of doing business,” says Gauthier of the Edmonton police. “They don’t want to come out and say, ‘This is a huge problem,’ because they’ll bite themselves in the foot.”

Greg Ivany, a Halifax university student who had $500 stolen from his bank account after his debit card was fraudulently duplicated, is suspicious of his bank’s reaction.

“They asked that I not contact the police because they do their own investigations and if I contacted the police it would hamper their investigation,” said Ivany. “I didn’t really understand because it is a criminal thing.”

© The Vancouver Sun 2007